Pressure is mounting on American air carrier Southwest Airlines (LUV) as activist investor Elliott Investment Management has increased its stake to cross the 10% threshold. According to Reuters, Elliott converted some of its derivative holdings in Southwest to common stock, enough to raise its stake to over 10%. However, the investor’s overall economic interest remains the same.

Crossing the threshold gives Elliott the right to convene a special shareholders meeting. The news comes just days before the two parties prepare for a scheduled meeting on September 9 to discuss strategic solutions to boost LUV’s share price. The hedge fund is miffed that Southwest Airlines stock has lost over 50% of its value in the past three years. Elliott first disclosed its stake in Southwest in June this year.

Elliott Intensifies Pressure on Southwest

As a logical step, Elliott would wait until the September 9 meeting before taking any further drastic actions. Failing any favorable developments, Elliott could call for a special shareholder meeting to replace the board. Elliott is determined to drive major changes in Southwest’s board and plans to nominate ten directors to the latter’s 15-member board.

Moreover, Elliott wants to oust CEO Robert Jordan and Executive Chairman Gary Kelly, as it believes the leadership has failed to navigate the airline through its troubles effectively. Paul Singer-led Elliott is one of the biggest activist hedge funds globally, with over $70 billion in assets under management. Singer is known to have brought about a drastic overhaul in companies that he feels are being hammered by poor leadership.

Bowing to its pressure, Southwest already announced a few changes to its policies in July. The airline started premium seating, offered seats with extra legroom, scheduled overnight flights, and even named new board members. Nonetheless, Elliott balked at the measures. Interestingly, Southwest Airlines also adopted a “poison pill” by enacting a shareholder rights plan, making it difficult for a single shareholder to increase its stake to over 12.5%.

Insights from TipRanks’ Bulls Say, Bears Say Tool

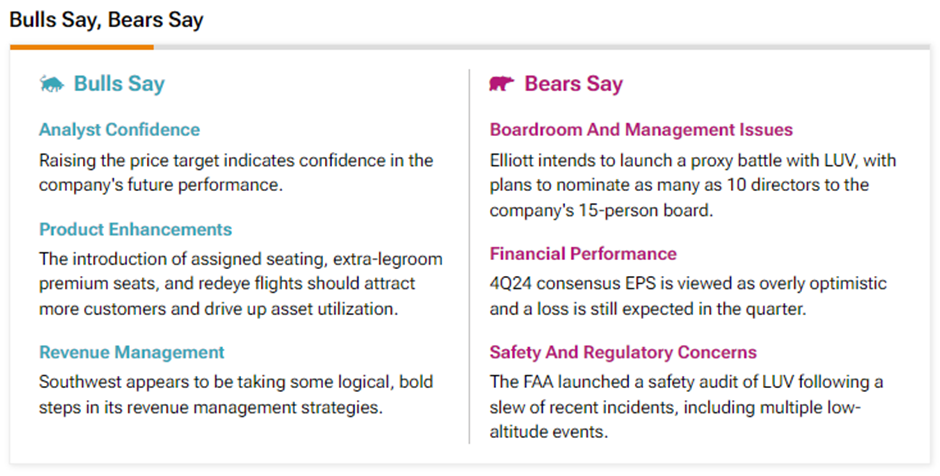

Amid the activist pressure and the strategies adopted by the air carrier, analysts have mixed views on Southwest Airlines. According to TipRanks’ Bulls Say, Bears Say tool, some analysts are optimistic about the steps taken by LUV to boost its revenues. Bulls even increased their price targets as a sign of confidence in Southwest’s revenue management strategies.

On the other hand, Bears are highly concerned about challenges such as Elliott’s proxy battle, LUV’s overly optimistic earnings guidance for Q4 FY24, and the safety audit launched by the FAA (Federal Aviation Administration) following several incidents.

Is Southwest Stock a Buy or Sell?

Given the ongoing activist drama, Wall Street prefers to remain on the sidelines for now. On TipRanks, LUV stock has a Hold consensus rating based on three Buys, seven Holds, and two Sell ratings. Also, the average Southwest Airlines price target of $26.85 implies 7.2% downside potential from current levels. Year-to-date, LUV shares have gained 1.3%.