Plug Power Inc. (PLUG) saw its stock decline by 3.4% during regular trading hours after it missed analysts’ expectations, despite posting $173.7 million in revenue for Q3 2024. Analysts had forecasted revenue to be $207.25 million for the quarter. However, the company showed significant signs of progress in its journey to become a leader in the hydrogen economy, with strong growth driven by a surge in electrolyzer deployments and the continued expansion of its hydrogen production network. Plug saw a 285% quarter-over-quarter increase in electrolyzer sales, marking a key milestone as the business scales up.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

In particular, Plug secured a major order for a 25 MW electrolyzer system from BP and Iberdrola’s joint venture at Spain’s Castellon refinery. “This is a significant inflection point for the industry,” said CEO Andy Marsh in a statement, emphasizing that the growth in electrolyzers positions Plug for expansion in 2025 and beyond.

Plug Power Demonstrates Improved Margins

While Plug reported a net loss of $211.2 million for Q3, this marked an improvement over the $262.3 million loss in Q2 2024. The company’s focus on cost efficiency is starting to pay off, with operating cash flow improving by 31% from the previous quarter. Furthermore, gross margin loss decreased by 37%, largely due to improved revenues across multiple streams—equipment, service, and fuel. Plug is continuing to streamline its manufacturing footprint, which will allow for better leverage as production scales. This is essential as Plug navigates the competitive landscape and positions itself for profitability.

PLUG’s EPS Improves Amid Challenges

In terms of earnings per share (EPS), Plug reported a loss of $0.25 for Q3 2024, an improvement compared to the $0.36 loss in the prior quarter. However, this fell short of analysts’ consensus estimate of a loss of $0.24. This decrease in losses highlights the company’s ongoing efforts to manage costs, increase operational efficiencies, and grow its revenue base. With new deployments in its electrolyzer business and improvements in hydrogen production, Plug is working toward achieving sustainable profitability, though it acknowledges that strategic investments and market dynamics continue to impact its bottom line.

PLUG Expects a Brighter Future

Looking ahead, Plug expects its 2024 revenue to range between $700 million and $800 million, driven by strong orders across its electrolyzer, cryogenic, and material handling businesses. CEO Marsh remains optimistic about the future, stating, “Our progress in electrolyzer deployments, advancements in hydrogen production, and expansion into new markets reflect our team’s dedication to leading the build out of the hydrogen economy.”

Is Plug Power a Good Buy Right Now?

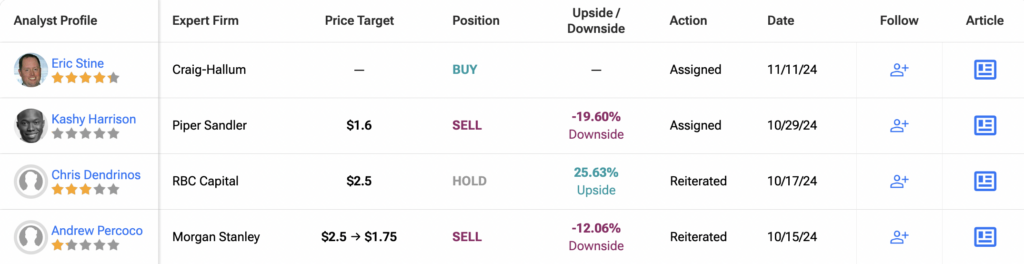

Analysts remain sidelined about PLUG stock, with a Hold consensus rating based on two Buys, six Holds and three Sells. Year-to-date, PLUG has declined by more than 50%, and the average PLUG price target of $2.41 implies an upside potential of 21% from current levels. These analyst ratings are likely to change following PLUG’s results today.