Financial services platform Robinhood Markets (HOOD) upbeat Q2 results would not have surprised users of TipRanks’ Website Traffic Tool. Investors should note that the tool gathers data about a company’s website performance over a specific time frame. This information can be used to predict the upcoming earnings report, as growth in online usage may point to higher sales.

At the time of writing, the shares of the company are up 3% in pre-market trading. Learn how Website Traffic can help you research your favorite stocks.

Website Traffic Showed Uptrend

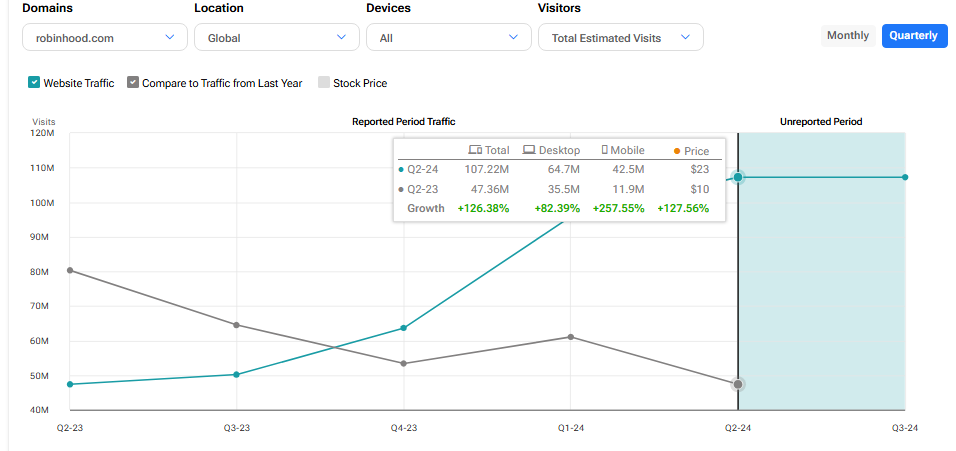

Ahead of the Q2 earnings release, the website traffic tool showed that total estimated visits to robinhood.com grew by 126.38% for the quarter compared to the same period last year. The increase in website traffic pointed to solid top-line performance.

Eventually, HOOD reported solid second-quarter revenues, which increased 40.3% year-over-year. The company experienced robust growth in interest-earning assets and an increase in transactions. Also, cryptocurrencies such as Bitcoin (BTC-USD) contributed $81 million in revenue during the second quarter. Meanwhile, the company reported EPS of $0.21, which beat analysts’ consensus estimate of $0.16 per share.

A Top-rated Analyst Expects Upside in HOOD Stock

Following the release of Q2 earnings, Top-rated analyst Devin Ryan from JMP Securities reiterated a Buy rating on the stock with a price target of $30, implying about 75.2% upside potential from the current level. (To watch Ryan’s track record, click here.)

Apart from Ryan, two Wall Street analysts rated HOOD stock a Hold.

Is Robinhood Markets a Good Stock to Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating based on six Buys, seven Holds, and two Sells assigned in the past three months. After a year-to-date gain of over 34%, the analysts’ average price target on HOOD stock of $22.77 implies an upside potential of 33%.