As the need for power grows, notably due to the rise of AI data centers, Oklo (OKLO) is making strides in the advanced fission power plant sector. The firm is on a solid trajectory toward its first commercial fission plant, and it has recently announced new partnerships with two substantial data center providers, fueling further anticipation for its power supply solutions. The company, already recognized for its developments in nuclear fuel recycling and power plants, is also expanding its footprint in the radioisotope market, projected to be worth $55.7 billion by 2026.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

While the election has ushered in uncertainty about how new policies might impact the company, President-elect Trump has chosen Chris Wright, CEO of Liberty Energy (LBYE) and Oklo board member, to be the next U.S. energy secretary.

Oklo Expands into New Market

Oklo is a fission technology and nuclear fuel recycling company developing large-scale, reliable, clean energy solutions through fast fission power plants. The company is making significant progress, having secured a site use permit from the U.S. Department of Energy, fuel material from Idaho National Laboratory, and submitted the first advanced fission custom combined license application to the U.S. Nuclear Regulatory Commission. Oklo is also developing advanced fuel recycling technologies in cooperation with the U.S. Department of Energy and U.S. National Laboratories.

The company announced the acquisition of Atomic Alchemy, a U.S. firm known for its radioisotope production. The proposed acquisition builds on the strategic partnership between the two companies and maximizes opportunities in power generation, fuel recycling, and radioisotope production. Oklo is optimistically looking towards creating new revenue streams from radioisotopes, a market predicted to reach $55.7 billion by 2026.

The demand for radioisotopes is booming across various sectors, including healthcare, energy, industry, and technology. However, the supply of these essential materials has been impacted due to outdated reactor infrastructure and a disjointed global supply chain. Oklo, through this acquisition, aims to address this gap by producing radioisotopes using its core clean energy and fuel recycling technologies.

Atomic Alchemy also offers its Neutron Transmutation Doping (NTD) technology, a process used predominantly for semiconductor doping. With the high demand for cutting-edge semiconductors, Oklo projects that NTD capabilities could be ground-breaking for the semiconductor industry.

Oklo’s Recent Financial Results

The company recently released its Q3 financial update, reporting a net loss of $63.3 million, primarily due to decreased accounts payable. GAAP earnings per share (EPS) of -0.08 were aligned with analysts’ projections.

As of the quarter’s end, the company had cash and marketable securities totaling $288.5 million. This included cash and cash equivalents valued at $91.8 million and marketable securities valued at $196.7 million. Oklo recently received a significant boost of $276.0 million in net-of-fee proceeds from a deal closure, which primarily influenced its cash and securities balances.

What Is the Price Target for OKLO Stock?

The stock has enjoyed a recent price spike, surging up over 184% in the past three months. It trades near the higher end of the 52-week price range of $5.35 – $28.12, though it shows mixed technical indicators regarding price momentum.

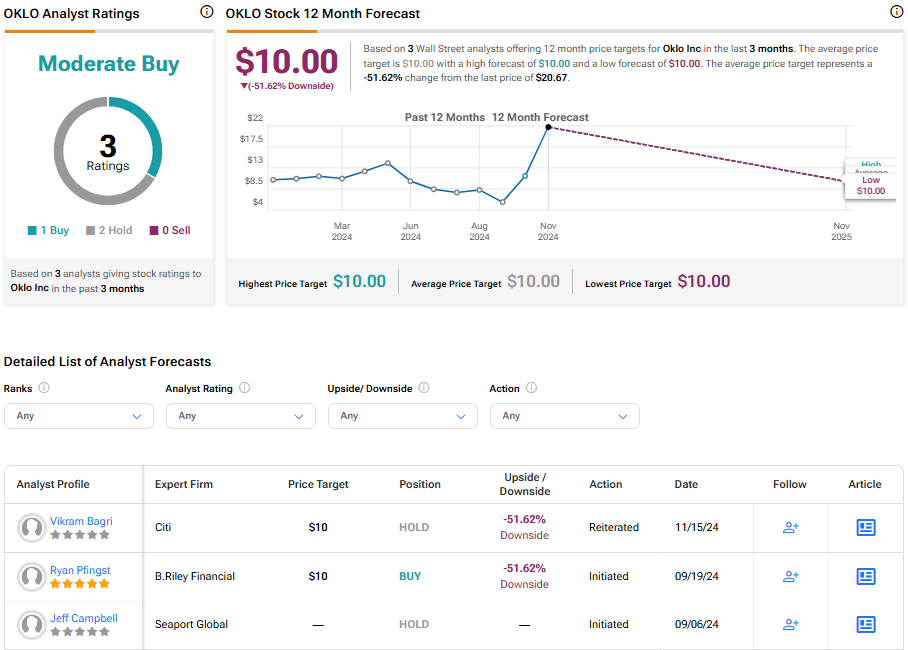

Analysts following the company have taken a cautiously optimistic stance on OKLO stock. Based on three analysts’ recent recommendations, Oklo is rated a moderate buy overall. The average price target for OKLO stock is $10.00, representing a potential downside of -51.62% from current levels.

Bottom Line on OKLO

Oklo is progressing in the advanced fission power sector, establishing vital partnerships with two leading data center providers and reporting significant headway toward launching its first commercial power plant. The company’s expansion into the increasingly lucrative radioisotope market diversifies Oklo’s revenue streams and addresses the global gap in radioisotope supply due to outdated infrastructures.

Despite the company’s recent financial losses, its solid cash and securities balances following a substantial deal closure indicate a promising financial future. The stock is a compelling option for investors interested in the next generation of nuclear power.