Despite a lackluster economic print from China, the benchmark crude WTI is up 1.47% today and a massive 14% over the past month to $84.14 at 10.32 a.m. EST. The gains come as Ukraine ramps up attacks in its conflict with Russia and potential disruptions to energy supplies become ever more likely.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Saudi Arabia is staying committed to its one million barrel-a-day output cuts starting next month but other oil majors such as Libya and Venezuela are moving in to fill the gap with higher outputs.

Latest numbers from the American Petroleum Institute indicate a rise of nearly 4.1 million barrels in U.S. commercial stockpiles during the week ended August 4. Further, numbers from the Energy Information Administration point to an increase of nearly 5.9 million barrels in crude inventories during the same period. In comparison, crude inventories had decreased by about 17 million barrels in the prior week and the Street had pegged only a 0.57 million-barrel increase for the week ended August 4.

Meanwhile natural gas is surging 6.63% to $2.96 today as expectations of a hotter August build-up. Additionally, an expected rise in natural gas exports from the U.S. is also contributing to buoyant natural gas prices, which have shot up 13.4% over the past month now.

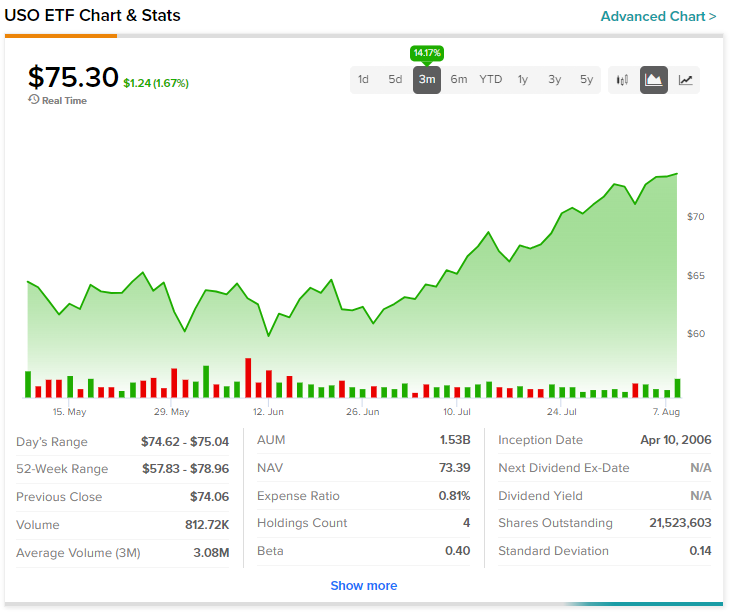

The United States Oil Fund ETF (USO) is also up 1.67% to $75.30 today and has gained 14.17% over the past three months.

Here is a list of energy stocks that can be influenced by the latest developments in the energy markets.

Read full Disclosure