Artificial Intelligence (AI) and graphics card company Nvidia (NVDA) had options traders excited on Wednesday as it prepared to release its earnings reports for the third quarter of 2024 after markets close. Earnings reports offer incredible insight into a company’s performance and often result in large gains or losses, depending on the results.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

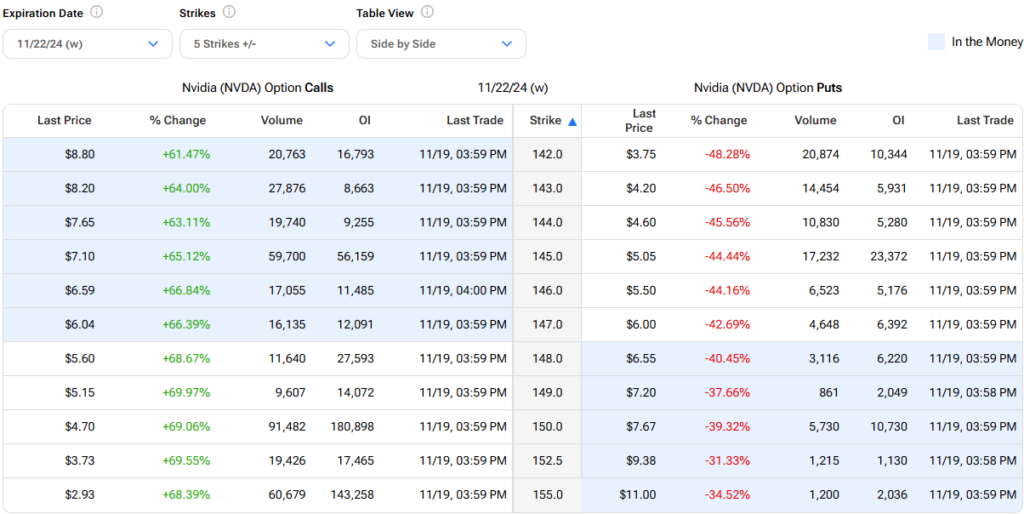

Nvidia is no different. The company historically sees major movement alongside the release of its earnings results. Options traders are preparing for the report later today with a large volume of calls and put for the stock. These options are set to expire on Friday, just two days after the results are posted.

What Options Traders Expect from NVDA

Based on the latest options data, NVDA shares could experience an 8.5% gain or drop following the release of its earnings report. Considering Nvidia’s size, this could see its market capitalization increase or decrease by $292 billion.

Nvidia’s history shows that its stock movement often falls below market expectations, meaning it’s unlikely to reach that 8.5% gain or loss. However, when it does exceed them, it typically does so in a positive direction. That’s worth considering when weighing call or put options on NVDA shares.

What to Watch in the Nvidia Earnings Report

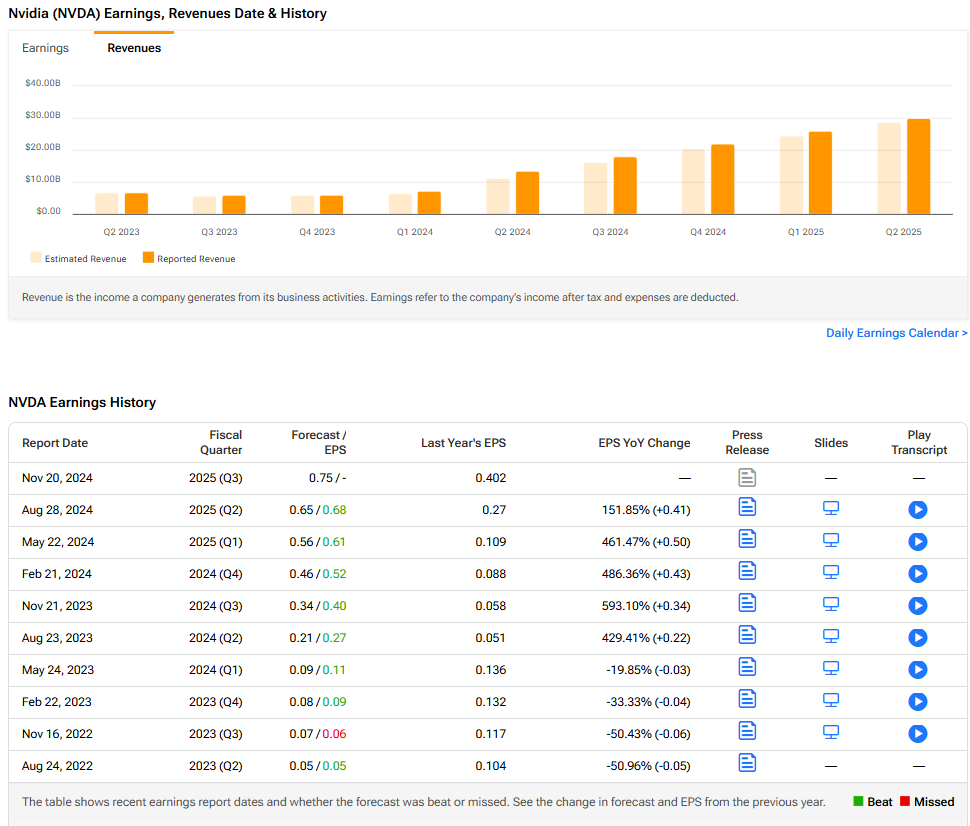

The biggest highlights of the Nvidia report are its earnings per share and revenue. Wall Street expects NVDA to post EPS of $0.75 alongside revenue of $33.11 billion.

Based on its performance over the last nine quarters, Nvidia seems likely to beat Wall Street’s estimates. During that period, it only missed EPS estimates once and never came in below analysts’ revenue expectations.

Is NVDA Stock a Buy?

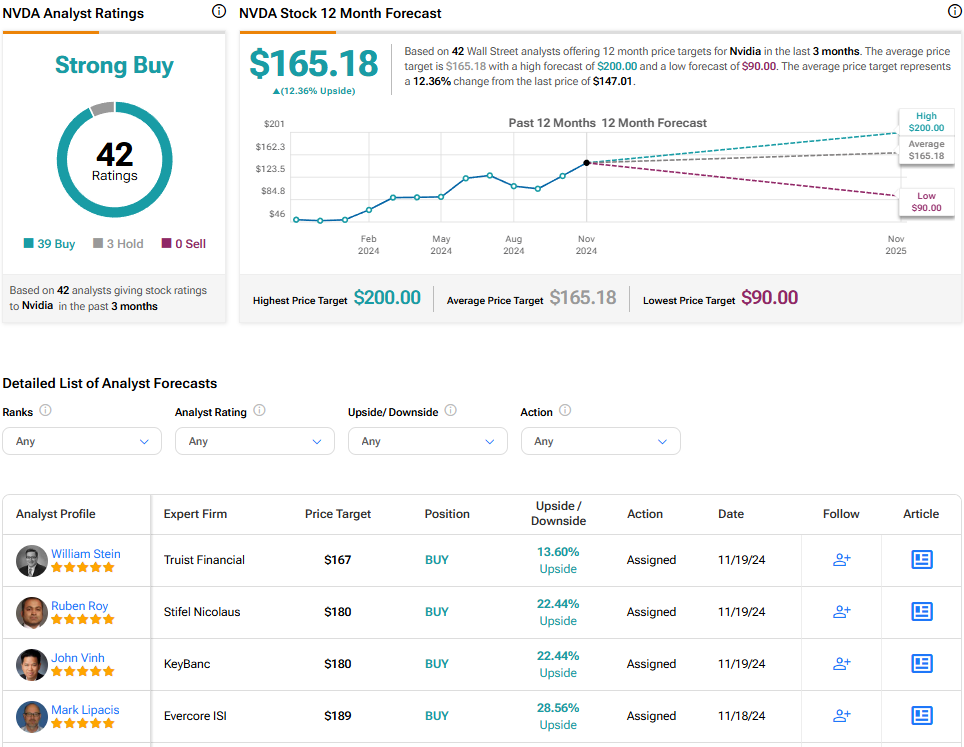

Turning to Wall Street, the analysts’ consensus rating for Nvidia is Strong Buy based on 39 Buy and three Hold ratings over the last three months. This comes with an average price target of $165.18, a high of $200, and a low of $90, representing a potential 12.36% upside for NVDA shares.