Normally, when analysts turn on a stock like Rocket Companies (NYSE:RKT), the stock goes down as investors lose confidence for much the same reasons that analysts do. Yet that wasn’t the case this time around, as Rocket Companies blasted off and added over 7% in Friday afternoon’s trading, holding on to gains from the morning well into the afternoon.

The analyst who lost confidence, JPMorgan’s Kabir Caprihan, had quite a bit to say, starting out by lowering Rocket Companies from Overweight to Neutral. The reason behind that move was undeniably sound, as Caprihan pointed out that there’s likely to be quite a bit less mortgage origination in 2024. Since Rocket Companies—the company behind Rocket Mortgage—has a heavy presence in mortgages, that’s likely to impact the bottom line. Rocket Companies recently staged some cost-cutting measures, taking about $200 million in excess, but Caprihan noted that that likely wouldn’t be enough if mortgage originations reach a projected $1.3 trillion or less as expected.

Further, Rocket Companies is also making a push to get more involved in getting real estate more active. It’s joining the call to bring employees back to the office for a full five-day work week. Rocket’s former interim CEO Bill Emerson noted that fully remote jobs’ days are going to be limited to “…a small percentage of the population” going forward. Emerson stuck to the old standards, noting that innovation can “…only happen(s) through collaboration, and collaboration happens best when human beings are interacting with one another on a face-to-face basis.” How Emerson explains the innovation that happened over the last three years, with little if any face-to-face interaction, is unclear at best.

What is Rocket Companies Target Price?

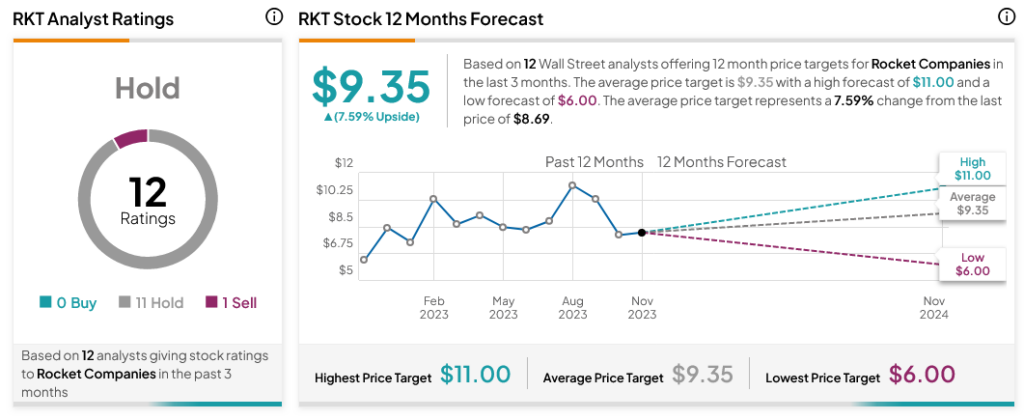

Turning to Wall Street, analysts have a Hold consensus rating on RKT stock based on 11 Holds and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average RKT price target of $9.35 per share implies 7.59% upside potential.