PagerDuty (PD) is set to release its fiscal Q2 2025 financials on September 3. Wall Street analysts expect the company to report earnings of $0.17 per share for Q2, down 10.5% year-over-year. At the same time, analysts expect revenues of $116.63 million, up 8% from the year-ago figure of $107 million, according to TipRanks’ data.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

PagerDuty provides a digital operations management platform that helps organizations manage and resolve critical incidents and operational issues in real-time.

It’s important to highlight that the company has surpassed the consensus EPS estimates in all of the last nine quarters.

Key Takeaways from TipRanks’ Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool shown below, analysts are optimistic about PagerDuty’s financial performance, citing its success in securing large multiyear deals and expanding into healthcare and the public sector. They also noted that PagerDuty’s flexible pricing model could ease business adoption, potentially driving growth in its customer base and revenue.

It’s also important to consider the bearish arguments. Bears highlighted that PagerDuty faces strong competition from established players, potentially impacting its market position. They noted that customers see PagerDuty as a discretionary tool, which has contributed to a slowdown in growth. Additionally, revenue and ARR growth have declined recently due to macroeconomic headwinds.

It’s important to highlight that ARR (Annual Recurring Revenue) is a key metric for evaluating the financial health and growth potential of companies, particularly those in the software-as-a-service (SaaS) industry.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can gauge what options traders anticipate for PagerDuty stock right after its earnings report. The expected earnings move is calculated by evaluating the at-the-money straddle of options that are set to expire soon after the announcement.

At present, the Options tool indicates that options traders are predicting a 10.64% swing in either direction for PD stock.

Is PagerDuty a Good Stock?

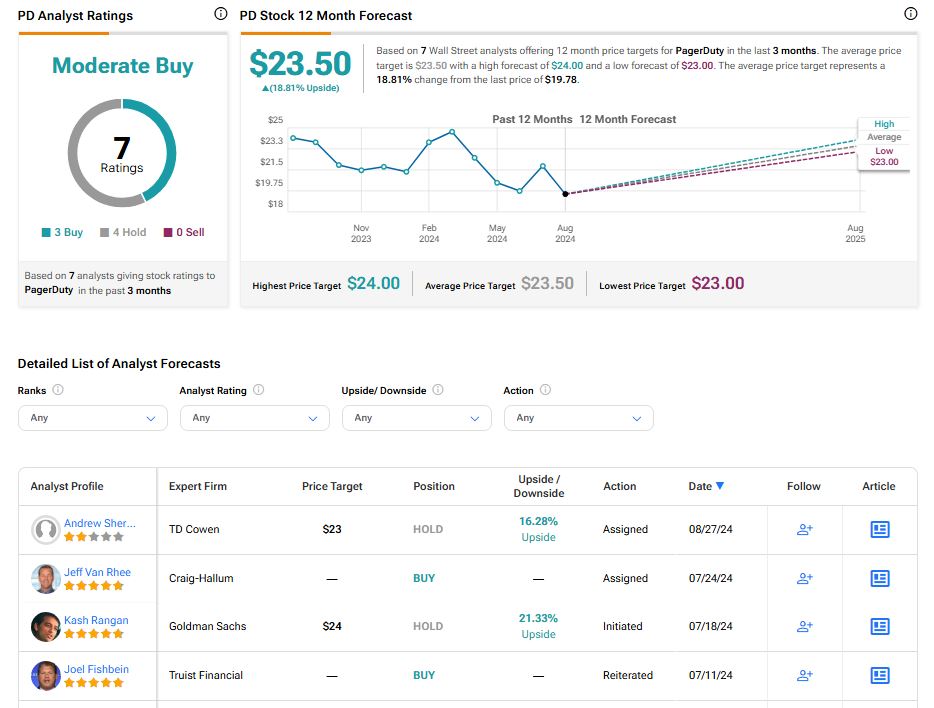

Turning to Wall Street, analysts have a Strong Buy consensus rating on PD stock based on three Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 14% year-to-date decline, the average PD price target of $23.50 per share implies 18.81% upside potential.