Cloud service provider Oracle (ORCL) is set to report its earnings for the first quarter of Fiscal 2025 on September 9th. Ahead of the results, I’m adopting a Hold rating due to cautious sentiment around moderate Wall Street expectations and uncertainties about the company sustaining revenue growth amid artificial intelligence (AI) demand. Moreover, ORCL stock is trading close to all-time high multiples after a significant surge this year. Given these factors, the potential upside in the stock may be limited going forward.

Investors will likely seek more clarity on Oracle’s growth strategies, but this might not be enough to sustain such valuations. In this article, I will explore why adopting a cautious stance amid the current momentum might be the best approach for investors.

Here’s What Drove Oracle Stock Higher in 2024

Although I’m cautious about investing in Oracle at the moment, that doesn’t mean I don’t like the stock. Oracle is renowned for its database management systems and offers a range of cloud services, including computing power, storage, and networking through its Oracle Cloud Infrastructure (OCI).

Top AI companies like Nvidia (NVDA), Microsoft (MSFT), Alphabet (GOOGL), xAI, and OpenAI are choosing Oracle’s cloud services and data centers because OCI trains large language models faster and at a fraction of the cost compared to other clouds. Its operating system and database are fully autonomous, eliminating human error and reducing costs, which results in faster, less expensive, and more secure data for its customers.

This high demand for cloud infrastructure, driven by AI, has pushed Oracle shares up by more than 35% this year alone. The company is building data centers at a record pace and recently signed an infrastructure contract with Nvidia.

Much of the bullish momentum has also been driven by ambitious targets for the coming years. During the latest earnings call, management suggested that their $65 billion revenue target for 2026 might be too conservative, given the current momentum. Notably, remaining performance obligations (RPOs) surged 44% in the recent quarter, reflecting a strong backlog of unbilled revenue.

Current Concerns About Oracle

One of the reasons for my neutral stance on Oracle is its balance sheet and capital structure. The company has $10.6 billion in cash and $86.9 billion in total debt, resulting in an Enterprise Value of $466.1 billion at a market cap of around $390 billion. Over the last 12 months, Oracle’s revenue has grown by 6% to just under $53 billion, with a net income of $10.5 billion and almost $21.2 billion in adjusted EBITDA.

Taking these points into account, Oracle today is valued at 25x price-to-earnings. This valuation may seem unattractive when considering Oracle’s recent history, where revenues between 2015 and 2020 grew by only 2% in total due to the shift from on-premises services to cloud providers like Amazon’s (AMZN) AWS.

Although revenue grew by about 18% in FY23, a significant portion of this growth came from the acquisition of the healthcare business Cerner. Mediocre growth and a large debt load might not sound compelling, but Oracle’s stock is near an all-time high due to future potential rather than past performance.

Skepticism over Reliability of Projections

Concerns related to the reliability of Oracle’s growth projections also keep me on the sidelines. According to Oracle’s management, the company is targeting 50% year-over-year growth for Fiscal 2025 for OCI, which should leverage the Remaining Performance Obligation (RPO) metric. The issue is that, as noted by Morgan Stanley’s (MS) Keith Weiss, there hasn’t been any detailed disclosure regarding the duration of RPOs.

Additionally, the potential variability in revenue generation from the new infrastructure capacity raises concerns about the accuracy and reliability of these projections

I, therefore, view the reliability of these robust growth projections with some skepticism, mainly due to the fact that the bar is set too high for AI-driven demand, as has been noted during the current earnings season. The long-term nature of the demand may even limit EPS upside. As such, Oracle trades at an EV/EBITDA of 22x, which is almost a quarter above the industry average of other large-cap software companies and more than 40% above the stock’s historical average.

Given that the stock has moved quite a bit this year, with a more cautious profile going forward, I don’t see much upside ahead for Oracle for the time being.

What to Watch for in Oracle’s Q1 FY25 Earnings Report

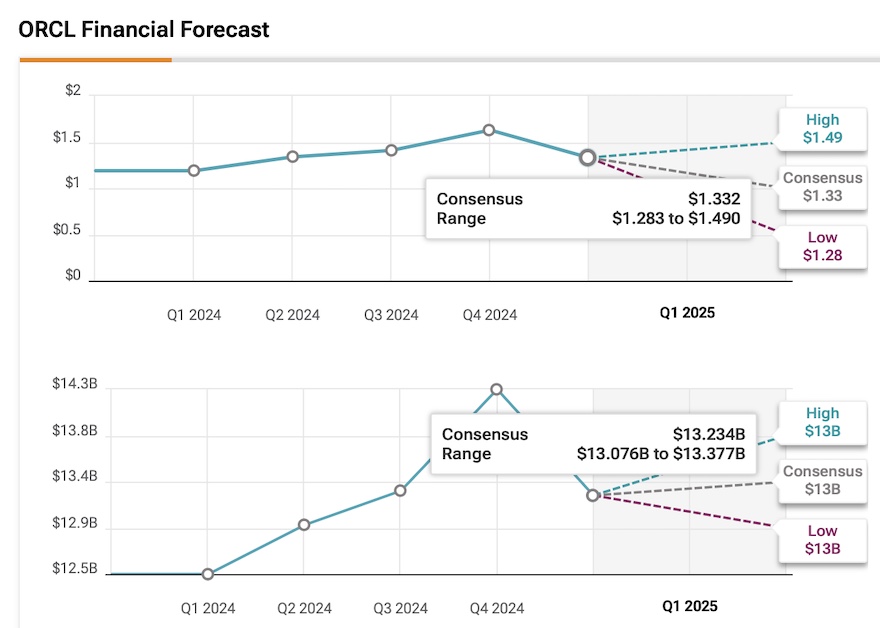

As Oracle prepares to report its Fiscal Q1 earnings, my neutral outlook on the company’s shares partly reflects the low expectations set by Wall Street for this quarter. It’s important to note that in Q4 FY24, Oracle missed EPS estimates and reported slower growth in cloud services revenue.

Analysts are expecting an EPS of $1.33, which would represent a 12% year-over-year growth. However, this consensus comes after 13 analysts raised their projections over the past three months, while five have lowered their estimates. The outlook for revenue isn’t as positive. The consensus for Q2 revenue is around $13.2 billion. Notably, all analysts covering ORCL have revised their top-line estimates downward in the last three months.

Considering these more moderate expectations, I believe Oracle has a good chance of exceeding estimates, primarily driven by the strength of OCI, which could offset weaknesses in SaaS and license revenue. However, I believe that more important than topping estimates will be any insights regarding the duration of RPOs, as this will likely provide a clearer picture of AI demand longevity and how Oracle’s growth may continue in the future.

Is ORCL Stock a Buy, According to Analysts?

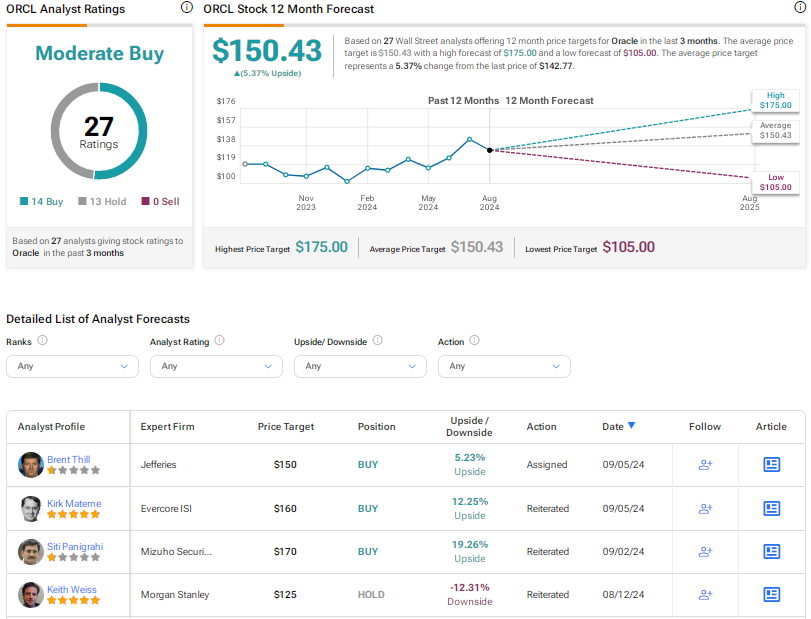

Wall Street’s consensus on Oracle stock is predominantly bullish, resulting in a Moderate Buy rating. However, opinions are fairly divided among analysts. Of the 27 analysts covering the stock, 14 have a Buy recommendation, while 13 have a Hold rating.

The average price target is $150.43, suggesting a potential upside of 5.4% from the current share price.

Key Takeaways

Oracle shares have seen a substantial increase in price this year, likely driven by strong growth in AI-driven demand for its cloud business. Despite Wall Street’s more moderate expectations for the upcoming Q1 FY25 earnings, I see limited potential for further gains. Even with exceptionally high AI demand, it may not be sufficient to sustain growth at current valuation multiples. Therefore, I maintain a Hold stance due to the stock trading close to its all-time highs and the uncertainty surrounding future growth.