Pinterest’s (PINS) performance has been impressive, with accelerating revenue growth driven by steady user base expansion and effective monetization strategies. However, one concern that continues to weigh on investment value is the company’s substantial stock-based compensation (SBC) program. This leads to ongoing shareholder dilution, which can impact future total returns in a very negative way. As a result, I hold a neutral stance on the stock despite the two recent Buy ratings from Oppenheimer and Deutsche Bank.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Strong User Growth Fuels Investment Case

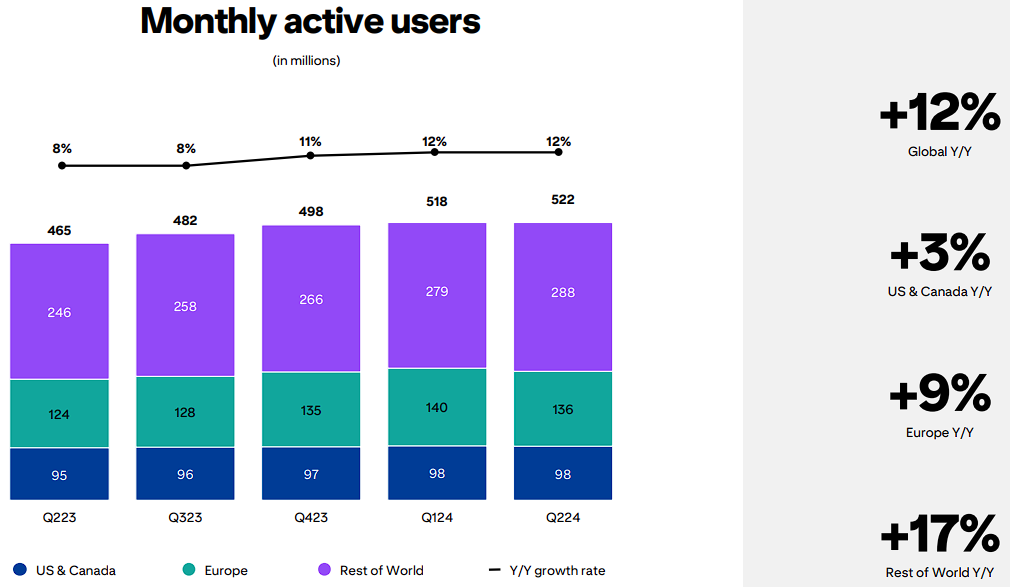

Although I carry a neutral rating for PINS stock, the company’s recent second-quarter results highlighted sustained growth in its user base; a trend that has clearly been one of the main pillars powering the stock. Specifically, Global Monthly Active Users (MAUs) reached a record high of 522 million, a 12% rise year-over-year, accelerating from a pace of 8% growth in MAUs in the prior-year period. The most substantial growth came from international markets, with the Rest of the World (RoW) region seeing a 17% increase to 288 million MAUs. North America, Pinterest’s most profitable market, also grew, though at a more modest 3%.

Pinterest’s ability to sustain this growth seems to stem from several initiatives. One is its intensified focus on AI-driven personalization, which has improved the relevance and engagement of content users see on the platform. Another driver is Pinterest’s emphasis on curation and unique content formats like collages, which resonate particularly well with Gen Z. The rollout of these features is helping Pinterest differentiate itself from other social media platforms by offering a positive, more action-oriented user experience. Bill Ready, Pinterest’s CEO, stressed in the earnings call how Pinterest’s ability to guide users from inspiration to action seamlessly on the platform has driven more meaningful engagement.

Revenue Growth Accelerates as Monetization Efforts Pay Off

Although there are offsetting concerns that prevent me from adopting a bullish outlook, the ongoing strong growth in Pinterest’s user base, along with management’s successful monetization efforts, has been instrumental in driving an acceleration in revenue growth. Pinterest registered $854 million in revenues for Q2, marking a 21% gain compared to last year. This performance notably outpaced Q2-2023’s revenue growth of 6.3% a year ago.

A notable contributor to this acceleration, as part of Pinterest’s efforts to improve monetization, has been the expansion of its lower-funnel advertising solutions which focus on driving actions such as clicks and conversions rather than merely impressions. Also, the company’s focus on performance-driven advertising has resonated well with advertisers. Pinterest has, in fact, more than doubled the number of outbound clicks to advertisers for three consecutive quarters.

From a regional standpoint, the Rest of the World market once again stood out, posting a 32% year-over-year revenue increase, significantly outpacing the 19% growth in the U.S. and Canada. Europe also saw a 25% jump in revenue as advertisers in these markets increasingly adopt Pinterest’s full-funnel solutions. This geographic diversification is critical as Pinterest looks to reduce its dependency on North American revenue, which still makes up most of its top line.

Stock-Based Compensation is a Lasting Dilution Risk

Despite strong user and revenue growth, Pinterest’s reliance on stock-based compensation (SBC) remains a major investor concern, and a reason why I’m neutral on PINS stock. In Q2 alone, Pinterest incurred $196 million in SBC expenses, which accounted for nearly 23% of total revenue. This level of SBC as a percentage of revenues has been typical over the past several years, generally hovering just above 20%. That presents two primary issues for shareholders: dilution and inflated financial metrics.

First, stock-based compensation results in the continuous issuance of new shares, which dilutes existing shareholders’ ownership. Pinterest’s share count has been steadily rising due to SBC, with the number of outstanding shares growing from 529.4 million at the time of its 2019 IPO to over 686.2 million at the end of Q2 2024. In other words, the compound annual growth rate (CAGR) of Pinterest’s share count from April 2019 to June 2024 is about 5.16%. That represents a rather damaging dilution rate and seriously dampens the company’s per-share value creation prospects.

Second, SBC inflates Pinterest’s free cash flow (FCF) figures, creating a potentially misleading picture of the company’s underlying finances. In Q2 2024, Pinterest reported $462.6 million in operating cash flow for the first half of the year, but $358.9 million, or nearly 78% of it, was non-cash SBC. Therefore, while Pinterest’s FCF growth may seem impressive on the surface, investors must consider how these numbers would fare if SBC levels reflected a real cash cost.

Beware of Pinterest’s Valuation

As I just explained, Pinterest’s ongoing SBC dilutes shareholders and inflates some of its financial metrics. While some investors may choose to overlook these concerns, I don’t believe that they should do so here. Although Pinterest is projected to generate $918.6 million in free cash flow this year, which suggests a P/FCF ratio of 24.1x, a significant portion of this figure is mitigated by dilution. The same applies from a forward P/E perspective. While PIN stock’s P/E multiple stands at around 21x, that multiple looks less attractive in a scenario where shareholders are being diluted.

Is PINS Stock a Buy, According to Analysts?

Looking at Wall Street’s view on Pinterest, the stock carries a Moderate Buy consensus rating based on 19 Buys ratings and eight Hold ratings assigned in the past three months. At $42.59, the average PINS stock price forecast points to about 30% potential upside.

If you’re unsure which analyst you should trust, the most profitable analyst covering the stock (on a one-year timeframe) is Deepak Mathivanan from Cantor Fitzgerald, with an average return of 25.10% per rating and an 89% success rate.

Takeaway

To sum up, while Pinterest shows promising user and revenue growth metrics, its ongoing SBC poses a significant risk. SBC leads to shareholder dilution and inflates critical financial metrics like free cash flow, making the company’s overall numbers and valuation appear more attractive than it may actually be.

Consequently, I believe investors should be wary of these factors when assessing the stock’s future potential. Sure, the company’s operational highlights are impressive, but the dilution risk tempers my enthusiasm and leads me to retain a more cautious, neutral outlook on PINS stock.