Quebecor (TSE: QBR.B) posted higher profits and revenues in the fourth quarter as compared to a year ago.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The leader in telecommunications, entertainment, culture, and news media services also increased its quarterly dividend.

Revenues & Earnings

Revenues for Q4 2021 came in at C$1.18 billion, an increase of 3.2% versus C$1.15 billion in the prior-year quarter.

Net income attributable to shareholders amounted to C$160.5 million (C$0.67 per share), up from C$159.8 million (C$0.64 per share) during the three months ended December 31.

Adjusted income was C$157.6 million (C$0.66 per share), compared to C$165 million (C$0.66 per share) in Q4 2020.

Mobile phone services connections increased by 30,600 (1.9%), while Internet access service subscriptions grew by 8,100 (0.4%) in the quarter.

Quebecor increased the quarterly dividend on its Class A Multiple Voting Shares and Class B Subordinate Voting Shares by 9% from C$0.275 to C$0.30 per share.

CEO Commentary

Quebecor president and CEO Pierre Karl Péladeau said, “In the 2021 financial year, operating in an environment of ongoing and particularly intense competition in the Québec telecom industry, we posted increases of 5.5% in revenue, 1.1% in adjusted EBITDA and 5.3% in adjusted cash flows from operations. We stayed focused on the sound management of our operations, our balance sheet and our investments, as evidenced, among other things, by the 7.4% increase in adjusted cash flows from operations in the fourth quarter of 2021. With net available liquidity of C$1.57 billion as at December 31, 2021, we have a solid foundation to pursue our strategic priorities and offer our growing customer base the most innovative technology at the best price.”

Wall Street’s Take

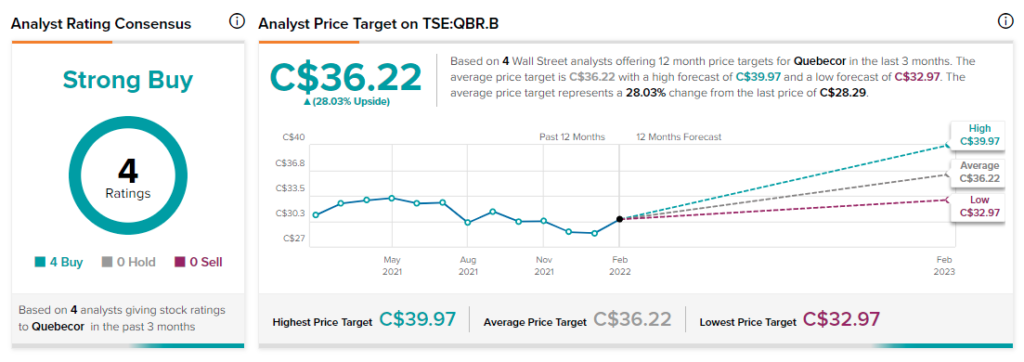

On February 18, Scotiabank analyst Jeff Fan kept a Buy rating on QBR.B and lowered its price target to C$34 (from C$36). This implies 20.1% upside potential.

The rest of the Street is bullish on QBR.B with a Strong Buy consensus rating, based on four Buys. The average Quebecor price target of C$36.222 implies upside potential of 28% to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

Telus Q4 Profit More Than Doubles

BCE Q4 Profit Falls, Dividend Rises

Rogers Communications Posts Lower Profit in Q4