Ford (NYSE:F) shares have missed out on the gains of 2024’s bull market, slipping nearly 4% year-to-date. This lackluster performance stems from a series of underwhelming quarterly reports, with the latest Q3 release not only lowering guidance but also pointing to increasing uncertainties for 2025.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Before the Q3 results, Bernstein analyst Daniel Roeska held an upbeat take of Ford’s prospects. However, the recent report has led him to reassess.

“Following this humbling performance, we decided to do a full autopsy on what went wrong and whether the current level represents a compelling entry point into the stock,” the analyst explained.

Roeska’s findings do not bode well for Ford shares and although the stock has benefited from increased optimism around the US election, Roeska doesn’t think Ford will be immune to the substantial discounts rivals are “unleashing on the US market.”

While Roeska agrees with the Street’s view that earnings will remain broadly flat between 2024 and 2025, the analyst anticipates significantly lower free cash flow in 2025. And even though the recent “disappointing performance” should prompt management to “launch cost restructuring and a new BEV strategy,” he thinks it won’t be any earlier than 2026 when such measures will be able to “affect upside.”

Meanwhile, driven by a broad slowdown across all segments and stagnant performance for the Model e, Roeska expects Ford’s EBIT to decline by 17% year-over-year in 1H25. With “sluggish consumer sentiment” and intensified pricing competition, Ford will likely need to defend its F-150 cash cow in the US by ramping up discounts to protect market share. Moreover, the anticipated slowdown is expected to create a substantial headwind for free cash flow.

The question that needs to be asked is whether Ford’s performance is “due to market or idiosyncratic challenges?” Unfortunately, says Roeska, it is down to both.

Ford has indeed been hit by rising costs, softer demand, and “increasing pricing pressure,” like other OEMs. However, it also faces unique challenges: recalibrating warranty provisions, refining its EV strategy, and adjusting projections for its Ford Pro business.

“Every management team will always try to mitigate headwinds, but in the case of Ford these efforts have not been sufficient to steady the ship,” Roeska opined. “Instead, the ever shorter-term focus of executives creates the impression that the team feels it currently may not have sufficient control of the business.”

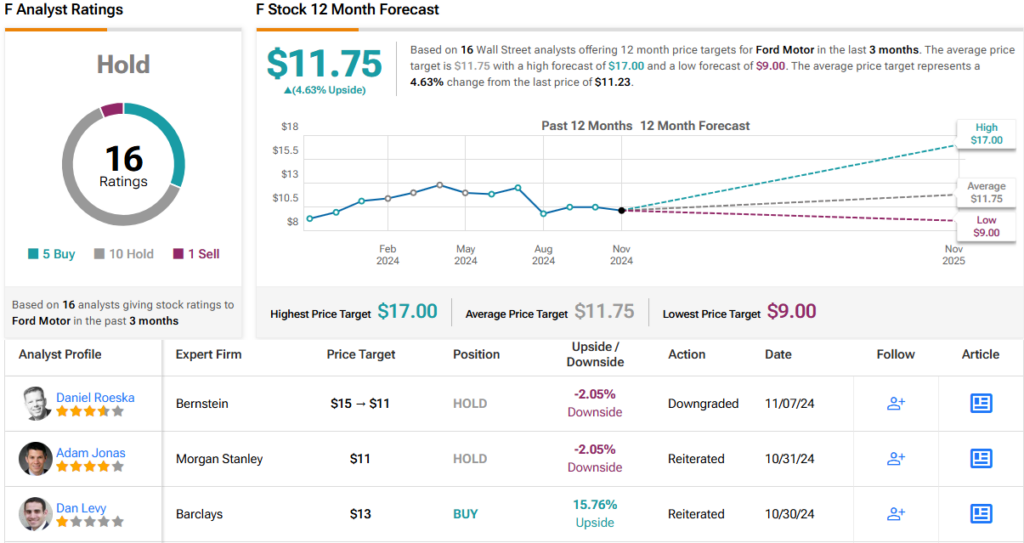

As such, Roeska has now downgraded his rating on Ford from Outperform (i.e., Buy) to Market-Perform (i.e. Neutral). Roeska’s price target of $11 suggests the shares are currently fully valued. (To watch Roeska’s track record, click here)

That is also the prevalent take amongst Roeska’s colleagues on Wall Street. Based on a mix of 10 Holds, 5 Buys and 1 Sell, the analyst consensus rates the stock a Hold. The average price target stands at $11.75, and factors in 12-month returns of ~5%. (See Ford stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.