Ace chipmaker Nvidia’s (NVDA) latest Blackwell chips are overheating in server racks, worrying customers. The news was first reported by The Information, citing sources familiar with the matter. The unfavorable news comes just days before the semiconductor company and one of the biggest AI (artificial intelligence) beneficiaries’ announcement of its Q3 FY25 results on November 20.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

How Does Chip Overheating Cause a Problem?

The report noted that Blackwell GPUs (graphic processing units) are overheating when interconnected in Nvidia-designed server racks. The issue challenges the deployment of these GPUs in data center racks created for AI. The Nvidia-customized racks are expected to hold up to 72 chips at a time. However, excessive heating could lead to operational inefficiencies or even hardware damage. Customers are gravely concerned with this issue since some of their new data center infrastructure was being built considering the installation of these advanced GPUs.

The report further added that Nvidia has asked suppliers to make minor changes to their GPU racks to circumvent the overheating problem, but this attempt has been unsuccessful so far. Moreover, Nvidia is reportedly trying to pacify the issue by saying that it is working in coordination with the cloud service providers and that such engineering alterations are common in the industry.

The GB200 Grace Blackwell chips are one of the most advanced chips for generative AI, with 2.5x more power and speed compared to the currently available H100 series. The chip’s production and supply have already been delayed once due to a design flaw. The Blackwell products are expected to hit the market by early 2025. These chips cost roughly $70,000, and the entire server rack costs more than $3 million. Nvidia aims to sell around 60,000 to 70,000 servers, making these delays a bit more worrisome for the company.

Analysts and investors alike would expect further clarity on the overheating issue and possible solutions in the upcoming Q3 results. The impact of the same might be visible in Nvidia’s Q4 guidance.

Is NVDA a Good Stock to Buy?

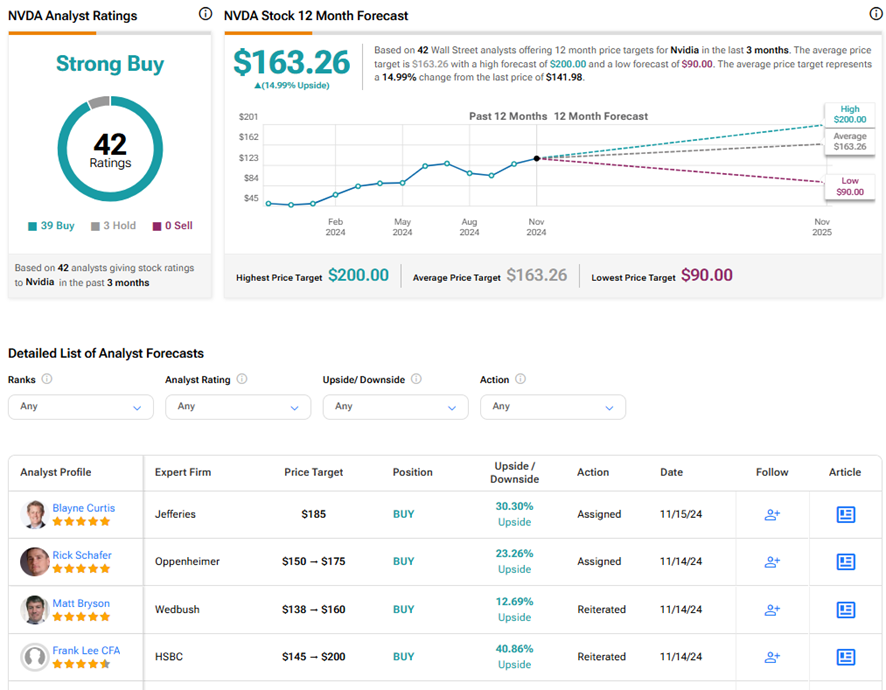

Wall Street enthusiastically awaits the financial results of the chipmaker. Ahead of the Q3 print, several analysts have reiterated their Buy views on NVDA stock and many have lifted their price targets.

On TipRanks, NVDA stock commands a Strong Buy consensus rating based on 39 Buys and three Hold ratings. Also, the average Nvidia price target of $163.26 implies a nearly 15% upside potential from current levels. Year-to-date, NVDA shares have zoomed 49.8%, thanks to its crucial role in the AI revolution.