Investors who frequently comb through small-cap stocks looking for up-and-coming investment opportunities will often come across biotechnology or biopharmaceutical companies in start-up mode, including Oculis Holding (NASDAQ:OCS). These companies are burning cash in a race against time to develop and bring something to market. If you’re lucky, their pipeline has some compelling treatment in later-stage development that points to a successful glide path forward. Such is the case for Oculis. The stock is up nearly 68% in the past year, based solely on bullish expectations.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Oculis’ Promising Pipeline

Oculis is a clinical-stage biopharmaceutical firm developing drug candidates for treating ophthalmic diseases. Its primary product, OCS-01 (currently in Phase 3 clinical trials), is a treatment for Diabetic Macular Edema (DME), a disease that impacts more than 37 million people globally.

The company has two other pipeline candidates in various stages of trials: OCS-02, which targets dry eye disease (currently in Phase 2b clinical trials), and OCS-05, a neuroprotective agent meant for several conditions, including glaucoma, dry age-related macular degeneration, and diabetic retinopathy.

Oculis currently has a cash position of $108.9 million, which, based on current development plans, is expected to fund its operations well into late 2025.

OCS: A High Risk, High Reward Bet

OCS stock trades in the upper middle of its 52-week range of $6.26-$14.50. Unlike other investment opportunities, where the stock valuation is primarily based on a company’s financial performance, valuing the stock of a start-up biopharma company involves a more qualitative approach. This is mainly because many of these companies go public without any earnings, as the value of their product is still speculative.

The critical distinction for investors to keep in mind is these companies have high developmental risk and require extensive technical development that takes considerable time to yield results. Despite these challenges, the potential rewards from successful biotech investments can be substantial.

A successful biopharma investment ideally involves a company in a solid financial position, with a promising development pipeline and good prospects of regulatory approval. In that regard, Oculis checks many boxes.

What is the Price Forecast for OCS in 2024?

Analysts following OCS stock have been quite bullish. For instance, Chardan’s analyst Daniil Gataulin has called Oculis one of his firm’s top picks in the biotech sector. The analyst believes the backdrop for OCS looks “favorable heading into 2024,” with the company moving ahead with several pivotal programs for its lead candidate, OCS-01, in DME and pain and inflammation following ocular surgery.

Andreas Argyrides, an analyst from Wedbush, recently assigned a Buy rating on the stock, citing a combination of factors surrounding the promising potential of Oculis’s product pipeline and the anticipation of topline results in the near future.

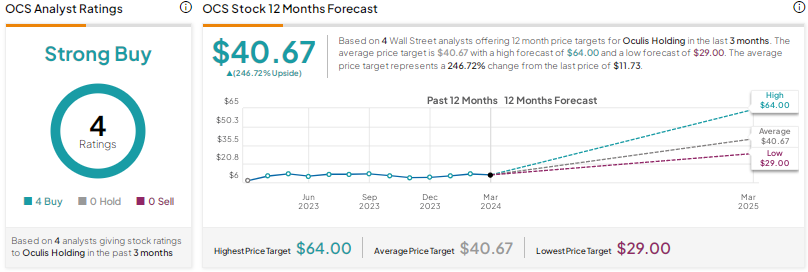

Oculis stock is currently listed as a Strong Buy based on four bullish reviews from Wall Street analysts in the last three months. The average price target for OCS stock is $40.67, representing a 246.72% upside potential from the last closing price of $11.73.

Final Thoughts on OCS

Investing in a start-up biopharma is never a sure thing, as promising as the treatment pipeline may appear. However, biopharma stocks can deliver a high reward for investors willing to put capital at risk.

The buzz behind OCS is substantial. The market has caught wind, and the stock has trended up. Hitting successful milestones in bringing the first treatment, OCS-01, to market will likely catalyze the stock’s price even further in the near term. A large addressable market, like that of DME, suggests the potential for solid revenue growth driving valuation in the long term. It is a speculative growth opportunity, to be sure, but one that could be a home run in time.