B2B SaaS company focused on developing digital ordering and delivery programs for restaurants Olo Inc. (NYSE: OLO) recently reported better-than-expected results for the first quarter ended March 31, 2022.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, shares of the company declined almost 10% to close at $8.02 in Tuesday’s extended trading session.

Revenue & Earnings

Olo’s revenues for the quarter stood at $42.8 million, up 18% from the same quarter last year. Further, the figure topped the consensus estimate of $41.71 million.

Platform revenues stood at $41.15 million, up 19% year-over-year, and aided the overall growth in total revenues.

Further, earnings of $0.01 per share surpassed the consensus estimate of $0.00. The company had posted earnings of $0.03 per share in the same quarter last year.

Other Operating Metrics

Olo’s average revenue per unit (ARPU) declined 2% from the previous year to $516. However, ending active locations witnessed a rise of 19% year-over-year to 82,000. Dollar based net revenue retention was about 107%

At the end of the quarter, the company’s cash and cash equivalents stood at $463.7 million.

Outlook

For the second quarter, the company expects revenue to hover between $45.5 million and $46 million.

For the full Fiscal Year 2022, the company forecasts revenue in the range of $195 million-$197 million. The consensus estimate for the same is pegged at $193.8 million.

Management Commentary

The CEO of Olo, Noah Glass, said, “In the first quarter, Olo’s revenue and profitability momentum continued, as we took meaningful strides towards enabling digital hospitality. Our platform supported year-over-year growth in transaction volume, and we expanded our product portfolio and use cases, added new and expanded existing relationships, and grew our technology partner ecosystem.”

Stock Rating

Consensus among analysts is a Strong Buy based on five unanimous Buys. OLO’s average price target of $21.60 implies upside potential of 142.7% from current levels. Shares have declined 68.8% over the past year.

Positive Sentiment

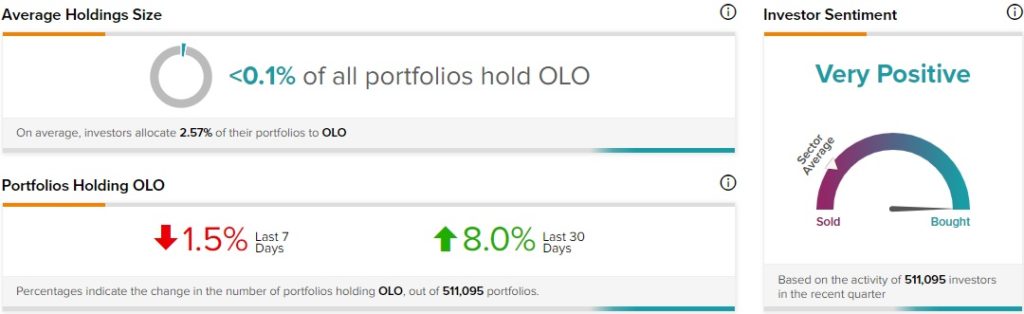

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on OLO, as 8% of portfolios tracked by TipRanks increased their exposure to OLO stock over the past 30 days.

Conclusion

Olo’s strong quarterly results, along with a robust liquidity position, give the company a strong footing to increase its operations more efficiently.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Lemonade’s Q1 Results Were Sweet, but Outlook Leaves a Sour Taste

Why Did Palantir Stock Lose 21% on Monday?

Musk’s Twitter Offer is Risky, Says Activist Short-Seller