Now that the election is behind us, market watchers are digging into what Trump’s victory could mean for the economy in the coming months. As the former and future President prepares to take office, certain economic trends have already become clear: inflation has been slowing throughout much of this year, and the Federal Reserve has adopted a lower-rate policy – both of which are likely to support economic growth.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

More importantly, Trump has signaled his intent to pursue a deregulatory economic policy, consistent with his previous administration. Historically, such periods of deregulation have often fueled economic growth, setting the stage for a potential phase of expansion.

This is the thesis behind recent comments from Raymond James’ market strategist Matt Orton, who stated, “We are heading into a very favorable seasonal period for the overall economy. So, I am very optimistic about where the markets go. I am more optimistic about the prospects that the growth we have been seeing can be maintained.”

Against this backdrop, Raymond James analysts have spotlighted two stocks with big upside — including one with a potential gain of nearly 440%.

What’s more, according to the TipRanks database, both stocks boast Strong Buy ratings from the analyst consensus. Let’s see why they are drawing plaudits across the board.

Mural Oncology (MURA)

Imagine a world where cancer treatments harness the body’s own defenses, using the immune system to fight back more effectively. That’s the vision behind Mural Oncology, a clinical-stage biopharmaceutical company focused on advancing cancer care. Mural has developed a proprietary protein engineering platform to create new cytokine-based oncological immunotherapies.

At the forefront of Mural’s pipeline is nemvaleukin alfa, a novel engineered IL-2 variant. IL-2 is a cytokine that stimulates both effector immune cells and regulatory T (Treg) cells, making it a prime candidate for anti-tumor activity. The company plans to develop nemvaleukin into a best-in-class immunotherapy and currently has the drug undergoing multiple human clinical trials targeting conditions such as platinum-resistant ovarian cancer (PROC), mucosal melanoma, and cutaneous melanoma.

Mural’s two leading clinical trials are ARTISTRY-7, a Phase 3 trial testing nemvaleukin against PROC, and ARTISTRY-6, a Phase 2 trial testing the drug in combination with pembrolizumab against unresectable or metastatic mucosal melanoma. The former has completed enrollment with 456 patients, and interim overall survival results are expected to be released early next year, either in late Q1 or early Q2. The ARTISTRY-6 trial has 92 patients enrolled, and Mural expects to release top-line results from cohort 2 during 2Q25.

These pivotal trials build on the success of ARTISTRY-1, a Phase 1/2 open-label study that evaluated nemvaleukin’s safety, tolerability, and preliminary efficacy. Results showed that nemvaleukin was well-tolerated and demonstrated durable responses in both monotherapy and combination therapy.

With several potential catalysts on the horizon and a share price of only $3.35, Raymond James analyst Laura Prendergast sees a compelling opportunity for investors.

“We believe MURA is currently undervalued for the following reasons: 1) lead asset, nemvaluekin, has near-term commercial opportunity that doesn’t seem to be on the radar yet for many investors, 2) management and board have notable experience that inspire confidence in ability to maneuver late stage drug development/commercial launch/BD execution; 3) MURA is currently trading at a 65% discount to cash and at 98% discount to its small cap biotech peer group,” Prendergast explained.

“If MURA can execute on [its] catalysts, we anticipate the company could become a major buyout target. We analyzed recent biotech acquisitions with similar 5-year forward sales estimates to MURA. Average historical take out multiple for this peer group is 5x EV/5-year forward sales which implies a potential deal value of ~$1.2B and $48 target price for MURA,” the analyst further noted.

For now, Prendergast rates MURA shares a Strong Buy, while her $18 price target suggests a robust upside of ~440% on the one-year horizon. (To watch Prendergast’s track record, click here)

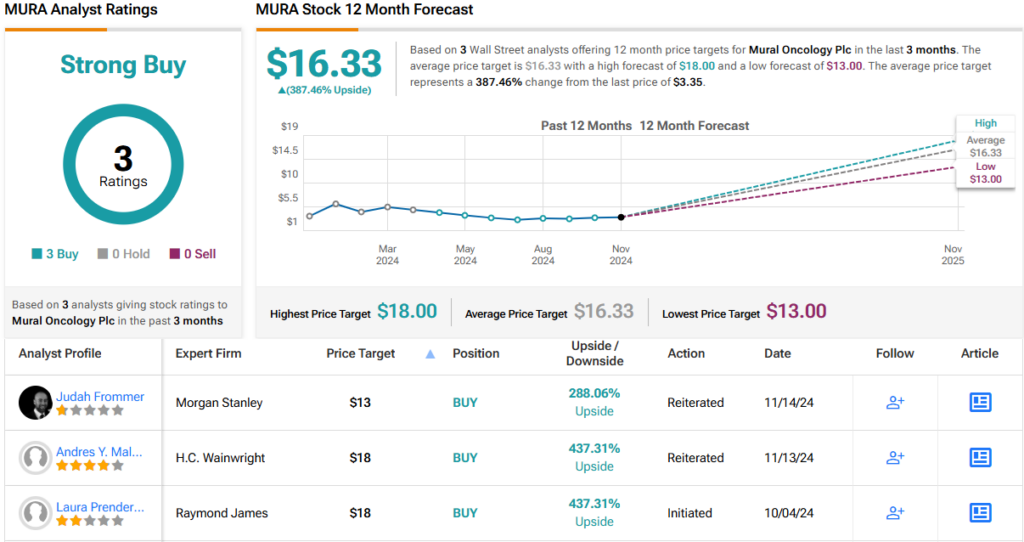

Other analysts are also optimistic about the cancer drug maker. MURA’s Strong Buy consensus rating breaks down into 3 Buys and no Holds or Sells. In addition, the $16.33 average price target puts the upside potential at 387%. (See MURA stock forecast)

Disc Medicine (IRON)

The next pick from Raymond James is Disc Medicine, a clinical-stage biopharmaceutical company dedicated to advancing treatments for hematologic diseases. Focused on the heme and iron pathways critical to red blood cell biology, the company aims to address some of the most pressing challenges in blood-related disorders.

Disc Medicine’s approach is driven by two key technology platforms. The heme synthesis modulation platform focuses on erythropoiesis, the process of red blood cell production. Meanwhile, the hepcidin pathway modulation platform addresses iron homeostasis, regulating how iron is absorbed, stored, and utilized – critical for hemoglobin production and healthy red blood cell development.

The company’s leading drug candidate, bitopertin, is a GlyT1 inhibitor designed to modulate heme biosynthesis. Disc Medicine is developing bitopertin as a potential treatment for erythropoietic porphyrias (EPP), a rare group of genetic blood disorders that cause extreme sensitivity to sunlight, severe pain, and skin blistering. Currently, no cure exists for EPP. Disc Medicine recently concluded a successful end-of-Phase 2 meeting with the FDA and plans to provide updates in the first quarter of 2025. The company is also preparing to launch a follow-up clinical trial by mid-2025.

In addition, Disc Medicine has seen success with its second drug candidate, DISC-0974. This is a new therapeutic agent under study as a treatment for various types of anemia, including anemia of myelofibrosis (MF) and anemia associated with chronic kidney disease (CKD). The drug candidate is a monoclonal antibody and a first-in-class antagonist of hemojuvelin, designed to enhance iron levels in patients with anemia. The company has an ongoing Phase 1b study on the CKD track, and has plans to initiate a Phase 2 study on the MF track before the end of this year.

All of this has caught the eye of Raymond James analyst Danielle Brill who wrote: “Disc Medicine has achieved regulatory alignment to file for accelerated approval for their lead asset bitopertin in EPP, representing our prior bull case scenario. This permits earlier market access for the company in addition to removing the risk having to run a large Phase 3 trial using a difficult primary endpoint… We expect a filing next year, with approval/launch by ~1H26 (RJ estimate).”

“Furthermore,” the analyst added, “we have increasing confidence in Disc’s next pipeline asset DISC-0974 for the treatment of MF and CKD anemia, for which we recently saw positive proof-of-concept efficacy in CKD anemia in a Ph 1 SAD study (prior note). We are optimistic ahead of full Ph 1b data in MF anemia which are to be presented at ASH, along with other incremental updates across Disc’s pipeline.”

This stance backs up the analyst’s Strong Buy rating on IRON stock, a rating that she compliments with a $110 price target – pointing towards a ~70% upside potential for the coming year. (To watch Brill’s track record, click here)

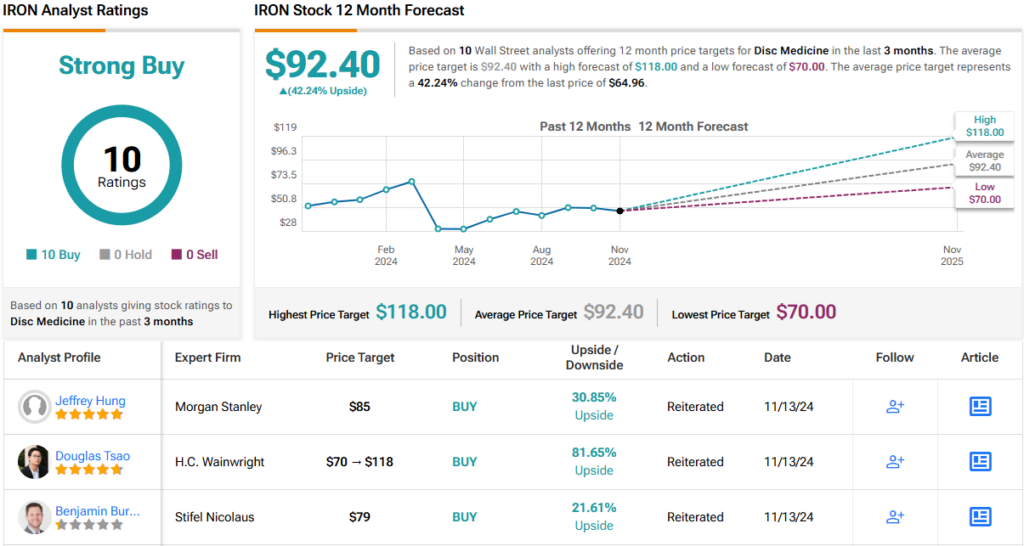

Brill’s colleagues on Wall Street are also in agreement. There are 10 recent analyst reviews of this stock on record and they are unanimously positive, giving IRON shares their Strong Buy consensus rating. The stock is currently trading for $64.96 and has an average target price of $92.40, suggesting a one-year upside of 42%. (See IRON stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.