Real estate investment trust PS Business Parks, Inc. (PSB) has inked a deal with Longfellow Real Estate Partners to sell its Lusk Business Park in San Diego, California, for a gross purchase price of $315.4 million. Net proceeds from the deal, including transaction costs, are likely to be around $311 million.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

According to the company, about $50.5 million of the net sale proceeds are likely to fall under Section 1031 exchange for its recently acquired Port America Industrial Park in Dallas, Texas. Additionally, some portion of proceeds might be paid as a one-time special dividend by the year-end if not suitably charged under any section. Lastly, the remaining amount is expected to be used for the redemption of preferred shares.

PS Business Parks CEO Mac Chandler said, “Our infill 20.6 acre Lusk property with its 1.8 million square feet of zoned life science development potential is an extremely valuable asset. This accretive transaction will allow us to realize significant value for our stockholders.”

Markedly, the company is also willing to vend its Royal Tech Business Park in Irving, Texas. (See Insiders’ Hot Stocks on TipRanks)

Recently, Wells Fargo analyst Blaine Heck upgraded the stock to Hold from Sell and lifted the price target to $163 from $155 as he believes that “the company has successfully overcome many concerns related to the impact of COVID-19 on small tenants and recent large move-outs, and valuation now appears fair relative to peers.”

Overall, the stock has a Moderate Buy consensus rating based on 1 Buy and 1 Hold. The average PS Business Parks price target of $169 suggests upside potential of 3.4% from the current levels.

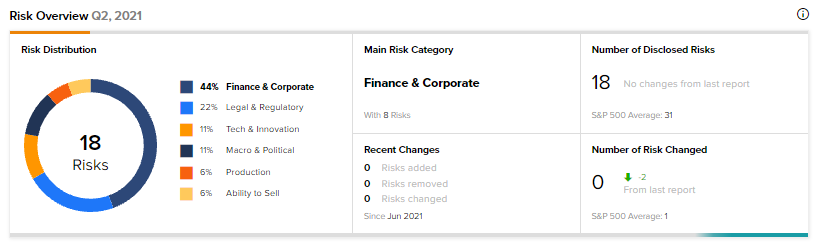

Investors should always be aware of the risks involved in any stock. According to the new TipRanks’ Risk Factors tool, PS Business Parks is at risk mainly due to two factors: Finance and Corporate, and Legal and Authority, which contribute 44% and 22%, respectively, to the total 18 risks identified for the stock. Under the Finance and Corporate risk category, PSB has eight risks, details of which can be found on the TipRanks website.

Related News:

Accuray Inks Deal with C-RAD to Enhance Breast Cancer Treatment

Xencor Inks Collaboration and License Agreement with Janssen; Shares Rise

PepsiCo Q3 Revenue & Earnings Beat Estimates