Palantir Technologies (PLTR) has been on an impressive run, with its stock climbing 165% over the past year, thanks to its rapidly expanding AI capabilities, commercial adoption, and high-profile government contracts. While these developments continue to fuel what seems to be a thrilling investment case, the stock’s current valuation may now be of concern. Palantir’s valuation multiples have reached sky-high levels in my opinion, and this is something to worry about. Therefore, although I remain invested in Palantir and believe in its long-term prospects, I am neutral on the stock at this price level due to valuation.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Government and Commercial Growth Showcase Robust Momentum

While I might be cautious at the current share price, one of the main drivers behind Palantir’s ongoing rally is its continued success in both government and commercial sectors, where it has expanded its influence through key partnerships and contracts. In the government space, Palantir has recently secured significant deals like its $480 million, five-year contract with the U.S. Department of Defense for its AI-driven data fusion platform. That was a big win, once again illustrating Palantir’s unique ability to create real-time data analysis solutions that give the U.S. and its allies an edge in today’s highly volatile geopolitical environment.

In the commercial realm, Palantir also keeps gaining considerable traction. Its recent multi-million-dollar deal with Nebraska Medicine is an example of how Palantir’s Artificial Intelligence Platform (AIP) is being used to transform industries; in this case, healthcare. The platform helps streamline operations, optimize resources, and drive efficiency in patient care. This highlights the potential for Palantir’s technology to extend far beyond defense; an element some of Palantir’s bears seem to have a hard time grasping.

In addition, considering the flurry of recent developments for Palantir, its growth prospects appear even brighter. The company just secured a $99.8 million contract to expand the Maven Smart System across all U.S. military branches, reinforcing its dominance in defense technology. Further, strategic partnerships like the renewed five-year deal with BP focused on AI for operational improvements are set to be a significant contributor on the commercial front. Thus the 23% government and 33% commercial revenue growth seen in Q2 2024 could accelerate, especially with an influx of new clients yet to sign significant contracts. This further explains investors’ ongoing enthusiasm.

Profitability and the Rule of 40 Boost Investor Confidence

Palantir’s recent profitability metrics are equally impressive, surely boosting investor confidence in the stock. The company achieved a Rule of 40 score of 64% in Q2, which is exceptional and indicates a rare combination of high growth and margin expansion. If you are unfamiliar with the Rule of 40, it’s a measure that combines revenue growth and profit margin, and a score above 40 is typically considered a sign of an excellent all-around trajectory in tech companies. However, due to the current valuation level I’m not looking to add shares.

Palantir’s ability to exceed this benchmark by such a wide margin illustrates top-notch execution and suggests the company is well-positioned for long-term profitability. Analysts on Wall Street have been revising their revenue and EPS estimates higher over the past few months, supporting this trend. Revenue is expected to grow by around 24%, 20%, and 20% in Fiscal 2024, 2025, and 2026, with EPS projected to rise by 42%, 21%, and 20% during those years.

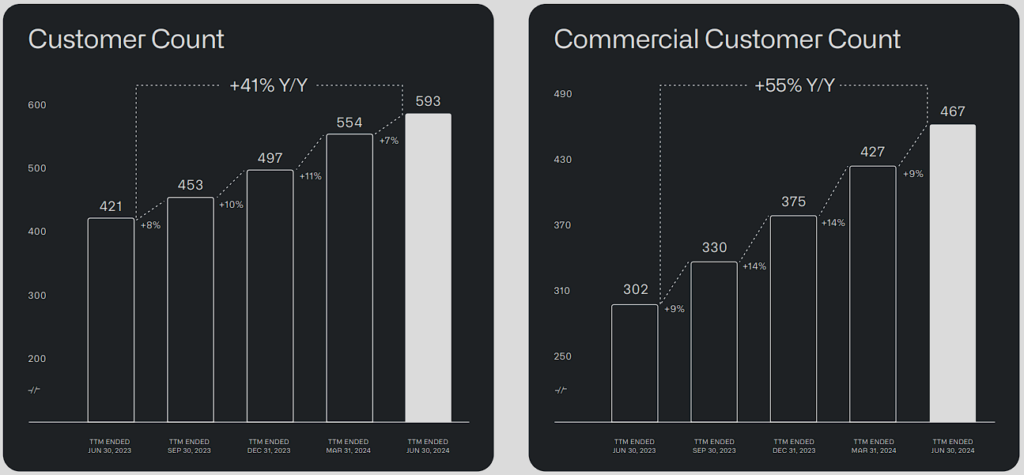

That being said, I believe these forecasts might be somewhat conservative. Palantir’s customer base, particularly on the commercial side, is expanding faster than its revenue, suggesting that numerous new contracts are likely in the pipeline, which could further accelerate the company’s growth.

S&P 500 Inclusion Boosts Palantir Stock

Lastly, another critical driver behind Palantir’s recent rally is its upcoming inclusion in the S&P 500, which takes effect today, September 23, 2024. This milestone has significantly contributed to Palantir stock’s upward momentum, as being added to the S&P 500 often triggers a surge in demand for a company’s shares. Millions of 401(k) accounts and institutional portfolios that track or invest in S&P 500 index funds will now automatically buy Palantir stock.

The anticipated surge in buying volume is likely to create strong upward momentum for the stock in the short term, which explains why investors have been eagerly accumulating shares ahead of this trend.

The Valuation Risks

Despite the exciting growth narrative, I believe that Palantir’s valuation is becoming a cause for concern. The stock’s meteoric rise has pushed its price to over 30 times this year’s expected revenues. Such a lofty multiple suggests the market is pricing in near-flawless execution moving forward. Even though I believe Palantir’s robust AI deal pipeline will likely exceed Wall Street’s current revenue projections, it’s difficult to envision the stock continuing to rally from such an elevated base.

From an earnings perspective, the valuation looks equally stretched. Palantir trades at over 100 times this year’s expected EPS, and even after accounting for a growth rate that outpaces Wall Street’s expectations, the stock appears to be priced as if it’s already achieved the profits it might see years down the line. This makes the current valuation stock price level hard to justify, even for those who believe in the company’s long-term potential. Therefore, some downside potential seems rather probable from here.

Is PLTR Stock a Buy, According to Analysts?

Wall Street appears to be cautious on Palantir as well, as reflected in its current Hold consensus rating, stemming from four Buy ratings, five Hold ratings, and six Sell ratings over the past three months. With an average price target of $27.08 for PLTR, this suggests a potential downside of nearly 28%. That consensus view is consistent with my concerns about the stock’s valuation.

If you’re wondering which analyst you should follow if you want to transact in PLTR stock, the most accurate analyst covering the stock (on a one-year timeframe) is Mariana Perez Mora from Bank of America (BAC) Securities, with an average return of 83.76% per rating and a perfect 100% success rate. Click on the image below to learn more.

Takeaway

In conclusion, despite Palantir’s excellent growth prospects in both government and commercial sectors, driven by its AI capabilities and strategic partnerships, in my view the current valuation presents significant risks. I will continue to hold my shares, however, in reflection of the critical role Palantir plays for its clients and its potential for long-term success. However, I won’t be adding to my position at these levels due to the stock’s elevated valuation multiples, which seem difficult to justify in the near term.