Pharmaceutical giant Pfizer (PFE) is set to release its second quarter Fiscal 2024 results on July 30. The Street expects Pfizer to post adjusted earnings per share (EPS) of $0.46 on revenue of $12.96 billion. The adjusted EPS estimate reflects a steep decline compared to the prior-year quarter’s figure of $0.64, while the revenue forecast shows a marginal improvement on Q2 2023’s top line of $12.73 billion.

It is worth noting that Pfizer is facing unfavorable quarter-over-quarter trends owing to the falling demand for its COVID-19 drugs, Comirnaty and Paxlovid. The drug maker is strategizing to improve its sales from other key non-COVID drugs, including the Vyndaqel line, Eliquis, and the Prevnar family. Pfizer is also taking measures to meet its targeted $4 billion in net cost savings by this year’s end.

Pfizer’s Danuglipron in Focus

Pfizer is betting big on its once-daily, oral, small-molecule GLP-1 drug called Danuglipron to fight against the existing competition in weight loss drugs. Early this month, Pfizer announced that after a thorough evaluation of the results from the ongoing pharmacokinetic study, the company is hopeful that a once-daily dose of Danuglipron could show favorable efficacy and safety standards for treating obesity.

Danuglipron is also the focal point of discussion that could act as a catalyst for PFE stock in the future. According to TipRanks Bulls Say, Bears Say tool, the Bulls are optimistic about the growing demand for Vyndaqel and encouraging data from Danuglipron in clinical trials. On the other hand, Bears still believe that the drug may not be that effective with a single dose and could require multiple pills or dosages per day.

Current Valuation Says PFE Stock Price Could Shoot Up

Pfizer stock currently trades at a discount to its peers in terms of both P/E (price-to-earnings) and P/S (price-to-sales) ratios. Its non-GAAP P/E multiple is 12.96x, while the industry average is 21.04x. Similarly, Pfizer’s P/S multiple stands at 3.17x, while the sector average is 3.88x. A favorable catalyst, like Danuglipron’s successful trials, could lead Pfizer stock higher in the future.

Options Traders Anticipate a Large Move

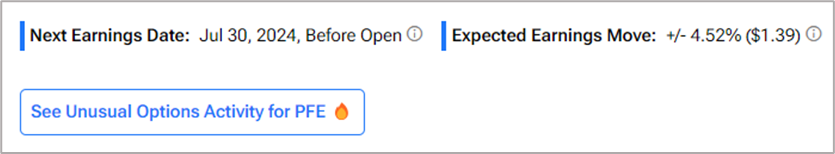

Using TipRanks’ Options tool, we can see what options traders are expecting from PFE stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 4.52% move for PFE stock in either direction.

Learn more about TipRanks’ Options tool here.

Is Pfizer a Buy, Sell, or Hold?

Wall Street remains divided on Pfizer stock’s trajectory. On TipRanks, PFE stock has a Moderate Buy consensus rating based on seven Buys versus eight Holds. The average Pfizer price target of $33.83 implies 9.9% upside potential from current levels. PFE shares have gained 11.7% so far this year.