CAC 40-listed Sanofi S.A. (FR:SAN) announced an agreement to resolve around 4,000 lawsuits in the U.S. courts related to its discontinued heartburn drug Zantac, which is linked to cancer. The French pharma company has chosen not to reveal the financial details of the agreement. The company did not acknowledge any liability in the settlement and reiterated its belief that the claims made by the plaintiffs were not true. Sanofi shares are trading up by 0.83% as of writing today.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Sanofi is a global pharmaceutical company that provides a wide range of medicines and vaccines.

Is it the End of Sanofi’s Litigation Drama?

The deal, which is yet to be finalized, is poised to resolve the bulk of lawsuits against Sanofi in the U.S. state courts, excluding Delaware. Moreover, the finalization of the deal is dependent on obtaining consent from individual plaintiffs, which is expected to take considerable time.

Sanofi stated that it opted to settle the cases to avoid the costs and disruptions associated with prolonged litigation. In October 2023, FTSE 100-listed GlaxoSmithKline PLC (GB:GSK) also reached a similar agreement for Zantac litigation in California to end its costly legal proceedings. Sanofi is still confronted with approximately 20,000 Zantac lawsuits in Delaware state court. Overall, there are roughly 70,000 cases filed in Delaware against Sanofi and other defendants, which include GSK, Pfizer, Inc. (NYSE:PFE), and Boehringer Ingelheim.

Since 2019, these companies have been embroiled in litigation following the detection of trace amounts of a potential human carcinogen, NDMA, in Zantac. In 2020, the U.S. Food and Drug Administration (FDA) asked these manufacturers to remove the drug from the market.

What is the Target Price of Sanofi?

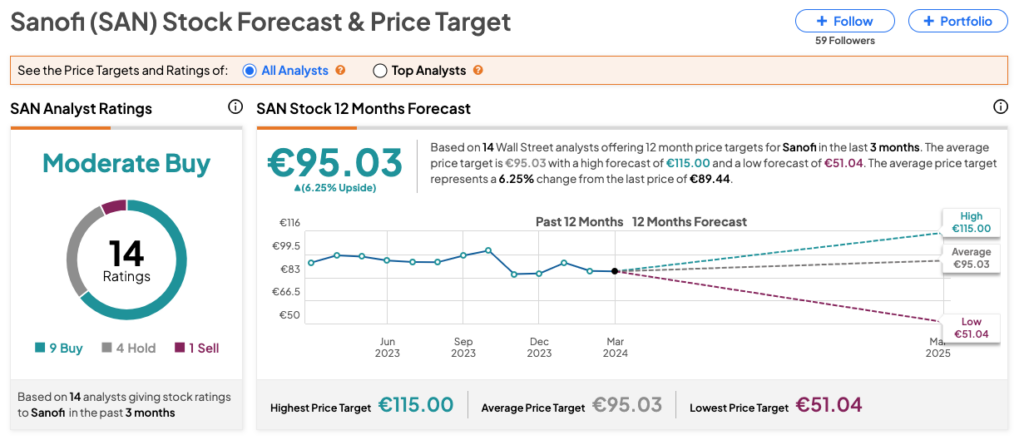

As per the TipRanks consensus, SAN stock has received a Moderate Buy rating, backed by nine Buys, four Holds, and one Sell recommendation. The average Sanofi share price target is €95.03, which is 6.25% above the current trading levels.