Packaging Corporation of America (NYSE: PKG) has delivered better-than-expected results for the second quarter of 2022. Earnings beat in the quarter was 12.9%, while sales surprise was 4.7%. Also, the metrics grew impressively on a year-over-year basis. However, analysts on TipRanks have a cautiously optimistic approach toward the stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The impact of the company’s upbeat results on investors is yet to be seen, as PKG will be holding a conference call (related to the results) on Tuesday. Shares of the $13.3-billion container products maker closed at $143.91 on Monday.

Top Line & Operational Strength Drove PKG’s Q2 Results

In the quarter, Packaging Corporation’s adjusted earnings were $3.23 per share, and its revenues were $2.24 billion. The metrics surpassed the consensus estimate of $2.86 per share for earnings and $2.14 billion for revenues. The bottom line exceeded the company’s guidance of $2.83 per share for the quarter.

On a year-over-year basis, PKG’s bottom line expanded 48.8% on the back of a 19.1% rise in revenues. However, costs of sales (up 15.2% year-over-year) and selling, general, and administrative expenses (up 7.1% from the year-ago quarter) played spoilsports.

Income from operations, adjusted, was $418.8 million, up 42.5% year-over-year.

The company’s Chairman and CEO, Mark W. Kowlzan, said, “Results for the quarter were excellent as we once again improved our margins while continuing to experience significant cost inflation across the Company as well as various supply chain challenges.”

For the Packaging segment, sales grew 20.3% year-over-year to $2.07 billion, and adjusted operating income was $419.3 million, up 33.5% from the year-ago quarter. Likewise, sales of the Paper segment stood at $149.8 million, and operating income was $26.2 million, reflecting year-over-year growth of 5.3% and 385.2%, respectively.

Revenues of the Corporate and Other segment came in at $20.6 million, and operating loss was $26.7 million in the quarter.

Packaging Corporation’s Projections for Q3

For the third quarter, Packaging Corporation anticipates earnings to be $2.80 per share, below $3.23 per share in the second quarter.

The Chairman and CEO of Packaging Corporation of America, Mark W. Kowlzan, said, “With economic conditions continuing to be negatively impacted by broad-based inflation and aggressive interest rate increases, we see corrugated products growth as softening in the quarter but demand still firm as certain end markets work through their current supply of inventory.”

Analysts Are Cautiously Optimistic on PKG Stock

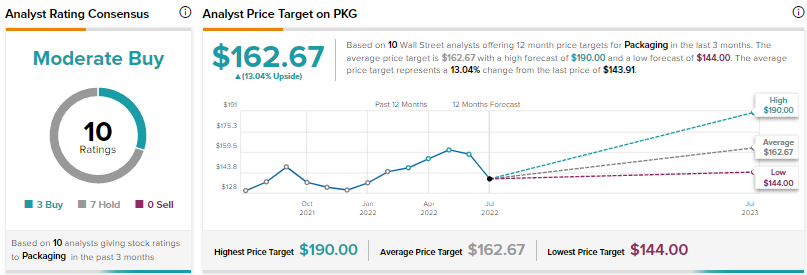

Overall, the Street is cautiously optimistic about Packaging Corporation and has a Moderate Buy consensus rating based on three Buys and seven Holds. PKG’s average price forecast of $162.67 reflects 13% upside potential from the current level.

Investors, Too, Have Mixed Feelings for PKG Stock

As per TipRanks, portfolios holding PKG stock have increased 2.7% in the last 30 days, while declining 1.6% over the last seven days. The mixed reaction by investors seems to be in sync with analysts’ cautious approach toward PKG.

Key Takeaways for Packaging Corporation’s Investors

Soft demand for products, labor problems, challenging rail services, and inflation in gas, electricity, and chemical prices could impact Packaging Corporation’s performance in the third quarter. These headwinds underpin the company’s sequentially lower projections for the third quarter. A wait-and-watch approach could be a good idea for investors.

Read full Disclosure