Phillip Securities analyst Jonathan Woo lifted the price target on Meta Platforms (META) to $640 from $555, implying 11.9% upside potential from current levels. The five-star analyst remains highly bullish on the social media stock’s trajectory based on its solid AI (artificial intelligence) potential. Woo increased the model estimates owing to solid ad revenue potential and cost efficiencies, thus leading to a higher price target.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Meta reported better-than-expected earnings and sales for the third quarter, accompanied by an increase in advertising impressions and average price per ad. Woo is impressed by Meta’s growing Daily Active User base and solid financial performance. The analyst sees Meta as one of the key players in AI based on its state-of-the-art AI infrastructure, large language model Llama 3.2, and the company’s ability to capitalize on its advanced AI technology.

Woo Shares 2 Positives and 1 Negative from Meta’s Results

Let’s take a look at Woo’s Positive and Negative takeaways from Meta’s Q3 Print.

- Q3 Revenue Met the High-End of the Guidance – Woo was encouraged by Meta’s revenues reaching the high-end of the guidance range, primarily driven by a healthy advertising landscape. E-commerce was the largest contributor, with ad pricing improving in Q4 and ad spend from North America and Europe increasing in Q3.

- AI is Boosting Monetization Opportunities – Meta is leveraging its advanced capabilities to monetize revenue opportunities and drive cost efficiencies. For instance, Woo noted that Meta’s new AI system enables it to study a user’s actions before and after the ad and helps target audiences and deliver higher conversions.

- Reality Labs Remains an Unknown Variable – Meta’s Reality Labs segment continues to remain a drag on the overall business and margins. It reported a $4.4 billion operating loss in Q3 and is poised for an annual operating loss run rate of roughly $18-$20 billion, Woo noted.

Overall, Meta Platforms reported a healthy quarterly performance and gave strong revenue guidance for Q4 (16% year-over-year growth at mid-point). Moreover, Meta continues to spend excessively, like all large tech companies, on AI-related infrastructure such as servers, data centers, and networking.

More About Woo

Woo ranks #409 of the 9,137 analysts ranked on TipRanks. The five-star analyst boasts an impressive success rate of 86% with an average return per rating of 47%.

To date, his best rating was on Nvidia Corp. (NVDA), where his Buy view since November 27, 2023 to date has earned him a return of 182.1%.

What is Meta’s Price Target?

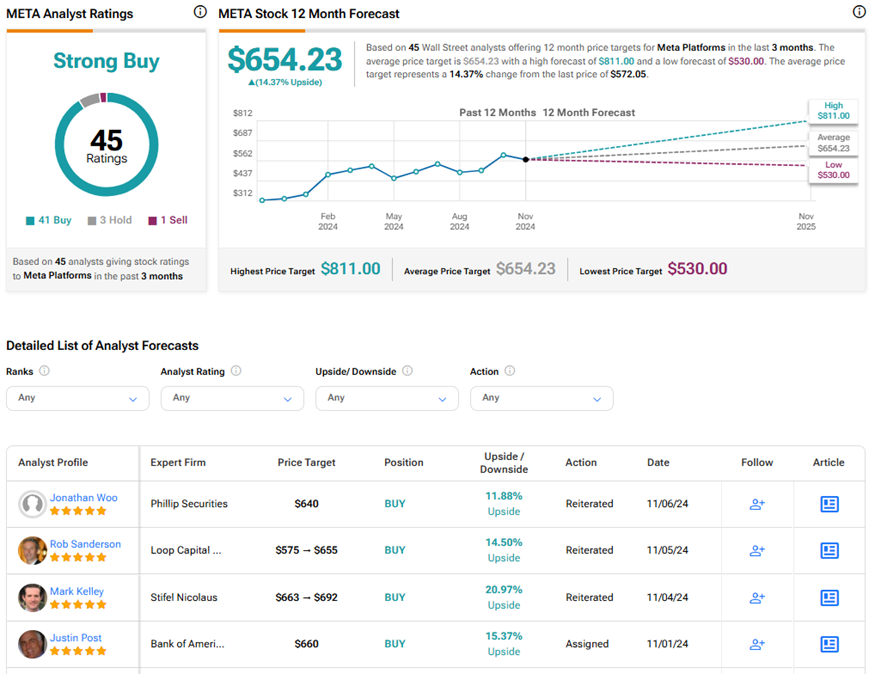

On TipRanks, the average Meta Platforms price target of $654.23 implies 14.4% upside potential from current levels. Also, META stock commands a Strong Buy consensus rating based on 41 Buys, three Holds, and one Sell rating. Year-to-date, META shares have gained 62.1%.