Shares of Orbcomm Inc. jumped 52% on April 8 after the mobile network provider inked a deal with GI Partners, a US-based investor in data infrastructure businesses, to be acquired in a cash-deal worth $1.1 billion, including net debt.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Orbcomm (ORBC) CEO Marc Eisenberg said, “GI Partners has an established track record of working with companies to accelerate growth, and we look forward to continuing to drive innovation, providing world-class service to our global customers and expanding our market share in the industrial IoT as a privately held company.”

Per the terms of the agreement, GI Partners will pay $11.50 in cash for each share of Orbcomm. The price tag represents a 52% premium to the company’s closing price on April 7. (See Orbcomm stock analysis on TipRanks)

The transaction, which awaits Orbcomm shareholders’ approval and certain regulatory approvals, is expected to close in the latter half of this year.

Canaccord Genuity analyst Michael Walkley downgraded the stock to Hold from Buy and decreased the price target to $11.50 from $13 following the announcement of the acquisition. Walkley said, “Given the premium paid and the fact it is an all cash transaction, we anticipate the deal will close by the second half of C2021.”

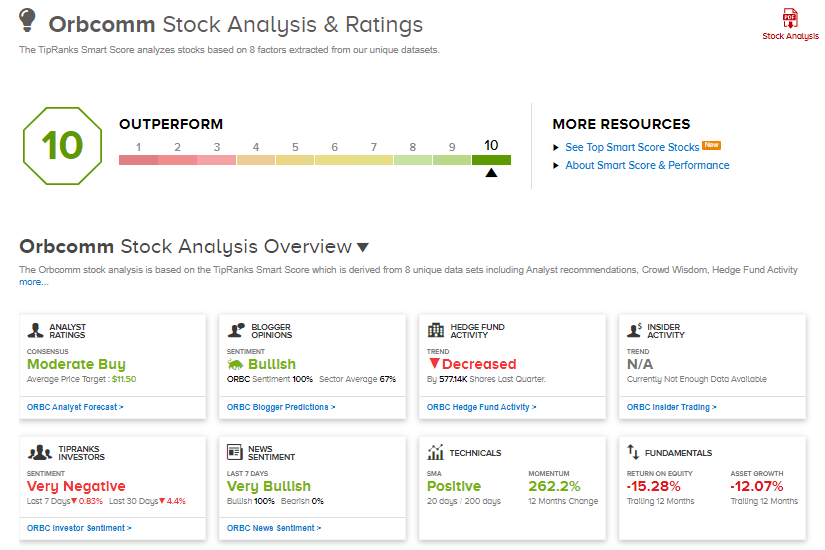

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 2 Buys and 3 Holds. The average analyst price target of $11.50 implies that shares are fully valued at current levels. Shares have increased 68% so far this year.

Orbcomm scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

FDA Approves NuVasive’s Simplify Disc For Two-Level Cervical Total Disc Replacement

Accenture Buys Core Compete For An Undisclosed Sum, Boosts Client Services

Everbridge Inks Deal To Acquire xMatters For $240M; Street Is Bullish