Shares of Palo Alto Networks (PANW) have been on a wild ride this year as the cybersecurity stock has both outperformed and underperformed the S&P 500 (SPY) at various times throughout 2024. However, as PANW shares approach their all-time high again, it appears that insiders are taking advantage of this rally by selling their shares.

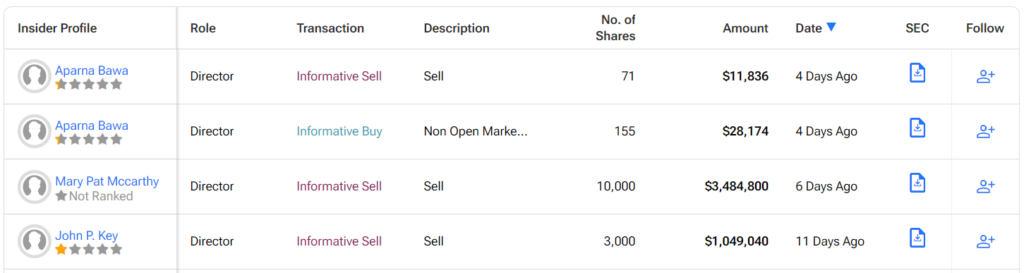

The most notable transactions have come from Directors John P. Key and Mary Pat McCarthy, who sold roughly $1.05 million and $3.48 million worth of shares, respectively.

While insider sales could be a sign of issues within a company, that doesn’t seem to be the case with PANW. In fact, John P. Key and Mary Pat McCarthy still have meaningful stakes in the company, valued at $3 million and $14 million, respectively, according to TipRanks. Therefore, his transactions were likely due to personal reasons, and investors probably do not need to worry about this issue specifically.

However, it’s worth noting that insiders aren’t the only ones selling. When it comes to “smart money,” money managers don’t seem to be all that confident in PANW stock. Indeed, hedge funds decreased their holdings in the stock by 217,100 shares in the past quarter. As a result, they have a very negative confidence signal.

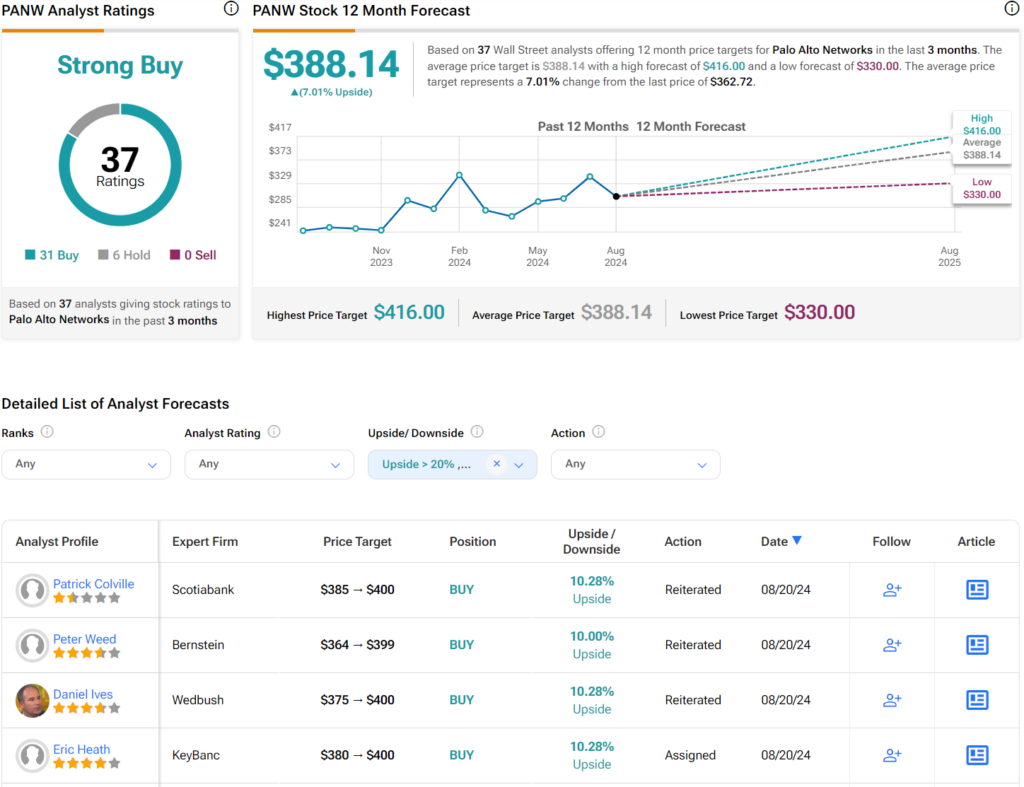

What Is the Price Target for PANW?

Turning to Wall Street, analysts have a Strong Buy consensus rating on PANW stock based on 31 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 48% rally in its share price over the past year, the average PANW price target of $388.14 per share implies 7% upside potential.