Spain-based Banco Santander, S.A. (ES:SAN) has kicked off a new share buyback plan for $1.7 billion (€1.53 billion). This launch aligns with the bank’s strategy to maintain a shareholder remuneration target of approximately 50% of its underlying profit, divided equally between dividends and buybacks. Following the announcement, SAN stock gained nearly 3% as of writing. Year-to-date, Santander shares have climbed by almost 16%.

Santander Group provides a wide range of financial services, catering to around 160 million customers worldwide.

Santander Unveils New Share Buyback Plan

Santander’s new buyback plan has been approved by the board of directors and amounts to approximately 25% of the company’s underlying profit in the first half of 2024.

The buyback programme will begin immediately and end before January 3, 2025. Additionally, the program will account for approximately 2.14% of the bank’s share capital.

Recap of Santander’s First-Half Performance

In the first-half results released last month, Santander reported a 16% year-over-year growth in its underlying attributable profit of €6.06 billion on constant exchange rates. The bank’s performance was mainly driven by strong growth in net interest income, additional customers, and effective cost management.

Santander’s net interest income increased 12% to a record €23.46 billion in H1, supported by growth across various segments and regions. Meanwhile, its underlying net operating income grew 15.1% year-over-year to €18.14 billion at constant rates.

Driven by the solid performance in the first half, Santander raised its revenue growth guidance for the full year to high-single-digit from the earlier forecast of mid-single-digit.

Is Santander Stock a Good Buy?

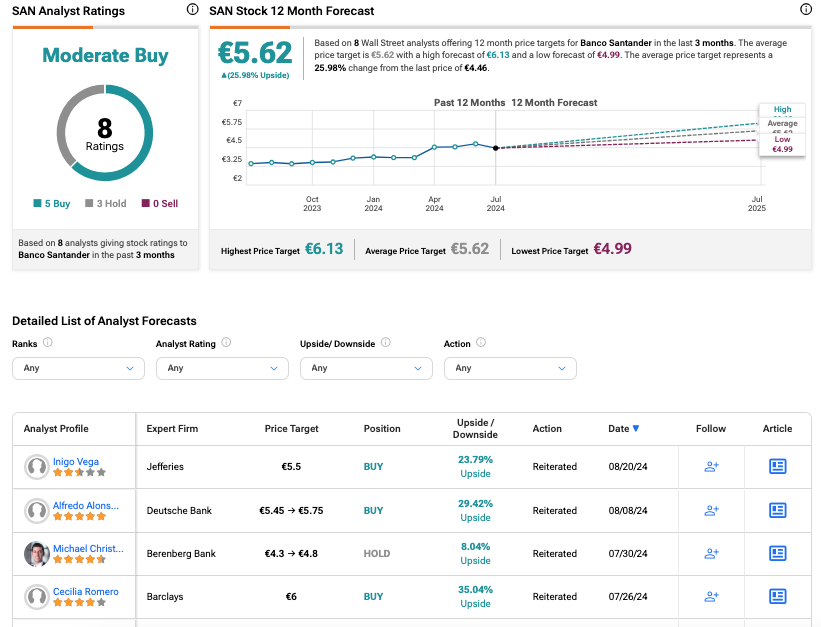

According to TipRanks’ analyst consensus, SAN stock has a Moderate Buy rating. The stock has five Buy and three Hold recommendations. The Santander share price forecast is €5.62, which is 26% higher than the current price level.