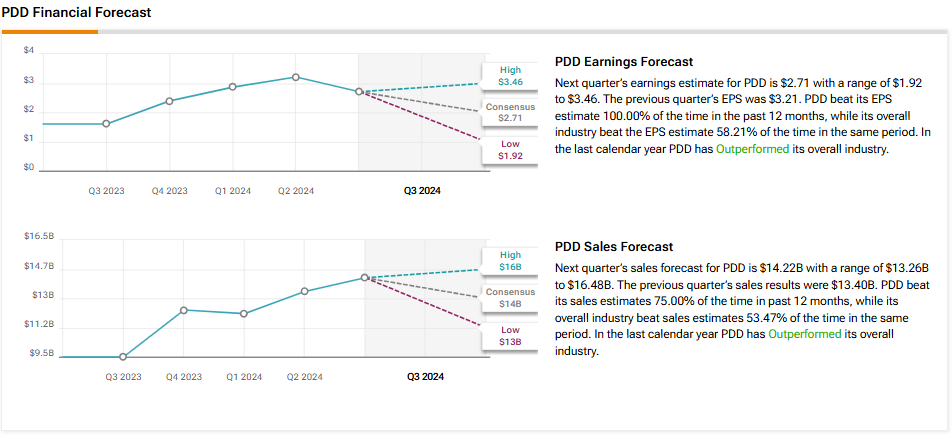

Shares of Chinese e-commerce retailer PDD Holdings (PDD) are up in today’s trading as investors await its Q3 earnings results on November 21 before the market opens. Analysts are expecting earnings per share to come in at $2.71 on revenue of $14.22 billion. This equates to 69.4% and 49.7% year-over-year increases, respectively, according to TipRanks’ data.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

It is always good to see earnings outpace revenue growth because it shows that the company is focusing on high-quality growth and that the business can be scaled effectively.

Bullish and Bearish Arguments

It is also worth noting that PDD has beaten earnings estimates in six consecutive quarters. And there are reasons to believe that this win streak could continue. In fact, according to TipRanks’ Bulls Say, Bears Say tool, bullish analysts point to the company’s overseas expansion as a growth catalyst, specifically noting the launch of Temu in North America as a way to target price-sensitive consumers.

Nevertheless, it is important to not forget about the bearish arguments, which include an increase in competition that will make it difficult to maintain market share. Indeed, Amazon (AMZN) is challenging Temu head-on with its own discount platform that will only carry items that cost less than $20.

Still, it seems like money managers agree with the Bulls. In fact, hedge funds increased their holdings in PDD stock by 1.6 million shares in the past quarter. As a result, TipRanks’ hedge fund confidence signal is currently very positive on the stock.

Is PDD a Good Stock to Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on PDD stock based on 12 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 1% decline in its share price over the past year, the average PDD price target of $169 per share implies 43.4% upside potential.