Semiconductor giants like Qualcomm (QCOM) and Taiwan Semiconductor Manufacturing Company (TSM) are each well-positioned to benefit from the trends driven by artificial intelligence (AI). While I hold positions in both QCOM and TSM, this article will present why I believe Qualcomm is the better holding, with help from the TipRanks Stock Comparison Tool.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

(Note: Taiwan Semiconductor Manufacturing Company will be abbreviated as TSMC below, even though that doesn’t correspond with the stock ticker)

A Closer Look at Qualcomm (QCOM)

I’m bullish on Qualcomm because of its strong growth, Artificial Intelligence tailwinds, and its reasonable valuation. Qualcomm’s strength lies in its widely used Snapdragon processors and essential modem and radio frequency technologies for mobile connectivity.

Additionally, the company has expanded into automotive, IoT, and AI-driven PCs, providing innovative solutions for connected devices. As a result, Qualcomm excels in smartphone modem manufacturing and maintains a competitive edge, particularly as AI integration becomes increasingly vital in mobile technology.

After more than doubling between September 2023 and June of this year, Qualcomm’s stock has since pulled back by more than 25%. I attribute this decline primarily to the market correction in high-growth and semiconductor stocks rather than any company-specific issues. Meanwhile, the stock is 16% higher than where it stood at the beginning of the year. Currently, Qualcomm trades at a forward P/E (non-GAAP) of 16.8x, approximately 30% lower than the industry average.

QCOM’s Latest Results

Qualcomm’s latest results have bolstered my bullish investment thesis. In Q3, the company reported revenues of $9.4 billion and non-GAAP earnings per share of $2.33, both exceeding expectations.

The company is making significant progress in the automotive sector, with more than 10 new design wins and 87% yearly growth in that segment. It is also leveraging AI advancements in smartphones through its Snapdragon 8 Gen 3 platform and entering the personal computer market with co-pilot PCs powered by its Snapdragon X Series. This expansion aligns with rising demand for PC upgrades, further enhancing Qualcomm’s growth prospects.

Over the past five years, Qualcomm has achieved a revenue CAGR of 8.1% and diluted EPS growth of 23.8%. Analysts expect continued robust growth, with EPS projected to rise by 19.1% and revenues anticipated to increase by 7.7% this year.

Qualcomm’s Potential Intel Acquisition

A key risk to my bullish thesis on Qualcomm is the potential acquisition of Intel (INTC). The chipmaker has faced significant challenges, losing market share to competitors like Nvidia (NVDA), and grappling with high costs and massive capital expenditures.

Reports suggest that Qualcomm has approached Intel regarding a possible takeover. If such an acquisition takes place, it may create synergies in areas like product development and management, potentially enabling a reduction in headcount. This could result in lower operating expenses and higher profits.

However, Intel’s shareholders are likely to demand a substantial takeover premium. I am skeptical whether a business combination would benefit Qualcomm shareholders as much as Intel’s.

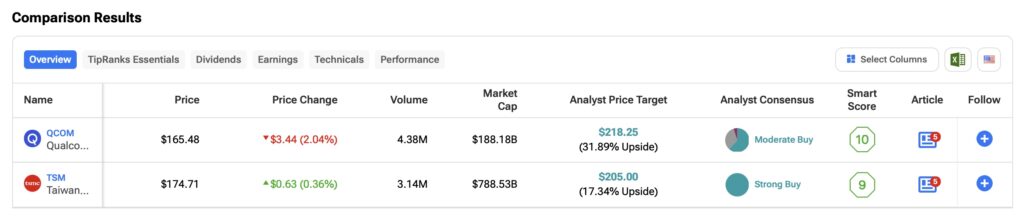

Is QCOM A Buy According to Wall Street Consensus?

Wall Street rates QCOM shares as a Moderate Buy. Out of 21 analysts, 13 rate it a Buy, and seven rate it a Hold, with only one Sell rating. Based on the average price target of $218.25, Wall Street sees a potential upside of ~32% for QCOM.

A Closer Look At Taiwan Semiconductor Manufacturing Company (TSMC)

It’s hard to view Taiwan Semiconductor Manufacturing Company (TSMC) negatively given its leading position in global chip production. As AI demand continues to grow, TSMC’s capacity to manufacture and supply chips drive significant barriers to entry. Shareholders can lean on TSMC’s expertise and strong partnerships with key players in the semiconductor, cloud, and technology sectors.

TSMC currently trades at a forward P/E (non-GAAP) of 26.3x, which is 9% above the industry average and significantly higher than Qualcomm’s valuation multiple. However, it’s important to note that TSMC is recognized for delivering high-quality products, including Apple’s (AAPL) custom-designed chips like the A-series processors used in iPhones. This reputation, along with strong pricing power, contribute to TSMC’s net income margin of 36.8% compared to 28.2% for Qualcomm.

TSMC’s Latest Results

My bullish view on TSMC has been strengthened by its strong Q2 performance. The company reported EPS of $1.47, which exceeded the consensus estimate of $1.41, and represents a nearly 30% increase from last year. TSMC also raised its Q3 guidance, anticipating continued benefits from the AI boom.

Key highlights include a 36.3% rise in net income and a 40% increase in revenues compared to Q2 last year, along with impressive operating margins of 42.5%. Management expects Q3 revenues of between $22.4 billion and $23.2 billion with operating margins projected between 42.5% and 44.5%, driven by strong demand for smartphones and AI-related products.

TSMC’s dominance in the semiconductor industry, its strong results, and attractive valuation have contributed to its shares rising more than 70% this year. Analysts forecast EPS growth of 27.4% on revenue growth of 28.1% for the year, significantly better than the five-year revenue CAGR of 19.2%.

TSMC Faces Geopolitical Risks

Every investment carries risks, and a significant threat to my bullish thesis on TSMC is the geopolitical landscape. Tensions between China and Taiwan, along with U.S.-China relations, could disrupt production and supply chains. This could lead to export restrictions, sanctions, and other barriers that negatively impact TSMC.

Comments from politicians, such as former President Trump’s suggestion that he might not defend Taiwan from a Chinese attack if re-elected, further amplify these concerns. Given these risks, TSMC’s relatively discounted valuation compared to other large-cap tech giants looks understandable.

Is TSMC A Buy, According to Wall Street Consensus?

All five Wall Street analysts who cover Taiwan Semiconductor Manufacturing Company hold a Buy rating. TSM stock carries a consensus Strong Buy rating with an average price target of $205.00, suggesting potential upside of 17.32%.

Conclusion

In summary, I see both Qualcomm and TSMC as attractive Buy opportunities in the semiconductor sector. However, if I had to choose one over the other, I’d consider Qualcomm the slightly better investment today due to its relatively de-risked valuation, despite its more moderate growth profile. While TSMC is expected to sustain robust long-term growth and industry dominance, political risks present a significant challenge that is difficult to quantify.