Shares of real estate company Redfin Corp. (NASDAQ:RDFN) are rising upward today after the stock scored a rating upgrade on the back of Redfin’s first-quarter performance.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Redfin’s Q1 revenue rose 45.5% year-over-year to $325.7 million, outperforming the Street’s estimates of $295.66 million. Additionally, the net loss per share at $0.55 came in narrower than the anticipated $1.01 mark.

The company has pared down its debt by $300 million and expects an improvement in gross margins in its core business in the second quarter. For Q2, revenue is anticipated between $268 million and $281 million. Net loss is expected between $44 million and $35 million. In comparison, Redfin had incurred a net loss of $78 million in Q2 2022.

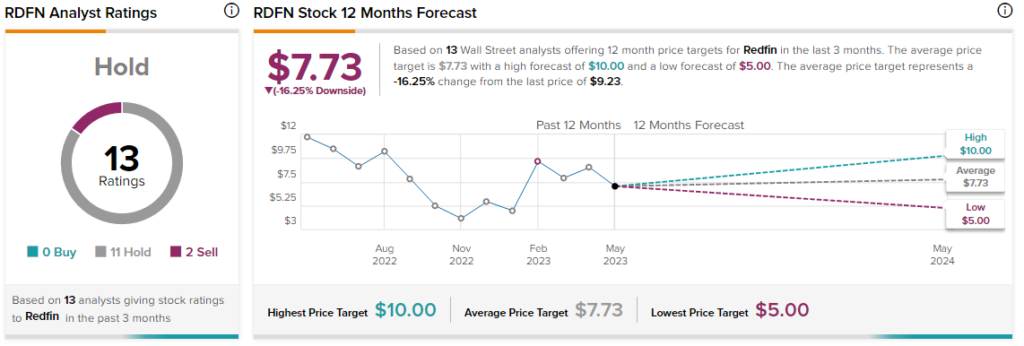

After this performance, Compass Point analyst Jason Weaver upgraded the rating on the stock today to a Hold from a Sell with a $7 price target. Still, the analyst sees substantial medium-term challenges for the company to boost its market share in its core market.

Overall, the Street has a $7.73 consensus price target on Redfin pointing to a 16% potential downside in the stock. That’s after a nearly 27% rise in Redfin shares till the time of publishing today.

Read full Disclosure