The benchmark crude WTI (CM:CL) rose by nearly 2% this week as rising tensions in the Middle East took center stage, offsetting concerns over rising oil stockpiles in the U.S.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Inventory Build-Up in the U.S.

The latest numbers from the EIA (Energy Information Administration) indicated an increase of 3.6 million barrels in U.S. crude inventories for the week ended June 21. In comparison, analysts had anticipated a decline of 2.6 million barrels for the period. Similarly, numbers from the American Petroleum Institute (API) pointed to a build-up of 914,000 barrels in U.S. commercial stockpiles for the week ended June 21.

Middle East Tensions

At any other point in time, the build-up would have dampened oil prices. However, rising tensions in the Middle East are acting as a catalyst for oil prices. While Houthi attacks in the Red Sea continue, tensions between Israel and Iran-backed Hezbollah could spiral into a wider conflict in the region. The geopolitical upheaval seems to be a key concern for oil traders, as indications of a potentially weakening U.S. economy (as indicated by the revised GDP estimate and an increase in weekly jobless claims) have failed to subdue oil prices this week.

At present, flooding due to tropical storm Alberto is weighing on gasoline demand in the U.S. Still, any further flare-up in the Middle East could mean oil quickly climbing back to highs last seen in April.

What Is the Prediction for Oil?

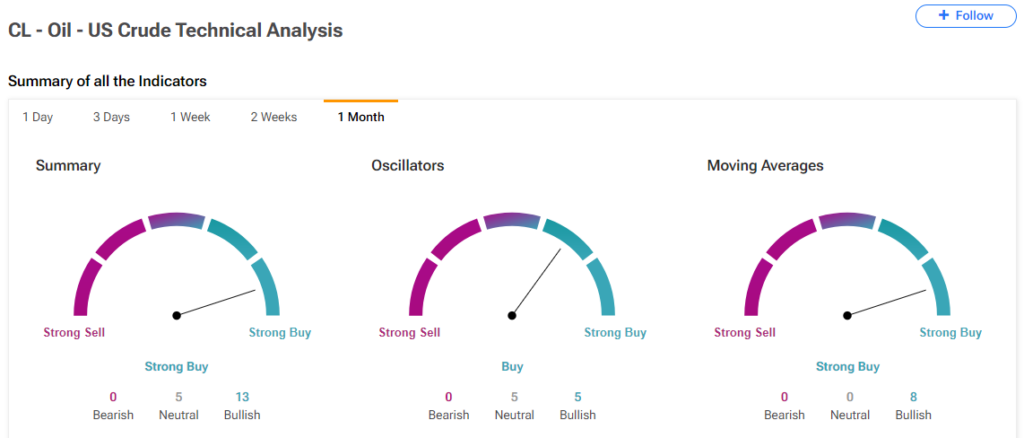

The TipRanks Technical Analysis tool is also flashing a Strong Buy signal for oil on a monthly time frame. This means a continuation of the Bullish strength in oil over the coming periods.

Ready to “commodi-tize” your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure