Shares of ASX-listed Rio Tinto Limited (AU:RIO) surged nearly 4% after the company announced plans to enhance profitability and capital efficiency, supported by a strong outlook for aluminium. The company is targeting an increase of 5 percentage points in both its EBITDA (earnings before interest, tax, depreciation, and amortization) margin and the return on capital employed in the aluminium division by 2030.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Based in Australia, Rio Tinto is engaged in mineral exploration, mining, and processing activities.

Rio Tinto Highlights Aluminium Market Potential

Rio Tinto is prepared to benefit from the increasing need for aluminium, particularly in electrification. The expected growth of 3% per year from 2023 to 2028 in aluminium demand indicates a favorable market. Additionally, the company stated that recycling is a key factor in meeting this demand. The partnership with Matalco for recycling is expected to boost profits even more, potentially adding around $70 million in operational, sales, and marketing benefits each year by 2028.

Furthermore, the company identified North America as the most promising region for aluminium demand in the coming years. Over the past five years, Rio Tinto’s products have enabled the company to sell aluminium at about 20% higher prices than the London Metal Exchange (LME) rates.

Apart from aluminium, Rio Tinto aims to raise the return on capital employed in its Iron and Titanium business by nine percentage points by 2030.

Is RIO Stock a Good Buy Now?

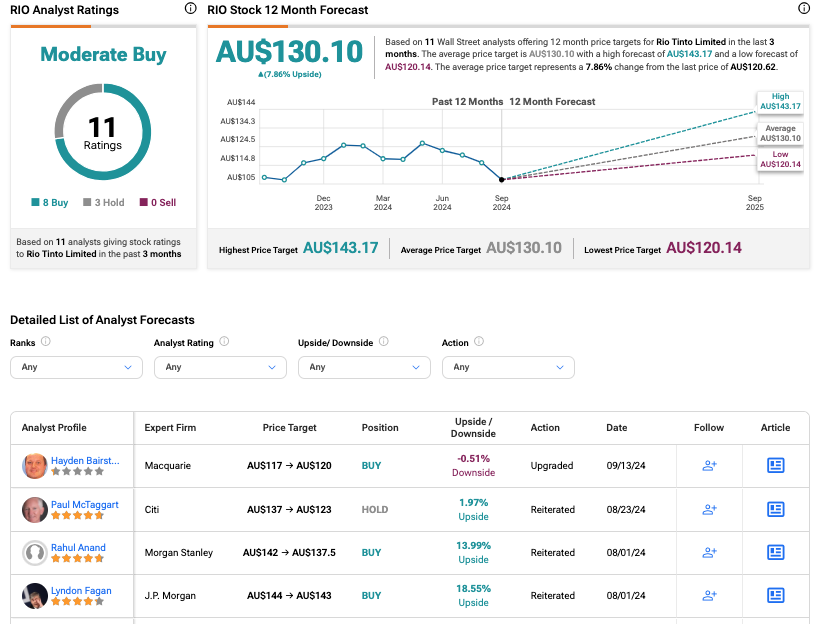

According to TipRanks, RIO stock has received a Moderate Buy rating based on 11 recommendations, of which eight are Buy. The RIO share price forecast is AU$130.10, which is 8% above the current trading level.