Billionaire Ray Dalio’s hedge fund, Bridgewater Associates, is teaming up with financial services company State Street Global Advisors (STT) to launch the SPDR Bridgewater All Weather ETF, which is designed to deliver long-term growth. The ETF will bring Bridgewater’s diversified asset allocation strategies for uncertain economic times to a wider audience.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Karen Karniol-Tambour, Bridgewater’s Co-CIO, explained that traditional investing has benefited from stable economic conditions in recent decades, but the future could bring a wider range of challenges. She emphasized the importance of alternative investments to prepare for these changes and to manage wealth effectively.

In addition, State Street’s research shows growing interest in alternative assets, which are investments that don’t fall into the traditional categories of stocks, bonds, or cash. In fact, 45% of institutional investors are planning to increase their investments in alternative assets in the next year. The new ETF will follow a model created by Bridgewater, with State Street managing it, though details like fees, holdings, and the ticker symbol haven’t been shared yet.

What Is Bridgewater Associates Famous For?

Bridgewater Associates was founded by Ray Dalio in 1975 and has become one of the world’s largest and most successful hedge funds. Indeed, it became known for its pioneering use of macroeconomic analysis to guide its investment strategies, particularly in global markets. Dalio’s “Pure Alpha” strategy and “All Weather” portfolio approach—designed to perform well in various economic conditions—cemented his reputation as a top manager.

Over the decades, he has consistently ranked among the most influential figures in the investment world thanks to his ability to accurately predict major financial trends, such as the 2008 financial crisis. This led to Bridgewater managing over $100 billion in assets at its peak. Although he stepped down as the investment firm’s CEO in 2021, he continues to influence the industry.

Is STT Stock a Good Buy?

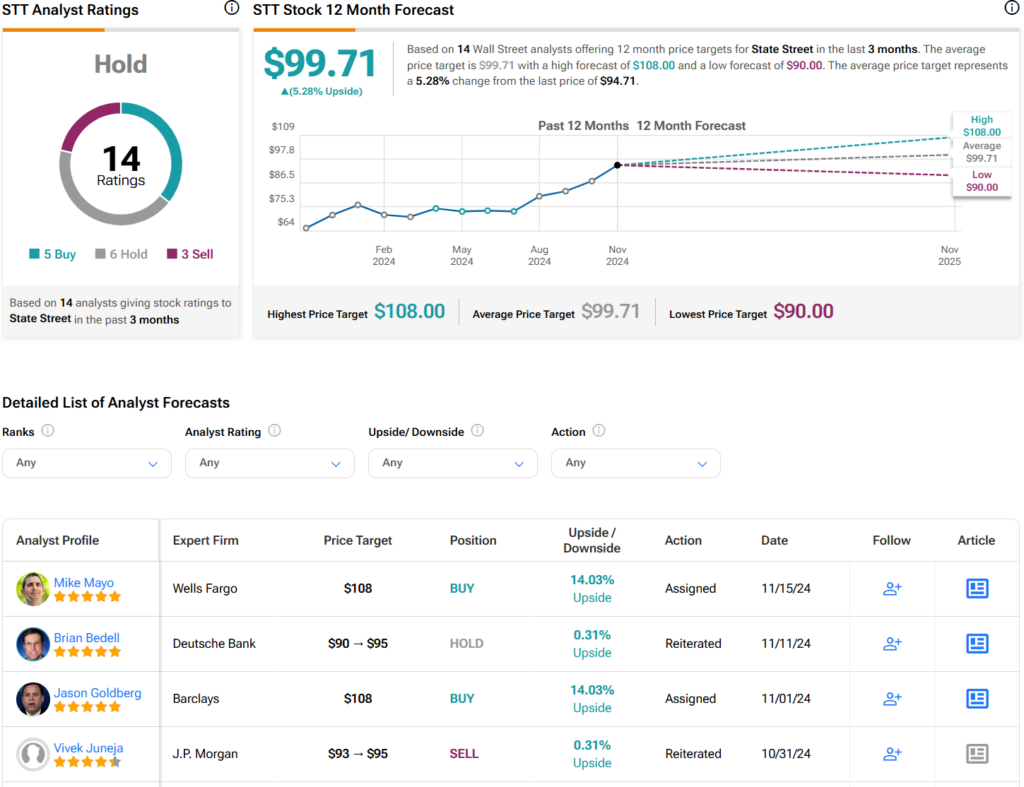

Turning to Wall Street, analysts have a Hold consensus rating on STT stock based on five Buys, six Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 40% rally in its share price over the past year, the average STT price target of $99.71 per share implies 5.3% upside potential.