Yesterday, we found out about Rogers Communications’ (TSE:RCI.B) (NYSE:RCI) plans to roll out some new streaming plans to help it make back some of the cash it lost through its Shaw deal. That didn’t sit well with investors, and Rogers’ latest plan to make some cash seems to be playing about the same way with investors. Its latest plan to raise cash fell flat, and so did share prices, down around 1.5% in Thursday morning’s trading.

Rogers’ plan this time revolves around ditching some of its data centers and the real estate on which they sit to bring in an extra billion dollars to tackle the debt load it took on thanks to Shaw. If you just thought that sounds like Rogers preparing to eat its own seed corn, take heart; Rogers’ CFO, Glenn Brandt, made it clear that the planned sales are mostly connected to third-parties.

Therefore, there won’t be any impact on its current wireless operations. The sales will likely have to push for high-dollar deals, though; Rogers has 12 data centers in Canada. If it sells five out of every six, that means each will have to go for an average of $100 million to bring in that $1 billion hoped for.

The Timing Is Not Great

Even Brandt admits that this is not the best time to sell large amounts of real estate. The real estate market in Canada is starting to slow down, and that could seriously impact the price that Rogers can get for these data centers. Commercial real estate is something of a different beast, but reports from The Globe and Mail noted that the private real estate sector’s valuations aren’t moving very rapidly.

That could prove helpful, or it could not. Valuation assessments are virtually impossible right now, the report noted, and with interest rates still high, it may not matter what the property is “worth” because no one will pay that price anyway.

What Is the Price Target for RCI.B Stock?

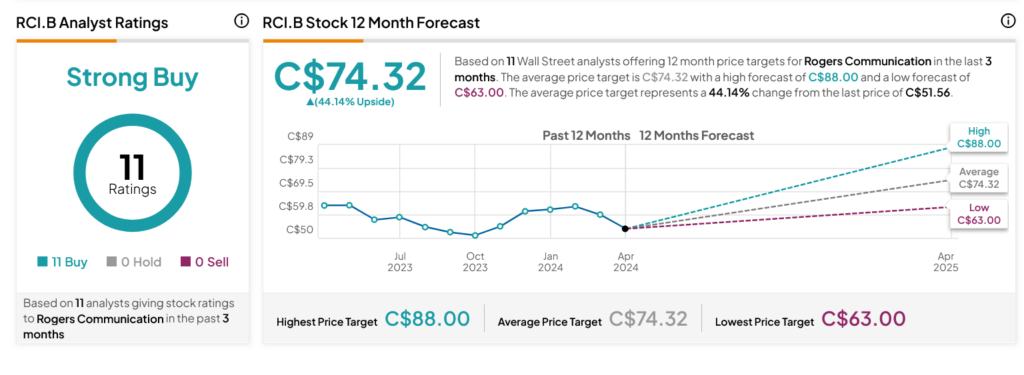

Turning to Wall Street, analysts have a Strong Buy consensus rating on RCI.B stock based on 11 Buys assigned in the past three months, as indicated by the graphic below. After a 19.71% loss in its share price over the past year, the average RCI.B price target of C$74.32 per share implies 44.14% upside potential.