The RealReal, Inc. (NASDAQ: REAL) posted better-than-expected results for the first quarter of 2022. Its quarterly loss per share was narrower-than-feared, while revenues surpassed the consensus estimate by 7.4%.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The earnings and revenues surprise in the quarter, as well as healthy projections for the second quarter, seemed to have temporarily lifted the sentiment for RealReal. Shares of this $375-million company increased 9.3% to close in the after-hours session on Tuesday. However, it is worth noting that the stock had lost 4.3% in the normal trading period on Tuesday and is now down over 10% on the day.

RealReal provides an online platform that attracts buyers and sellers of pre-owned luxury goods. Its headquarters is located in San Francisco, CA.

Financial Highlights

In the quarter, RealReal reported a loss of $0.47 per share, narrower than the consensus estimate of a $0.51 loss per share. The quarterly bottom line was better than the year-ago loss of $0.49 per share.

Revenues came in at $147 million, above the consensus estimate of $136.8 million and the company’s guidance of $130-$140 million. The top line increased 48.5% year-over-year, driven by a 30.4% growth in Consignment and Service revenues and a 105.7% surge in Direct revenues.

The company’s Gross Merchandise Value (GMV), at $428.2 million, was up 30.8% year-over-year. It also surpassed the company’s projection of $410-$425 million. Net Merchandise Value (NMV) increased 27.2% to $310.5 million. The number of orders grew 27.2% year-over-year to 878,000 in the quarter.

The cost of revenue expanded 68.2% year-over-year to $68.1 million. Gross profit came in at $78.6 million, up 34.8% year-over-year. Total operating expenses increased 20% to $133.3 million. Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) were ($35.3) million in the quarter versus ($35.6) million in the year-ago quarter.

Balance Sheet and Cash Flow

Exiting the first quarter, RealReal’s cash and cash equivalents were $361 million, down 13.7% from the previous quarter. Its total liabilities, at $767.8 million, grew 12.6% quarter-over-quarter.

In the quarter, the company used net cash of $49.4 million for its operating activities, up 3.2% from the $47.8 million used in the year-ago quarter. Capital spending in the quarter was $8.4 million, reflecting an increase of 1.4% from the year-ago quarter. Free cash outflow was $57.8 million, up 3% year-over-year.

Projections

For the second quarter of 2022, RealReal anticipates revenues to be within the $150-$160 million range. It expects a GMV of $450-$470 million in the quarter.

For 2022, the company maintained its previous projections of $635-$665 million for revenue and $2,000-$2,100 million for GMV.

Management Commentary

The founder and CEO of RealReal, Julie Wainwright, anticipates leveraging healthy demand despite macroeconomic and geopolitical uncertainties. She opines that the consumers may find RealReal to be an attractive option “as inflation has ramped and prices have increased in the primary (i.e., new goods) luxury market.”

She added that the company is “well-positioned for a strong year.”

Wall Street’s Take

Yesterday, Marvin Fong of BTIG reiterated a Buy rating on RealReal while lowering the price target to $9 (125% upside potential) due to changes in sector multiples.

The analyst stated that “REAL’s ability to deliver double-digit growth while other e-commerce platforms falter should be viewed as evidence of REAL’s differentiated business model and secular growth prospects.”

Overall, the analyst community is cautiously optimistic about the growth prospects of RealReal and has a Moderate Buy consensus rating based on eight Buys and five Holds. The average RealReal price forecast of $11.92 suggests 198% upside potential from current levels.

Over the past year, shares of RealReal have plunged by over 80%.

Bloggers Sentiments

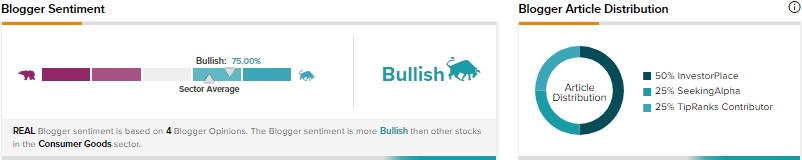

According to the TipRanks Bloggers tool, the opinions and sentiments of the financial bloggers on REAL are 75% bullish compared with the sector average of 67%.

Conclusion

Increasing demand for luxury products and cost hikes in the first-hand luxury market will likely keep growth prospects strong for second-hand luxury goods providers like RealReal. The company believes it is well-positioned to grow revenues by at least 30% annually, hitting the $1.5 billion level in 2025.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Despite Exceeding Q1 Expectations, Cano Health Shares Plunge 8.9%

Lemonade’s Q1 Results Were Sweet, but Outlook Leaves a Sour Taste

Why Did Palantir Stock Lose 21% on Monday?