Palantir (NYSE:PLTR), often criticized for its lofty valuation, has once again silenced skeptics. The stock skyrocketed 23% in Tuesday’s session following a strong Q3 beat-and-raise report.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company generated revenue of $725.52 million in the quarter, amounting to a 30% year-over-year increase and beating the Street’s forecast by $21.83 million.

Previously seen as a ‘dark horse,’ the U.S. commercial segment has now become the company’s standout performer, with a 54% year-over-year growth rate, outperforming analysts’ projections of 47%. This surge reflects rising demand for AI Platform (AIP), driving both new customer acquisitions and expansions of existing partnerships. Additionally, revenue from the company’s largest clients is on the rise, with sales from its top 20 customers increasing by 12% y/y to reach $60 million per customer.

The total number of deals exceeding $1 million reached 104, reflecting a 30% y/y increase and an 8% sequential uptick, while US Commercial deals rose by 27% from the year-ago period, thereby demonstrating the effectiveness of the company’s bootcamp strategy.

On the bottom-line, Palantir delivered too, recording adj. EPS of $0.10, edging ahead of the prognosticators by $0.01.

That was pleasing in itself, but the real cherry on top came from the outlook. For Q4, revenue is expected to hit a range of $767 to $771 million, compared to the consensus of $744.04 million. Palantir also raised its full-year revenue guidance to between $2.805 and $2.809 billion, while the Street had only anticipated $2.76 billion. Similarly, FY24 operating income is now projected to range from $1.054 billion to $1.058 billion, up from the prior guidance of $966.0 million to $974.0 million, easily surpassing the Street’s $980 million forecast.

Wedbush analyst Daniel Ives, a long-time supporter, says the guide shows that the company “continues to win share in this massive land grab opportunity for enterprise AI solutions.”

Not that the quarter itself was lacking in fireworks. “This was an eye-popping quarter for the Messi of AI growth story as AIP receives unprecedented demand as more enterprises realize the value of PLTR’s entire product suite with more AI use cases being brought to the table,” Ives opined.

In fact, calling the print a “masterpiece” and with Ives now increasingly comfortable with Palantir’s “game-changing AIP strategy,” the analyst has raised his price target to a new Street-high of $57 (up from $45), suggesting additional gains of 15% are in store for the coming months. Needless to say, Ives’ rating stays an Outperform (i.e., Buy). (To watch Ives’ track record, click here)

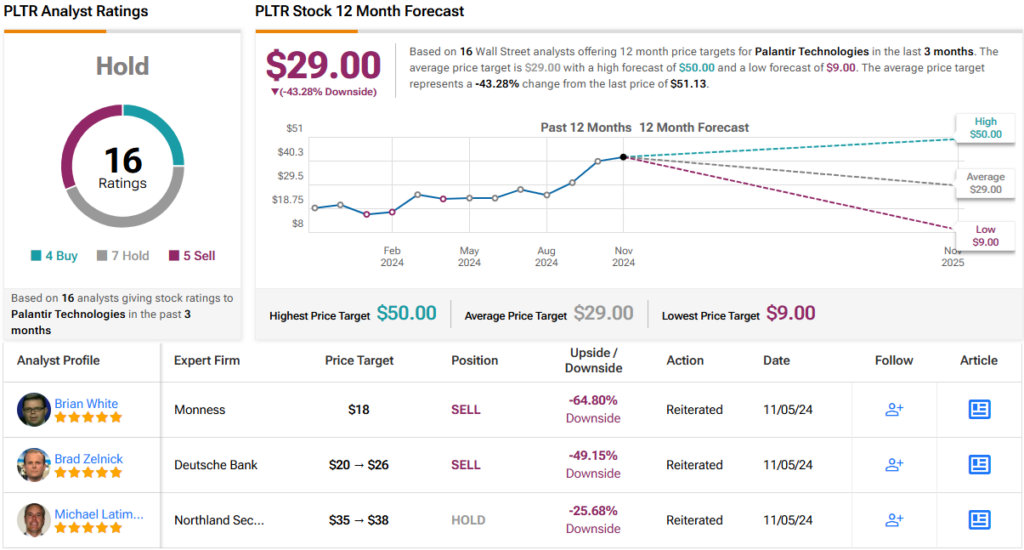

It should be noted that the stock is now up more than 140% year-to-date and almost all other analysts think the shares are now far too expensive; the average target stands at $29, implying the stock will post a decline of 43% in the year ahead. While 3 other analysts continue to rate PLTR shares a Buy, with an additional 7 Holds and 5 Sells, the consensus view is that this stock is a Hold (i.e. Neutral). (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.