Chipmaker Nvidia (NVDA) is once again the world’s most valuable publicly traded company, having finished trading on November 5 with a market capitalization of $3.43 trillion.

Nvidia has now surpassed Apple (AAPL) in terms of market cap to take the mantle as the most valuable publicly traded company. Nvidia achieved the feat as its stock rose 3% on the day to close at $139.91 per share. Apple stock rose less than 1% on the day to finish trading with a market cap of $3.38 trillion.

This is not the first time that Nvidia has passed Apple to become the most valuable company. Nvidia previously accomplished the feat in June of this year before its stock endured a summer selloff. Another technology giant, Microsoft (MSFT), is ranked as the third biggest publicly traded company with a market cap of $3.06 trillion.

Rising Sales and Dow Inclusion

NVDA stock has nearly tripled this year as sales of its graphics processing units, or GPUs, that power artificial intelligence (AI) models continue to sell at a rapid rate. The stock is now up more than 2,500% in the last five years, and its revenue has more than doubled in each of the last five quarters as demand for its processors remains red hot. Nvidia will report quarterly financial results on Nov. 20.

In recent days, NVDA stock has been climbing higher on news that it is replacing rival Intel (INTC) in the Dow Jones Industrial Average. Inclusion in the Dow is positive for Nvidia as mutual funds and exchange-traded funds (ETFs) that track the index of 30 leading U.S. companies are now required to buy its stock.

Is NVDA Stock a Buy?

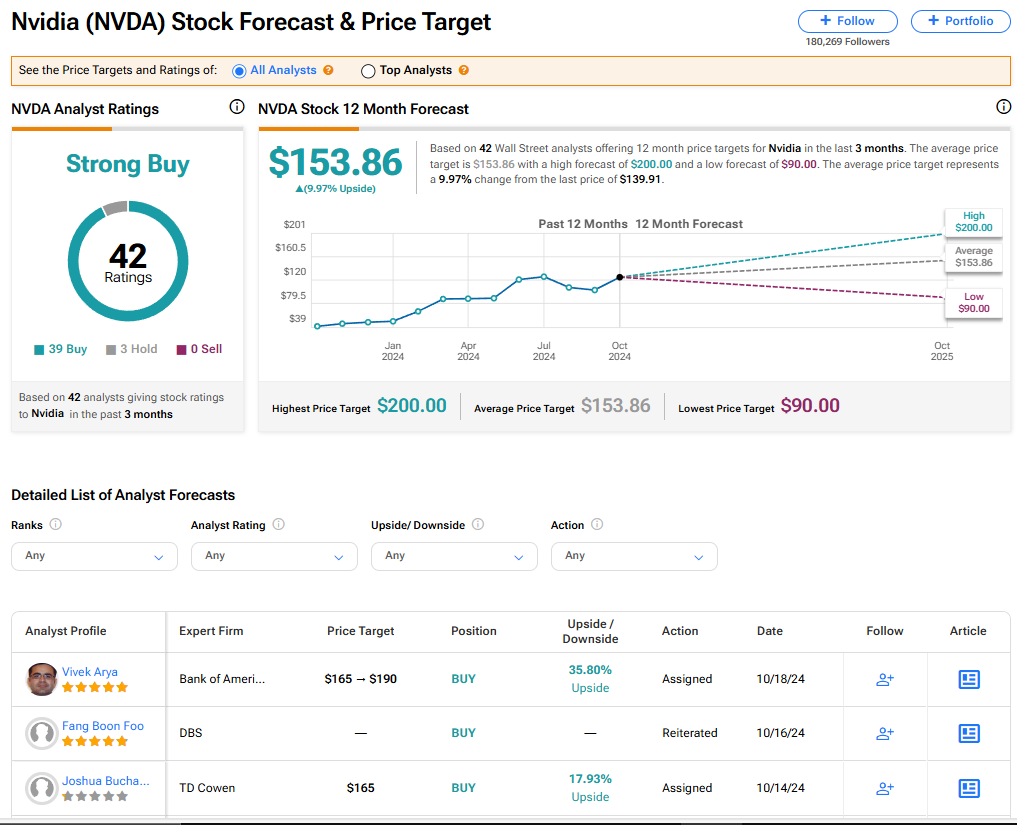

Nvidia’s stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 39 Buy and three Hold recommendations assigned in the last three months. There are no Sell ratings on the stock. The average NVDA price target of $153.86 implies 9.97% upside from current levels.