Earlier today, Pivotal Research initiated coverage on TKO Group Holdings (TKO) with a Buy rating and $170 price target due to its strong revenue growth potential. The firm, led by analyst Jeffrey Wlodarczak, believes the company, which focuses on wrestling and martial arts media, has unique assets and significant opportunities for expansion. As a result, shares increased slightly in today’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Pivotal expects TKO to benefit from the rising fees for media rights, along with an increase in event revenue and new revenue streams like gambling and digital platforms. It also anticipates that the company’s cost-cutting measures will lead to an annual EBITDA growth rate of approximately 15% through 2027.

Furthermore, Pivotal pointed to TKO’s valuable sports assets, as both the UFC and WWE have roughly 700 million global fans that could be better monetized with advertising and sponsorships. It also sees competition among traditional media and streaming platforms as a major catalyst for higher sports rights fees.

It’s worth noting that, so far, Wlodarczak has enjoyed a 53% success rate on his stock ratings.

Is TKO a Good Stock to Buy?

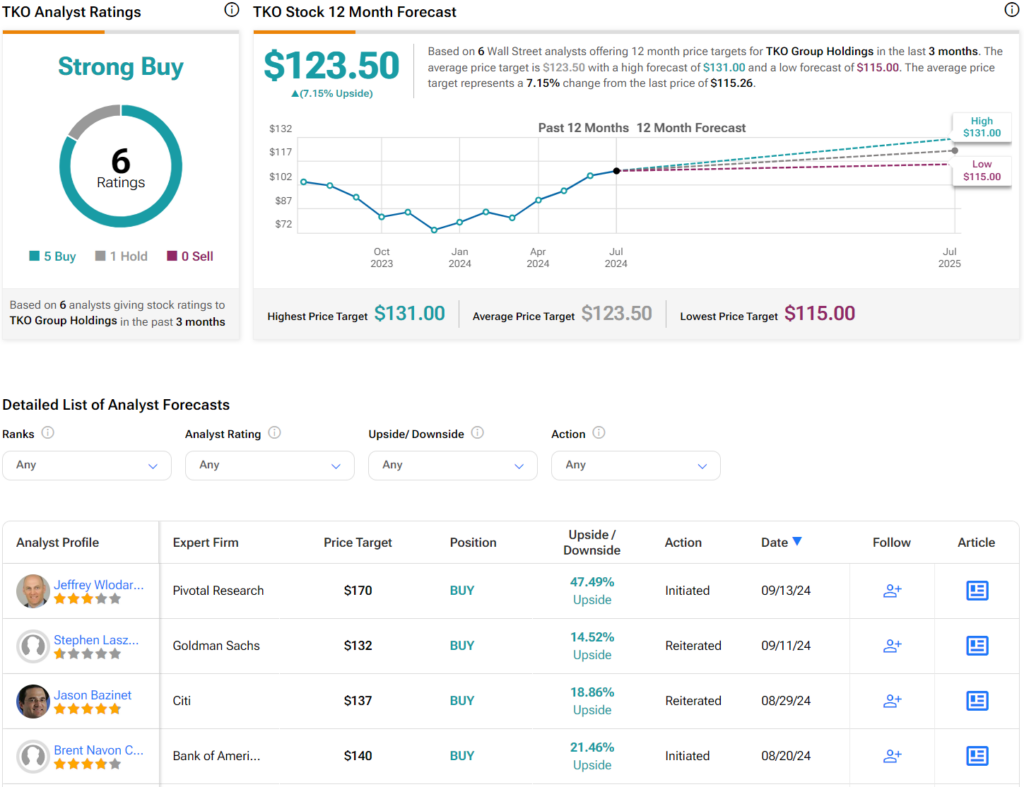

Overall, analysts have a Strong Buy consensus rating on TKO stock based on five Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 19% rally in its share price over the past year, the average TKO price target of $123.50 per share implies 7.15% upside potential.