Science Applications Int’l (NYSE: SAIC) shares jumped 4.2% on March 28 to close at $95.49, after the company delivered blowout fourth-quarter results and issued FY2023 earnings guidance ahead of analyst expectations.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Science Applications is an American company headquartered in Reston, Virginia, and provides government services and information technology support. SAIC shares have gained 16% over the past year.

Q4 Beat

Adjusted earnings of $1.50 per share massively beat analysts’ expectations of $1.24 per share. However, it was lower than reported earnings of $1.67 per share for the prior-year period.

Revenues jumped 4% year-over-year to $1.8 billion, and exceeded consensus estimates of $1.77 billion.

The increase in revenues reflects the ramp-up of new and existing contracts, as well as contributions from the acquisition of Halfaker and Associates, partially offset by contract completions.

FY2023 Outlook

Looking ahead, management provided financial guidance for FY2023.

The company forecasts FY2023 adjusted earnings in the range of $6.80 to $7.10 per share, while the consensus estimate is pegged at $6.84 per share.

Revenues are forecast to be in the range of $7.36 to $7.55 billion, versus the consensus estimate of $7.61 billion.

CEO Comments

SAIC CEO, Nazzic Keen, commented “Our focus to begin fiscal year 2023 is on positioning our portfolio to maximize value for all stakeholders. The outlook we are providing demonstrates our ability to increase free cash flow and capital returns to shareholders while investing internally to drive growth.”

Analysts Recommendation

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on two Buys and four Holds. The average Science Applications price forecast of $99.40 implies 4.09% upside potential to current levels.

Investors Weigh In

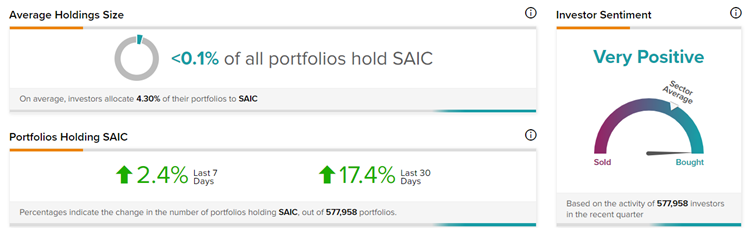

Important to note, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on SAIC, with 17.4% of investors increasing their exposure to SAIC stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Clear Secure Reports Quarterly Beat; Shares Up 16.8%

Winnebago Industries Shares Tank 11.8% Despite Q2 Beat

Traeger Shares Dip 20% on Muted FY22 Outlook Despite Q4 Beat