Multiple analysts praised streaming hardware and content provider Roku (ROKU), and the market responded, sending shares up 5.5%. Analysts at both Baird and ARK Invest threw in solid sentiment.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Baird analysts upgraded Roku from Neutral to a Buy-equivalent Outperform rating, and also hiked the price target substantially from $70 to $90. While Roku labors under a pretty substantial 23% deficit, it has plenty of potential to recover and grow in the long-term. Baird said that investors are “overlooking” that growth potential.

ARK Invest went so far as to declare Roku a top pick for 2025. In fact, Roku was second among those top stock picks. Though some believe that other stocks, particularly artificial intelligence (AI) stocks, will produce better returns, and faster, there is no denying Roku’s potential. Roku accounts for 7.66% of ARK’s overall portfolio.

A Digital TV Giant?

Calling Roku a good potential investment is not out of line. Calling it a “digital TV giant,” though, may seem a bit more of a long shot. Roku Media’s president, Charlie Collier, recently discussed how the company is advancing in a field dominated by much bigger competitors.

Given that Collier previously ran both AMC Entertainment (AMC) and Fox (FOXA) broadcast operations, he may be in a good position to help push Roku to the top of the rankings. With ad-supported tiers making a return in streaming, and showing streaming to be a lot like regular television, it may be that Collier’s experience will be especially beneficial.

Is Roku Stock a Good Buy?

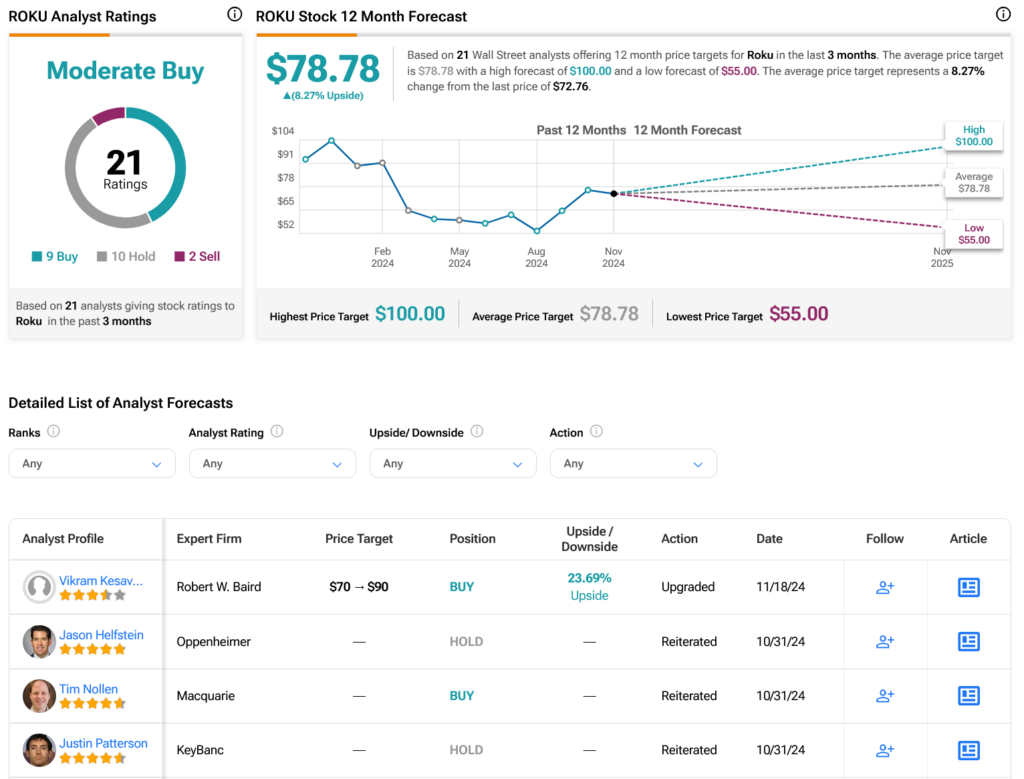

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ROKU stock based on nine Buys, 10 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 23.4% loss in its share price over the past year, the average ROKU price target of $78.78 per share implies 8.27% upside potential.