Shares of Riot Platforms (RIOT) are down at the time of writing after the Bitcoin (BTC-USD) miner provided a production update. In fact, August Bitcoin production dropped 3% year-over-year to 322 BTC. The company, along with the broader industry, is likely still feeling the impact of the April Halving (an event that reduced the reward for mining Bitcoin).

It also did not help that the hot Texas summer forced the company to be more strategic with its power usage, which likely led to the 13% month-over-month decrease. Nevertheless, there were some bright spots.

For starters, the firm saw a 224% year-over-year increase in its average hash rate (the number of calculations a miner can perform per second) to 14.5 EH/s. In addition, CEO Jason Les mentioned that the company remains on track to achieve its third-quarter and year-end hash rate targets of 28 EH/s and 36 EH/s, respectively. This expected growth can be attributed to Riot’s newly acquired Kentucky facilities and the almost complete Building B1 at its Corsicana Facility.

The company now holds 10,019 BTC worth roughly $564.5 million at the time of writing, or slightly more than a quarter of its $2.05 billion market cap. Interestingly, RIOT is trading at a price-to-book value of 0.99, according to TipRanks data, which suggests that the company is slightly undervalued since it is below one.

Is RIOT a Good Stock to Buy?

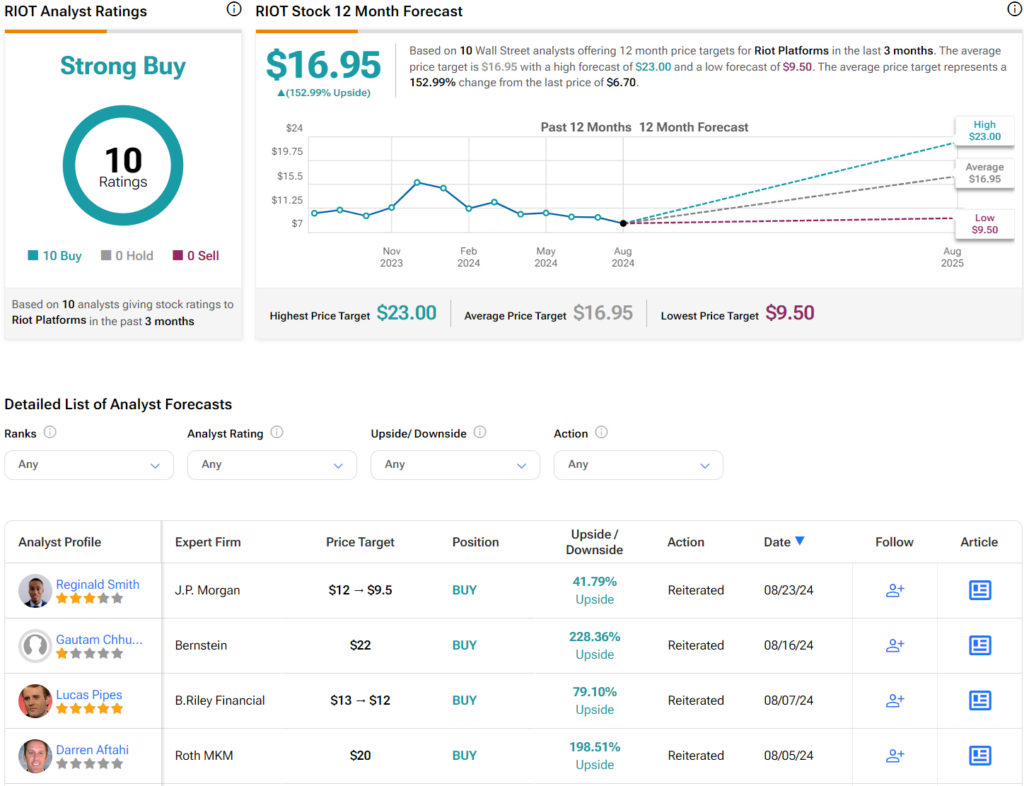

Turning to Wall Street, analysts have a Strong Buy consensus rating on RIOT stock based on 10 Buys assigned in the past three months, as indicated by the graphic below. After a 40% decline in its share price over the past year, the average RIOT price target of $16.95 per share implies 153% upside potential.