At CES 2026, Nvidia (NVDA) shared some of its biggest updates of the year, giving investors a clearer look at its long-term AI plans. The company rolled out new platforms and tools tied to AI, robotics, and self-driving tech. While the first market reaction was muted, Nvidia shares were trading higher in pre-market action today.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the event, Nvidia CEO Jensen Huang said production of Nvidia’s next Rubin chips, which will follow the Blackwell line, is ramping up at full speed. He also introduced the open-source Alpamayo AI models, built to help vehicles process data and make fast decisions for self-driving use.

Nvidia Launches the Rubin Platform

The key takeaway from Nvidia’s CES appearance was the launch of the Rubin platform. Built around six chips that work together as one AI system, Rubin is designed to handle both AI training and real-time use, where demand keeps rising.

CEO Jensen Huang said Rubin is arriving at the “right moment,” as AI needs continue to grow across the industry. He also described the platform as a “giant leap” as Nvidia moves into the next phase of AI computing.

Rubin brings several updates aimed at scale and efficiency. These include faster NVLink chip connections, a new Transformer Engine for large AI models, stronger security features, and the new Nvidia Vera CPU. The goal is to deliver more performance while keeping costs in check for customers running large AI systems.

Nvidia Expands Beyond the Data Center

Nvidia also used CES to underline its push into physical AI. The company shared new open AI models, tools, and frameworks designed for robots, self-driving cars, and smart machines that operate in real-world settings.

Instead of focusing only on cloud systems, Nvidia is pushing AI into machines used in the real world. By linking its chips with software and AI models, the company is helping build systems that can see, learn, and react on their own.

Investors are now watching to see when Rubin and other new products begin to contribute to revenue.

Is NVDA a Good Stock to Buy Now?

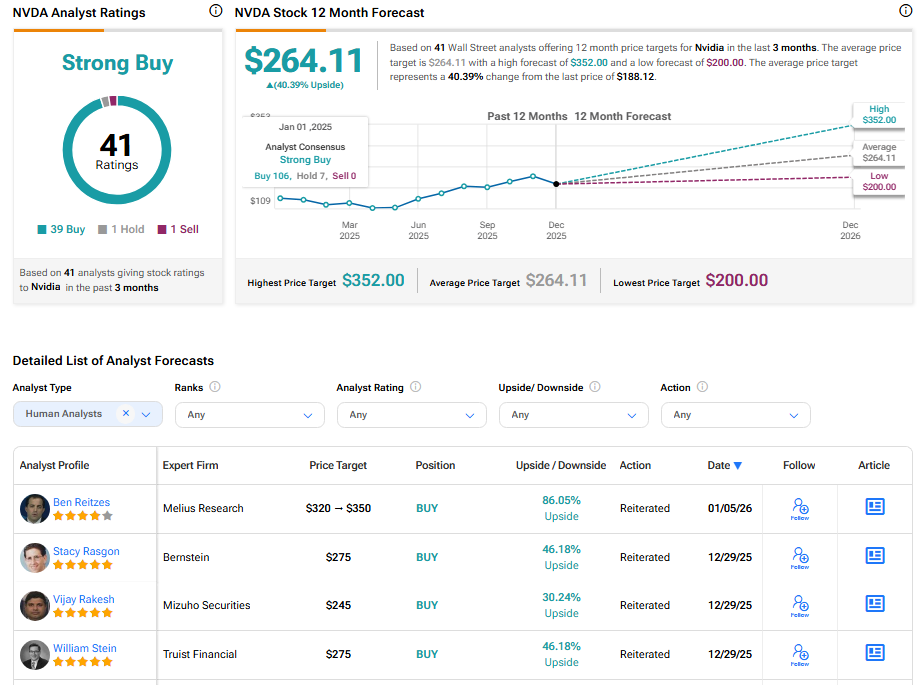

According to TipRanks, NVDA stock has a Strong Buy consensus rating based on 39 Buys, one Hold, and one Sell assigned in the last three months. At $264.11, Nvidia’s average share price target implies a 40% upside potential.