Shares of shoes and apparel company On Holding AG (ONON) finished down in today’s trading as investors await its Q2 earnings results on August 13 before the market opens. Analysts are expecting earnings per share to come in at $0.18 on revenue of $562.7 million. This equates to 26.4% and 350% year-over-year increases, respectively, according to TipRanks’ data.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This is ideal because earnings per share should grow faster than revenue as this demonstrates a high degree of operating and financial leverage in the business. It’s also worth noting that ONON has beaten earnings estimates five times during the past eight quarters.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a large 11% move in either direction.

Investor Sentiment for ONON Stock

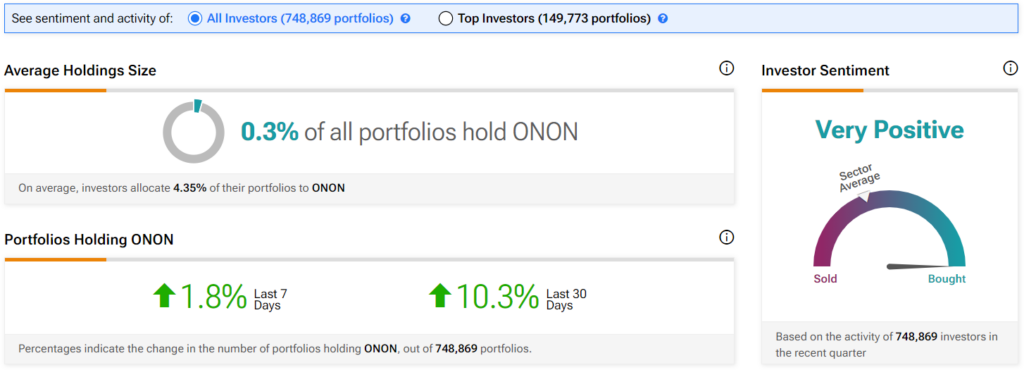

The sentiment among TipRanks investors is currently very positive. Out of the 748,869 portfolios tracked by TipRanks, 0.3% hold ONON stock. In addition, the average portfolio weighting allocated towards ONON among those who do have a position is 4.35%. This suggests that investors in the company are fairly confident about its future.

Furthermore, in the last 30 days, 10.3% of those holding the stock increased their positions. As a result, the stock’s sentiment is above the sector average, as demonstrated in the image below. Given that ONON appears to be an under-the-radar stock, there is plenty of room for more investors to pile in if the company keeps up its solid growth rate, which could potentially push the stock higher.

Is Onon Stock a Good Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on ONON stock based on 15 Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 14% rally in its share price over the past year, the average ONON price target of $44.33 per share implies 12.09% upside potential.