Major fintech players like PayPal (PYPL) and Block (SQ) saw rapid pandemic-driven growth but have since experienced significant declines as their growth slowed. Now trading at more reasonable valuations, both companies are working to regain investor confidence. While I remain bullish on both companies, I believe PayPal may be a better investment due to its renewed focus on profitability growth recovery and enhancing product offerings. In contrast, Block faces operational challenges and volatility from its crypto exposure.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

In this article, I will use TipRanks’ Stock Comparison Tool to assist in my evaluation of the current investment potential of both stocks.

A Closer Look At PayPal (PYPL)

I hold a bullish view on PayPal, as it is making solid progress in regaining investor confidence. PayPal is now in a turnaround phase, with a recent recovery in profitability growth and cost-cutting efforts driving improved performance with shares rising about 30% over the past twelve months. As a leading digital payments provider, its diversified revenue model is driven by transaction fees and merchant services, which help the company reduce reliance on a single income source.

To better understand PayPal’s situation, it’s crucial to note that the company struggled to sustain its pandemic-driven e-commerce boom. Since peaking at over $300 per share in mid-2021, PYPL stock lost more than 80% of its value. Investor enthusiasm was high then, driven by rapid growth, with revenues rising by 20% in 2020 and 18% in 2021, while operating income increased by 22% and 25%, respectively.

PayPal’s peak P/E ratio at over 100x was tough to maintain as competition in the digital payments industry intensified, and amid a growth slowdown. In 2022, revenues declined by 2%, followed by just 1% growth in 2023. Currently, PayPal’s stock trades at under 18x its forward earnings and less than 11x free cash flow, reflecting a valuation more aligned with stagnant growth. Despite this, growth continues, albeit at a slower pace than during the pandemic.

PayPal’s Latest Developments

To further support my positive outlook on PYPL stock, the company recently reported 8% year-over-year revenue growth and a 36% increase in non-GAAP EPS for its Q2 earnings, topping market expectations.

A key indicator of PayPal’s operational efficiency is its Transaction Margin Dollars, which measures payment processing profitability. In Q2, this metric grew by 8% to $3.6 billion, the best performance since 2021. This success was largely driven by the popularity of PayPal’s Braintree platform among startups and tech companies due to its developer-friendly approach and flexible solutions.

However, challenges remain, as analysts do not anticipate significant top-line growth improvements for PayPal in the mid-term to long-term, projecting around 7% annual growth over the next three years.

Is PYPL a Buy, According to Wall Street Analysts?

TipRanks reports a Moderate Buy rating for PayPal stock, based on Wall Street analysts. Of the 33 analysts covering the stock, 18 recommend a Buy, while 15 have a Hold rating. The average price PYPL target of $78.21 indicates potential upside of about 1.5% compared to the recent trading price.

A Closer Look At Block (SQ)

I hold a bullish view on Block, albeit with some caution, as it continues to innovate and expand its ecosystem for consumers and businesses. The company primarily generates revenue from transaction fees through services like Cash App and Square. Over time, Block has shifted its focus from its core payment processing business, which experienced strong growth, to blockchain technology and Bitcoin (BTC) which now account for about 44% of its revenue in recent periods.

Like PayPal, Block’s stock price declined substantially from its 2021 peak.

Unlike PayPal, however, Block’s growth during the 2020-2021 period was heavily tied to Bitcoin prices, leading to greater volatility. In 2022, Block’s revenue dipped by 1%, while growth in 2023 rebounded to 25%. Currently, Block trades at a forward P/E ratio of about 19x, representing a premium over PayPal. However, its PEG ratio of 0.48x, based on projected earnings growth over the next 3 to 5 years, suggests it is undervalued, especially compared to PayPal’s PEG ratio of 1.41x.

Block’s Latest Developments

My outlook for SQ stock reflects only cautious optimism due to the company’s current challenges, as evidenced by the mixed performance reported in Q2 and falling Bitcoin prices. While Block’s stock is up more than 50% in the last twelve months, it has declined almost 10% this year.

The weak performance is further highlighted by a deceleration in year-over-year growth in Gross Payment Volumes (GPV), which dropped from 12% in Q2 2023 to 5% in Q2 2024, while direct peers such as PayPal has been improving payment volumes.

In response to these challenges, Block has made strategic leadership changes and raised its fiscal 2024 gross profit adjusted EBITDA guidance by 1% and 2%, respectively. Management aims to reignite GPV growth through innovative sales strategies and new partnerships, demonstrating commitment to enhancing performance despite recent setbacks. Nevertheless, the success of these efforts remains to be seen.

Is SQ A Buy, According to Wall Street Analysts?

While my positive outlook on SQ is more tempered, Wall Street holds a different perspective, maintaining a Strong Buy consensus rating. Out of 26 analysts, 21 have Buy ratings, four have Hold ratings, and one analyst considers SQ a Sell. The average price SQ target of $87.63 suggests a potential upside of more than 30%.

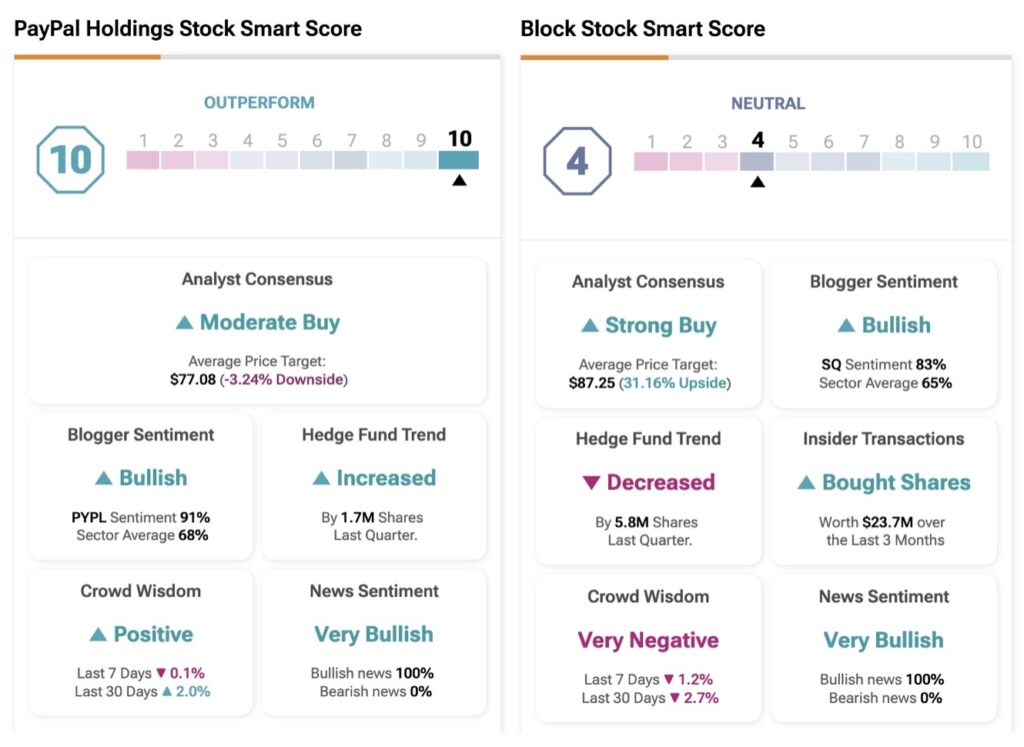

PayPal vs. Block According to TipRanks Smart Score

Despite being bullish on both stocks, I believe that PayPal is in a better position than Block, as supported by the TipRanks Smart Score. This score evaluates various indicators, including Wall Street consensus, hedge fund trends, news sentiment, technical indicators, and financial metrics such as ROE and asset growth. PayPal excels in these areas, earning a perfect score of 10 out of 10, suggesting that the stock is well-positioned to outperform. In contrast, Block’s score of four out of 10 indicates a neutral outlook.

Conclusion: PYPL Is the More Attractive Investment

In conclusion, while Block appears better valued relative to its growth potential, its Bitcoin volatility and mixed performance create uncertainties for its future operating performance. In contrast, PayPal is showing a strong commitment to profitability growth recovery, bolstered by effective operational strategies and positive market sentiment. Therefore, I believe PayPal presents a more compelling investment opportunity at this time.