Shares of Starbucks (SBUX) gained in after-hours trading after the coffee shop chain reported earnings for its third quarter of Fiscal Year 2024. Earnings per share came in at $0.93, which was in line with consensus estimates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales decreased by 1.1% year-over-year, with revenue hitting $9.1 billion. This missed analysts’ expectations by $9.249 billion. The decline was due to a 3% drop in global comparable store sales, which were driven by a 5% decline in the number of transactions. However, this was partially offset by a 2% jump in the average price per order.

Despite the underwhelming performance, it seems like management was able to talk investors into feeling optimistic. Indeed, CEO Laxman Narasimhan said that the firm’s three-part action plan is beginning to work, which he expects to improve financial performance. In addition, CFO Rachel Ruggeri stated that their efficiency efforts are exceeding expectations.

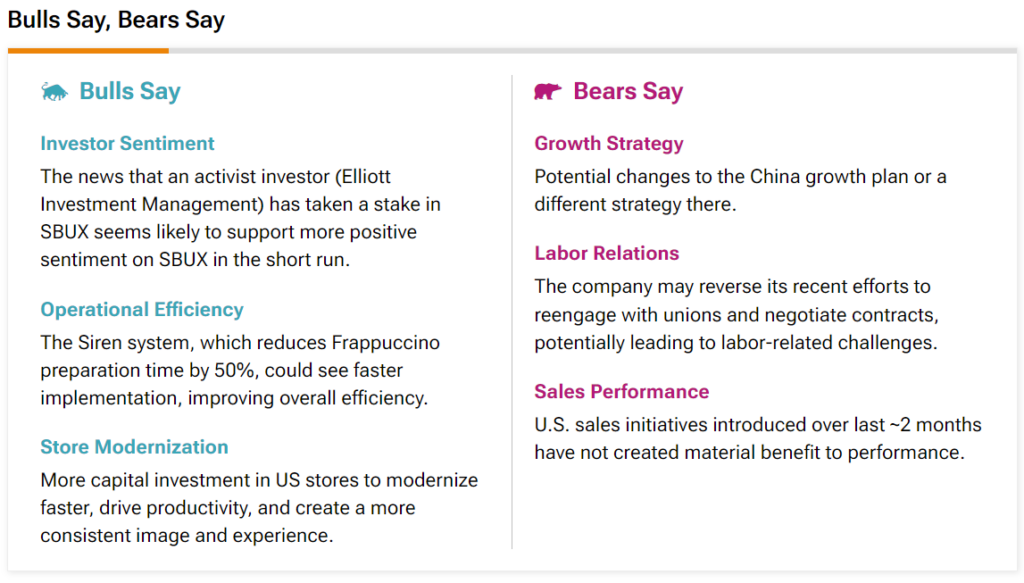

Interestingly, it seems like analysts are banking on these efficiency efforts to work. According to TipRanks’ Bulls Say, Bears Say tool pictured below, one of the bullish arguments includes an improvement in operational efficiency. Specifically, the bulls note the Siren System, which will help cut Frappuccino preparation time in half.

Is Starbucks a Buy or Sell Stock?

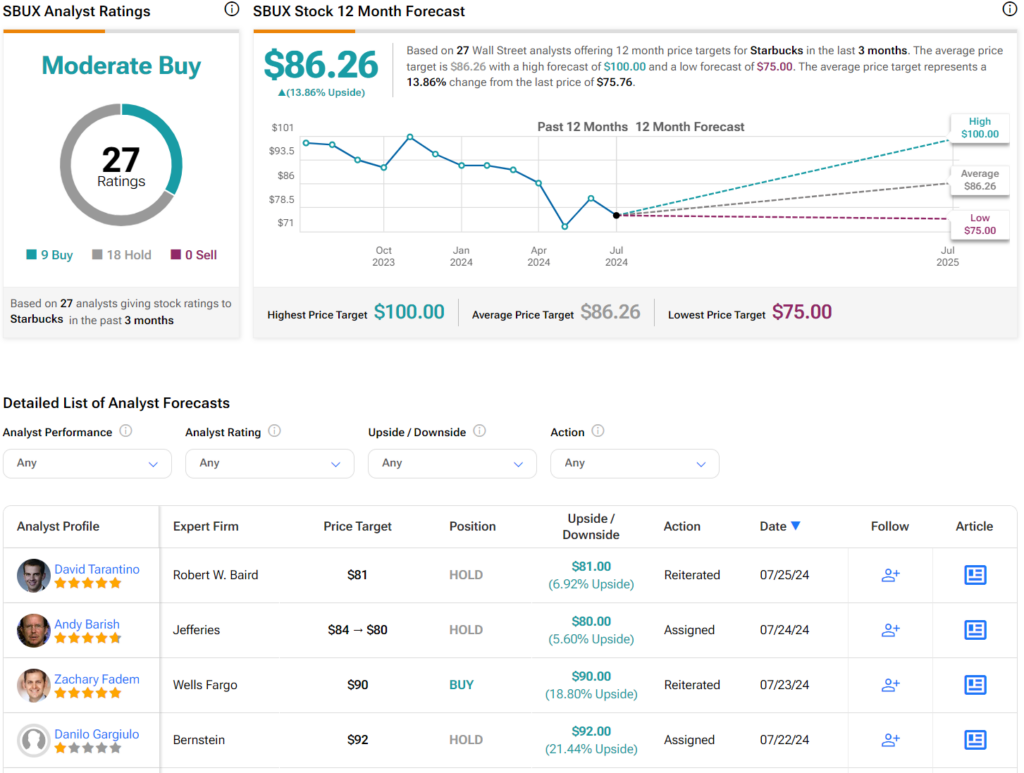

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SBUX stock based on nine Buys, 18 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 24% rally in its share price over the past year, the average SBUX price target of $86.26 per share implies 13.86% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.