Shares of software provider UiPath (NYSE:PATH) sank 30% in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2025. Earnings per share came in at $0.13, which beat analysts’ consensus estimate of $0.12 per share. Sales increased by 15.7% year-over-year, with revenue hitting $335 million. This beat analysts’ expectations of $333 million. However, the thing that spooked investors was the company’s huge guidance miss.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Looking forward, management now expects revenue for Q2 2025 to be between $300 million and $305 million (versus the consensus of $342.07 million). Meanwhile, adjusted operating income is anticipated to be breakeven. For Fiscal Year 2025, revenue is expected to land between $1.405 billion and $1.410 billion (versus the consensus of $1.56 billion), with an adjusted operating profit of $145 million.

In addition, the company announced that CEO Rob Enslin would resign and be replaced by founder and former CEO Daniel Dines.

Investor Sentiment for PATH Stock Is Currently Negative

The sentiment among TipRanks investors is currently negative. Out of the 736,443 portfolios tracked by TipRanks, 1.1% hold PATH stock. In addition, the average portfolio weighting allocated towards PATH among those who do have a position is 3.44%. This suggests that investors of the company are fairly confident about its future.

However, in the last 30 days, 1.1% of those holding the stock decreased their positions. As a result, the stock’s sentiment is below the sector average, as demonstrated in the following image:

Is PATH Stock a Good Buy?

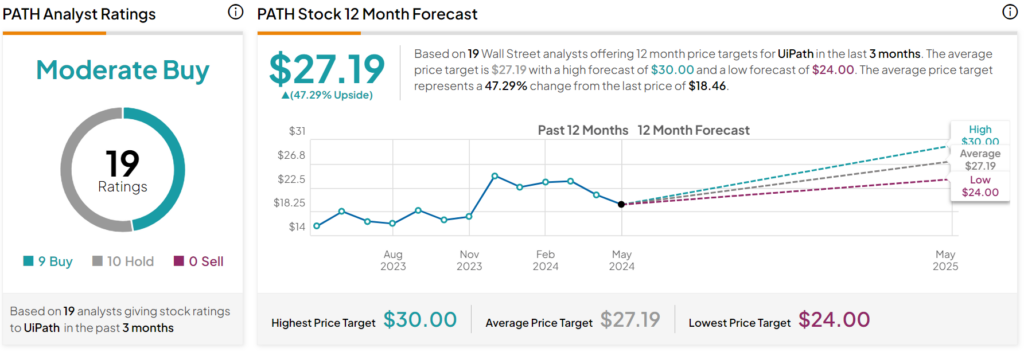

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PATH stock based on nine Buys, 10 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After an 11% rally in its share price over the past year, the average PATH price target of $27.19 per share implies 47.29% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.