Global biopharmaceutical behemoth Pfizer Inc. (PFE) has delivered a better-than-anticipated second-quarter performance on both its top-line and bottom-line.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

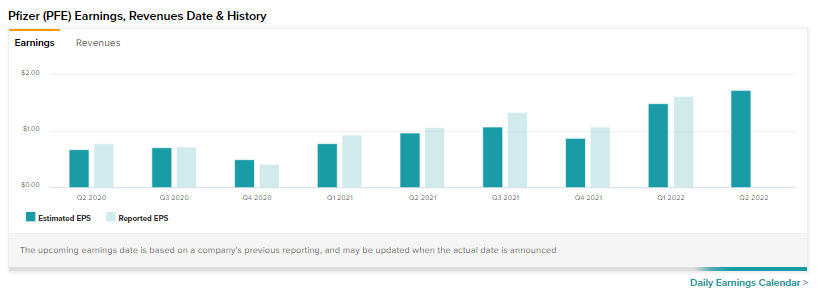

Driven by the robust performance of Paxlovid and Comirnaty, revenue jumped 47% year-over-year to $27.7 billion. Earnings per share (EPS) at $2.04 comfortably beat the Street’s expectations of $1.72, registering a 92% year-over-year growth in the company’s bottom line.

Additionally, the company also took its full-year 2022 guidance up a notch. It now expects revenue to be between $98 billion and $102 billion. Adjusted EPS is anticipated to be between $6.30 and $6.45.

PFE Management’s Comments

The CFO and Executive Vice President of Pfizer, David Denton, commented, “I am very pleased with the performance of our business this quarter, with strong operational revenue and earnings growth driven by multiple therapeutic areas across the company, and our COVID-19 franchises continuing to serve patients in need while also propelling us to an all-time high in quarterly sales.”

The Pfizer Biopharmaceutical Group continued to drive the majority of this performance with a 49% jump this quarter. The vaccines segment too continued to deliver with a 13% growth during this period.

Finally, Comirnaty and Paxlovid are expected to continue robust sales gains with expected revenue of $32 billion and $22 billion, respectively, in 2022.

Analysts’ Take on PFE

In the meantime, Wall Street remains cautiously optimistic about Pfizer with a Moderate Buy consensus rating alongside an average price target of $57.08, implying a 9.87% potential upside. That’s on top of the 22.4% rise in the share price over the past 12 months.

Closing Note

The global healthcare giant continues to make gains and create shareholder value. So far this year it has deployed $5.1 billion in R&D and $7 billion in business development ($6.3 billion in Arena Pharma acquisitions). Apart from this, so far this year, Pfizer has also announced the acquisitions of ReViral and Biohaven Pharmaceutical, which will entail a $13.3 billion upfront payment on completion.

During this period, Pfizer has also doled out $4.5 billion in cash dividends and spent $2 billion to buy back 39.1 million shares, which will also continue to drive the bottom line favorably for investors. The stock currently has a dividend yield of 3.05%.

Read full Disclosure