Pinterest (NYSE:PINS) stock fell over 9% in yesterday’s extended trading session after the company reported mixed results for the fourth quarter of 2023. The company provides a social media platform that allows users to discover and save ideas.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Q4 Earnings Snapshot

PINS reported adjusted earnings of $0.53 per share, which outpaced the Street’s estimates of $0.52 per share and increased 83% from the prior-year quarter. The bottom line benefitted from a 10% decline in expenses, primarily driven by lower sales and marketing costs. Meanwhile, net revenues grew about 12% year-over-year to $981 million but came below the analysts’ estimates of $991.3 million.

In terms of key metrics, Pinterest’s global monthly active users increased by 11% year-on-year to 498 million. Additionally, the average revenue per user came in at $2, up 2% from the year-ago quarter but lower than the analysts’ predictions of $2.05.

Looking ahead, management expects to report Q1 revenues in the range of $690 million to $705 million, reflecting 15% to 17% year-over-year growth. In addition to this, adjusted expenses are expected between $450 million and $465 million, up 9% to 13%.

Positive Development

The company announced a third-party ad integration partnership with Alphabet’s (GOOGL) Google. With this deal, PINS plans to venture into untapped international markets and boost its monetization potential.

It is worth mentioning that Pinterest expects third-party ad demand to keep growing and expects it to be a major revenue contributor going forward.

Is PINS Stock a Good Buy?

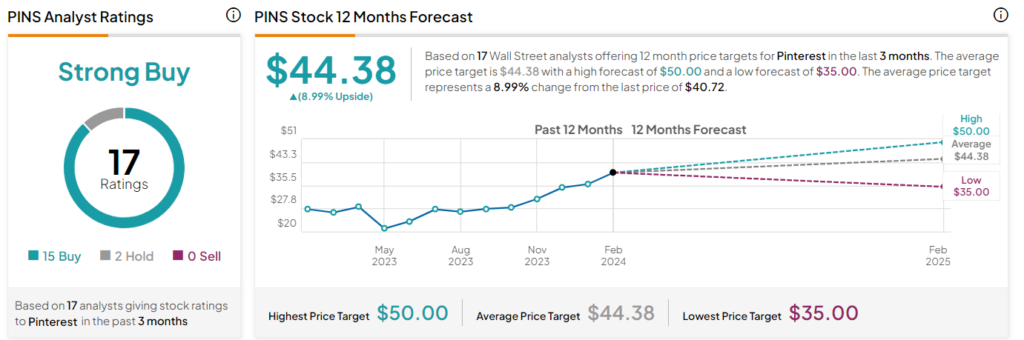

Following the Q4 earnings release, two analysts assigned a Buy rating on Pinterest stock. Overall, it commands a Strong Buy consensus rating on TipRanks, based on 15 Buy versus two Hold ratings received in the past three months. The average PINS stock price target of $44.38 implies a 9% upside potential from current levels. Shares of the company have gained 64.7% in the past year.