Shares of Israel-based Riskified Ltd. (NYSE: RSKD) jumped 2% on Wednesday to close at $5.60 following the release of its second-quarter results. Increased revenue guidance for full-year 2022 could have triggered the upside.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

How Does Riskified Work?

Headquartered in Tel Aviv, Riskified is an E-commerce risk management platform through which merchants can generate legitimate revenue. The platform uses machine learning, proxy detection, elastic linking, and behavioral analysis to detect and prevent fraud during an online transaction.

Riskified’s Q2 Performance

Revenues increased 8% year-over-year to nearly $60 million, and gross merchandise volume (GMV) surged 18% to $25.4 million.

Adjusted EBITDA stood at (13.7 million), compared to $1.6 million in the year-ago quarter. Adjusted net loss came in at eight cents per share, narrower than the Street’s loss estimate of 20 cents per share. In the second quarter of 2021, Riskified posted a profit of one cent per share.

The CEO of Riskified, Eido Gal, said, “As positive as I feel about our top-line performance, I am also excited by the progress that we’ve made to lower and optimize our cost base. This allowed us to raise our adjusted EBITDA outlook for 2022, and accelerate our path to profitability while keeping our long-term growth outlook intact.”

For the full-year 2022, the software as a service (SaaS) provider has increased its revenue guidance by $1 million between $255 million and $258 million. The adjusted EBITDA guidance range has been updated to ($54 million)-($57 million) from ($66 million)-($69 million).

TipRanks’ Tool Shows a Multi-fold Rise in Riskified’s Website Visits

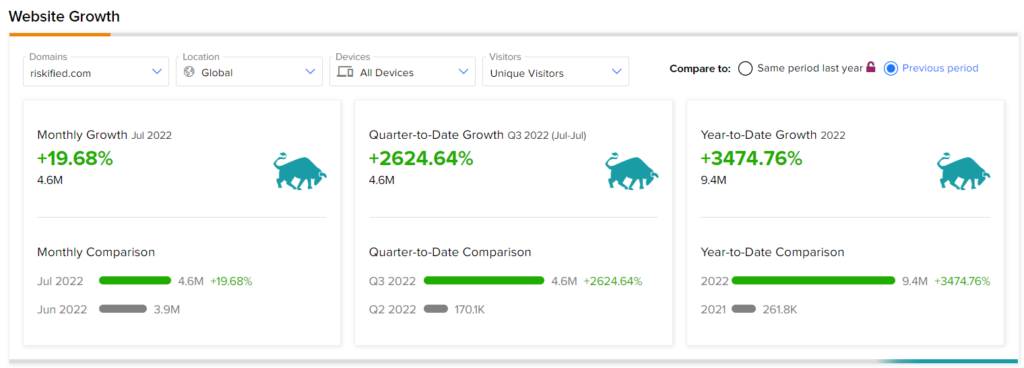

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Riskified’s performance.

According to the tool, Riskified’s website traffic registered a 19.7% rise in global visits in July, compared to June. Further, the footfall on the company’s website has grown 3,474.8% year-to-date against the same period last year. The significant rise in the visits to the company’s website is reflected in its revenues. Learn how Website Traffic can help you research your favorite stocks.

Is RSKD a Good Buy?

RSKD stock has a Moderate Buy consensus rating on TipRanks based on three Buys, two Holds, and one Sell. Riskified’s average price target of $6.17 implies 10.2% upside potential over current levels.

Analysts’ cautious view of the stock is justified as the company is yet to break even. Investors might want to wait and watch before investing in the stock, despite Riskified’s shares trading near their 52-week low of $3.76.

Read full Disclosure