Analyst upgrades can often do wonders for a stock, and for online investing platform Robinhood Markets (HOOD), that proved to be the case. In fact, a new report from analysts at Needham that upgraded HOOD stock to a Buy rating sent the shares up more than 8%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The team at Needham declared that Robinhood was likely to benefit from the upcoming changes in the U.S. Securities and Exchange Commission (SEC) leadership as Donald Trump returns to the White House. Plus, since the Trump administration is also likely to be friendly to crypto, it should open up space for Robinhood to expand into buying and selling cryptocurrency.

Given that currently only four crypto assets are on offer at Robinhood, there is a lot more room to expand outward into the altcoins that are difficult to buy. Plus, Needham also directly calls out Robinhood’s marketing initiatives, which have proven quite effective in drawing in retail investors.

Chinese Competition

While Robinhood delivers a safe and effective way to buy stocks, there are other options out there. One in particular that’s drawing attention from Congress is Webull, which is actually the creation of an Alibaba (BABA) executive. With Webull basically connected to China, that is attracting quite a bit of attention from Congress, which is pressing Webull for information.

Several red states are getting together to launch their own probe into Webull, seeing just how connected to China it actually is. And with an upcoming Trump administration looking increasingly antagonistic toward China, it is a safe bet that Webull will be getting scrutinized by lawmakers.

Is Robinhood Stock a Buy?

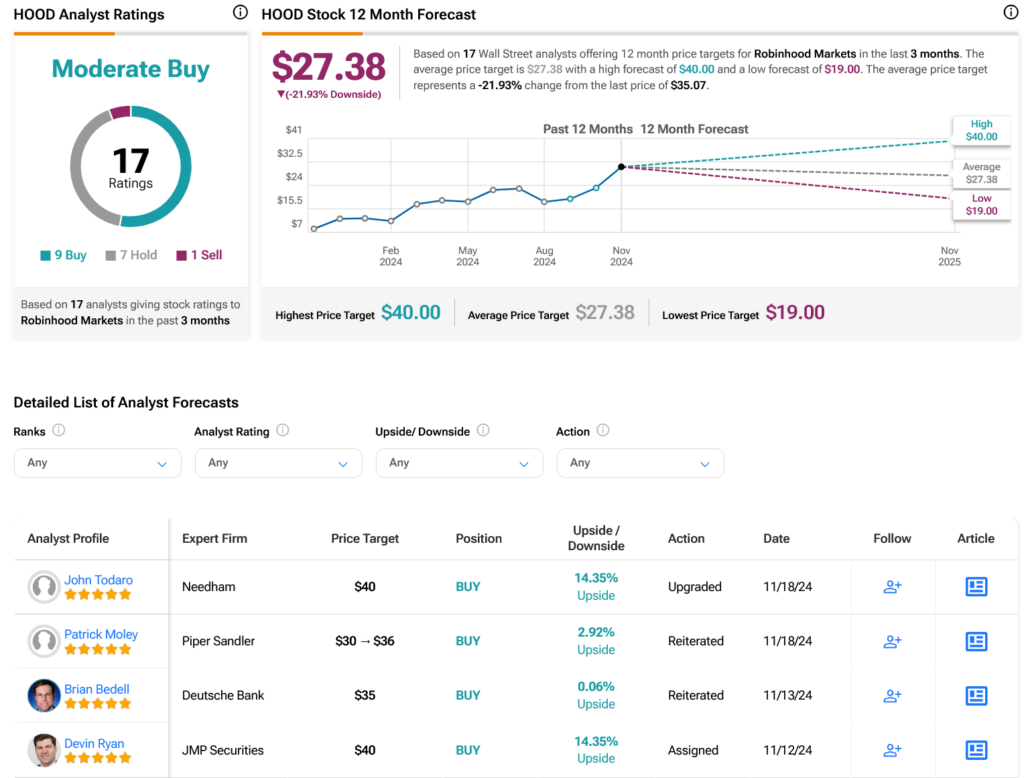

Turning to Wall Street, analysts have a Moderate Buy consensus rating on HOOD stock based on nine Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 330.01% rally in its share price over the past year, the average HOOD price target of $27.38 per share implies 21.93% downside risk.