BRISBANE, Australia, Dec. 19, 2023 (GLOBE NEWSWIRE) — Allkem Limited (ASX: AKE, “Allkem”) refers to the proposed merger of equals between Allkem and Livent Corporation (“Livent”), (“Transaction”).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Allkem is pleased to announce that the requisite majorities of Allkem shareholders have today voted in favour of the proposed scheme of arrangement pursuant to which Arcadium Lithium plc (“Arcadium Lithium”) will acquire 100% of the shares in Allkem (“Scheme”) in connection with the Transaction.

Results of the Scheme Meeting

In accordance with ASX Listing Rule 3.13.2 and section 251AA of the Corporations Act 2001 (Cth), a detailed report of the votes cast on the resolution to approve the Scheme is included as Annexure A to this announcement. In summary:

- 89.27% of Allkem shareholders present and voting (either in person (including online), or by proxy, attorney or corporate representative) voted in favour of the Scheme; and

- 72.07% of the total number of votes cast by Allkem shareholders (either in person (including online), or by proxy, attorney or corporate representative) were in favour of the Scheme.

Managing Director and CEO, Martin Perez de Solay said, “I would like to thank shareholders for their support of the merger which subject to Livent shareholder approval will bring together a highly complementary range of assets, growth projects and operating skills across extraction and processing under an integrated business model. Arcadium Lithium will have the scale and expertise to meet the rapidly growing demand for lithium chemical products and the product flexibility required by customers while remaining committed to the delivery and execution of a significant growth pipeline.”

Chairman, Peter Coleman said, “The combination of Allkem and Livent is expected to create a highly complementary and vertically integrated business model to enhance operational flexibility and reliability, which is expected to result greater value capture across the lithium value chain.

“The Combined Group will have an attractive geographic footprint and greater capacity to de-risk and accelerate growth with a deeper pool of technical, capital and projects expertise. We expect the delivery of unique and significant synergies and overall an enhanced value proposition for shareholders, customers, employees and local communities, with a firm commitment to sustainability and responsible growth.”

Next steps

The Livent stockholder meeting is scheduled to be held on 19 December 2023 (New York time), at which Livent stockholders will vote on the adoption of the Transaction Agreement and the approval of the transactions contemplated by it. The affirmative vote of a majority of Livent stock entitled to vote at the Livent stockholder meeting is a condition to implementation of the Scheme.

If Livent stockholders approve the adoption of the Transaction Agreement and the transactions contemplated by it, Allkem will apply to the Federal Court of Australia for approval of the Scheme at a hearing scheduled for 2:15 pm (AWST) on 20 December 2023 (“Second Court Hearing”).1

If the Court approves the Scheme at the Second Court Hearing, Allkem intends to lodge a copy of the orders of the Court with the Australian Securities and Investments Commission on 21 December 2023 (AEDT), so that the Scheme will become effective on that date. If this occurs, Allkem Shares will be suspended from trading on ASX with effect from close of trading on 21 December 2023 (AEDT), and from trading on TSX with effect from 4:00pm (Toronto time) on 21 December 2023.

Implementation of the Scheme is expected to occur on 4 January 2023 (AEDT), subject to the satisfaction or waiver of the remaining conditions precedent to the Scheme (including approval of the Scheme by the Court at the Second Court Hearing).

Scheme Timetable

The key remaining dates expected for the Transaction are set out below.

| Event | Date / time |

| Livent Stockholder Meeting | 19 December 2023 (New York time) |

| Second Court Date | 2:15 pm (AWST) on 20 December 2023 |

| Election Date

The latest time and date by which Election Forms (or Election Withdrawal Forms, if applicable) must be received by the Allkem Share Registry from:

|

Principal Register Shareholders: 5:00 pm (AEDT) on 20 December 2023

Canadian Register Shareholders: 5:00 pm (Toronto time) / 10:00 pm (UTC) on 20 December 2023 |

| Arcadium Lithium admitted to the official list of ASX | 21 December 2023 |

| Effective Date | 21 December 2023 |

| Suspension of Allkem Shares from trading on ASX | Close of trading on 21 December 2023 (AEDT) |

| Suspension of Allkem Shares from trading on TSX | 4:00 pm (Toronto time) / 9:00 pm (UTC) on 21 December 2023 |

| Arcadium Lithium CDIs to commence trading on ASX on a deferred settlement basis | 22 December 2023 |

| Record Date for determining entitlements to receive Scheme Consideration | 7:00 pm (AEDT) on 27 December 2023 |

| Scheme Implementation Date | 4 January 2024 |

| US Merger Effective Time | 4 January 2024 (New York time) |

| Last day of deferred settlement trading for Arcadium Lithium CDIs | 4 January 2024 |

| Arcadium Lithium Shares anticipated to commence trading on NYSE | 9:30 am (New York time) on 4 January 2024 |

| Dispatch of holding statements for Arcadium Lithium CDIs | 5 January 2024 |

| Arcadium Lithium CDIs to commence trading on ASX on a normal settlement basis | 10:00 am (AEDT) on 5 January 2024 |

| Expected date for Allkem to be delisted from ASX | Close of trading on 5 January 2024 (AEDT) |

| Expected date for Allkem to be delisted from TSX | Close of trading on 5 January 2024 (Toronto time) |

| First settlement of deferred settlement and normal settlement trading of Arcadium Lithium CDIs | 9 January 2024 |

Note: All references to time above are references to AEDT (Sydney time), unless otherwise specified.

All dates are indicative only and, among other things, are subject to all necessary approvals from the Court and other Governmental Entities and the satisfaction or permissible waiver of all other applicable closing conditions. Allkem reserves the right to vary the times and dates set out above. Any changes to the above timetable will be announced through ASX, filed under Allkem’s profile on SEDAR+ and notified on www.allkem.co.

This release was authorised by the Board of Directors of Allkem Limited.

| Allkem Limited

ABN 31 112 589 910 Level 35, 71 Eagle St |

Investor Relations & Media Enquiries

Andrew Barber Phoebe Lee |

Connect

info@allkem.co |

|

| LinkedIn, Facebook, X, YouTube | |||

IMPORTANT NOTICES

Not for release or distribution in the United States

This announcement has been prepared for publication in Australia and may not be released to U.S. wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction, and neither this announcement or anything attached to this announcement shall form the basis of any contract or commitment. Any securities described in this announcement have not been, and will not be, registered under the U.S. Securities Act of 1933 and may not be offered or sold in the United States except in transactions registered under the U.S. Securities Act of 1933 or exempt from, or not subject to, the registration of the U.S. Securities Act of 1933 and applicable U.S. state securities laws.

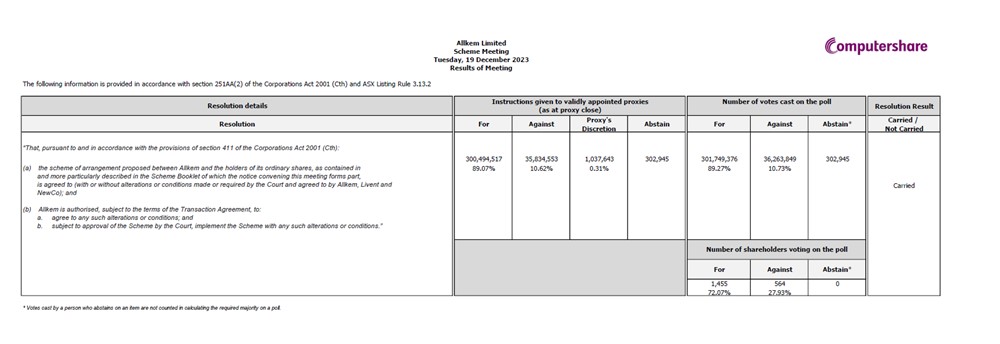

Annexure A: Voting results of the Scheme Meeting

The following information is provided in accordance with ASX Listing Rule 3.13.2 and section 251AA of the Corporations Act 2001 (Cth):

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ed174d49-e63c-4875-a729-88a6e7c09073

__________________________

1 The Scheme remains subject to certain conditions. The Second Court Hearing will only occur if all of the remaining conditions precedent to the Scheme (other than in relation to the Court’s approval of the Scheme) have been satisfied or waived as at 8.00 am (Australian Western Standard Time) on 20 December 2023 (being the date that is currently scheduled to be the Second Court Date). Full details of the conditions precedent to the Scheme (and other terms) are set out in the Transaction Agreement entered into between Allkem, Livent and Arcadium Lithium (as amended from time to time), a summary of which is included in the Scheme Booklet and which is available on the ASX website at www.asx.com.au and on Allkem’s website at https://www.allkem.co/.