Shares of social media platform Reddit (NYSE:RDDT) soared in after-hours trading after the company reported its first-quarter results. Sales increased by 48% year-over-year, with revenue hitting $243 million. This smashed expectations of $214 million. Ad revenue made up $222.7 million of sales, which was a 39% jump from the previous year. This growth was driven by record user traffic, as Daily Active Uniques (DAUq)—unique users that visited the website/app at least once during a 24-hour period—came in at 82.7 million. This equates to a 37% jump from Q1 2023.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Furthermore, earnings per share came in at -$8.19, which beat analysts’ consensus estimate of -$8.75 per share. Although this loss seems huge, it’s worth mentioning that it’s mostly attributable to stock-based compensation (a non-cash expense) due to the company’s recent IPO. In fact, free cash flow was positive at $29.2 million.

Looking forward, management now expects revenue and adjusted EBITDA for Q2 2024 to be in the ranges of $240 million to $255 million and $0 to $15 million, respectively. For reference, analysts were expecting $227.5 million in revenue.

Is RDDT a Buy or Sell?

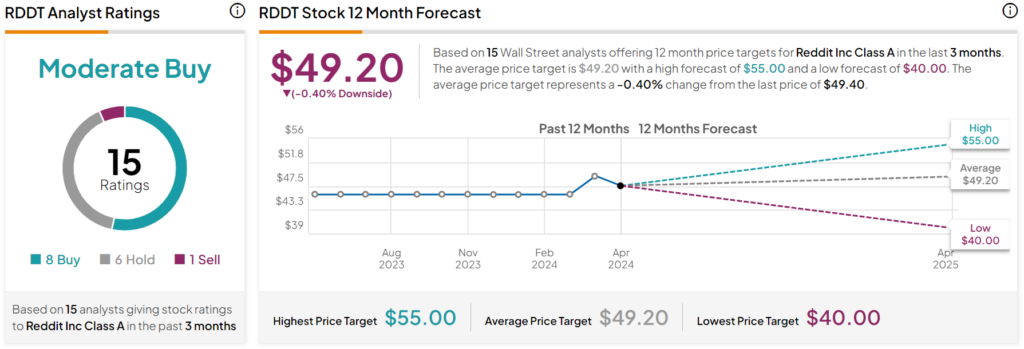

Turning to Wall Street, analysts have a Moderate Buy consensus rating on RDDT stock based on eight Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 7% post-IPO rally, the average RDDT price target of $49.20 per share implies that shares are fairly valued. However, it’s worth noting that estimates will likely change following today’s earnings report.